Telecom firms owe over Rs.92,000 Crores to Government of India

Government informs Supreme Court till date Telecom firms owe 92,000 crores

By

Team PGurus

-

July 29, 2019

Government informs Supreme Court till date Telecom firms owe 92,000 crores

The

Department of

Telecom (DoT) on Monday informed the

Supreme Court that leading private telecom firms like

Bharti Airtel,

Vodafone, and state-owned

MTNL and

BSNL have pending license fees outstanding of over

Rs.92,000 crores till date. DoT filed the affidavit of huge dues to the apex court in a case related to telecom firms and Telecom Tribunal.

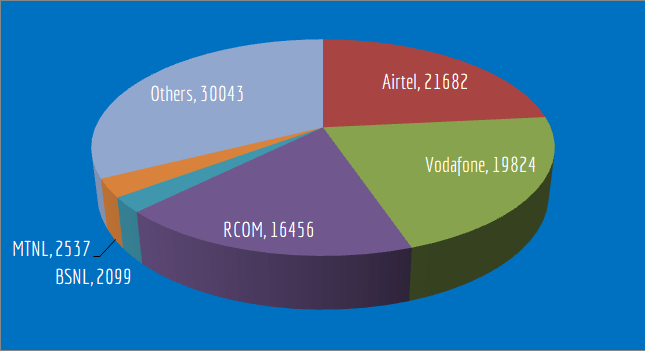

Airtel owes

Rs.21,682.13 crores as license fees to the Telecom Department. Dues from Vodafone totaled

Rs.19,823.71 crores while Anil Ambani’s defunct

Reliance Communications owed a total of

Rs. 16,456.47 crores, DoT said. The State-owned BSNL owed

Rs.2,098.72 crores while MTNL owed

Rs.2,537.48 crores to the public exchequer. The total amount which has to be recovered from all the telecom firms accrues to

Rs.92,641.61 crores as on date, said DoT.

Details of unpaid License fees by firms

As per the New Telecom Policy, telecom operators are required to share a percentage of their Adjusted Gross Revenue (AGR) with the government as an annual License Fee (LF). In addition, mobile telephone operators were also required to pay Spectrum Usage Charges (SUC) for the use of radiofrequency spectrum allotted to them.

In 2016, the Comptroller and Auditor General (CAG) had caught six telecom companies for not paying and hushing up more than

Rs.45000 crores to the public exchequer. The telecom firms’ fraud was caught by the auditing agency after inspecting their revenues during the period 2006 to 2010. After the 2G Scam, the CAG decided to audit the revenue of all telecom companies as they are mandated to share a portion of revenue to Government as per licensing agreement. All Telecom companies approached Delhi High Court and Supreme Court to prevent CAG from auditing them and lost the case.

https://www.pgurus.com/telecom-firms-owe-over-rs-92000k-crores-to-government-of-india/