https://www.cnbctv18.com/economy/sb...-220-defaulters-rti-query-reveals-4499621.htm

These are the banks posting good results?

For people like you and me, even if our balance goes below minimum amount, we are charged fined. If they have the balls, go get the money from these people. Or were these also designed as gifts from day one, with no intention of getting the money back.

What's the difference between these do called big companies and roadside chit funds?

I knowca person who can get you a loan on non existent properties, for a commission, shared between him and the bank executives.

Shame on the regulators.

These are the banks posting good results?

For people like you and me, even if our balance goes below minimum amount, we are charged fined. If they have the balls, go get the money from these people. Or were these also designed as gifts from day one, with no intention of getting the money back.

What's the difference between these do called big companies and roadside chit funds?

I knowca person who can get you a loan on non existent properties, for a commission, shared between him and the bank executives.

Shame on the regulators.

SBI writes off Rs 76,600 crore of 220 defaulters, RTI query reveals

Utkarsh Anand

3-4 minutes

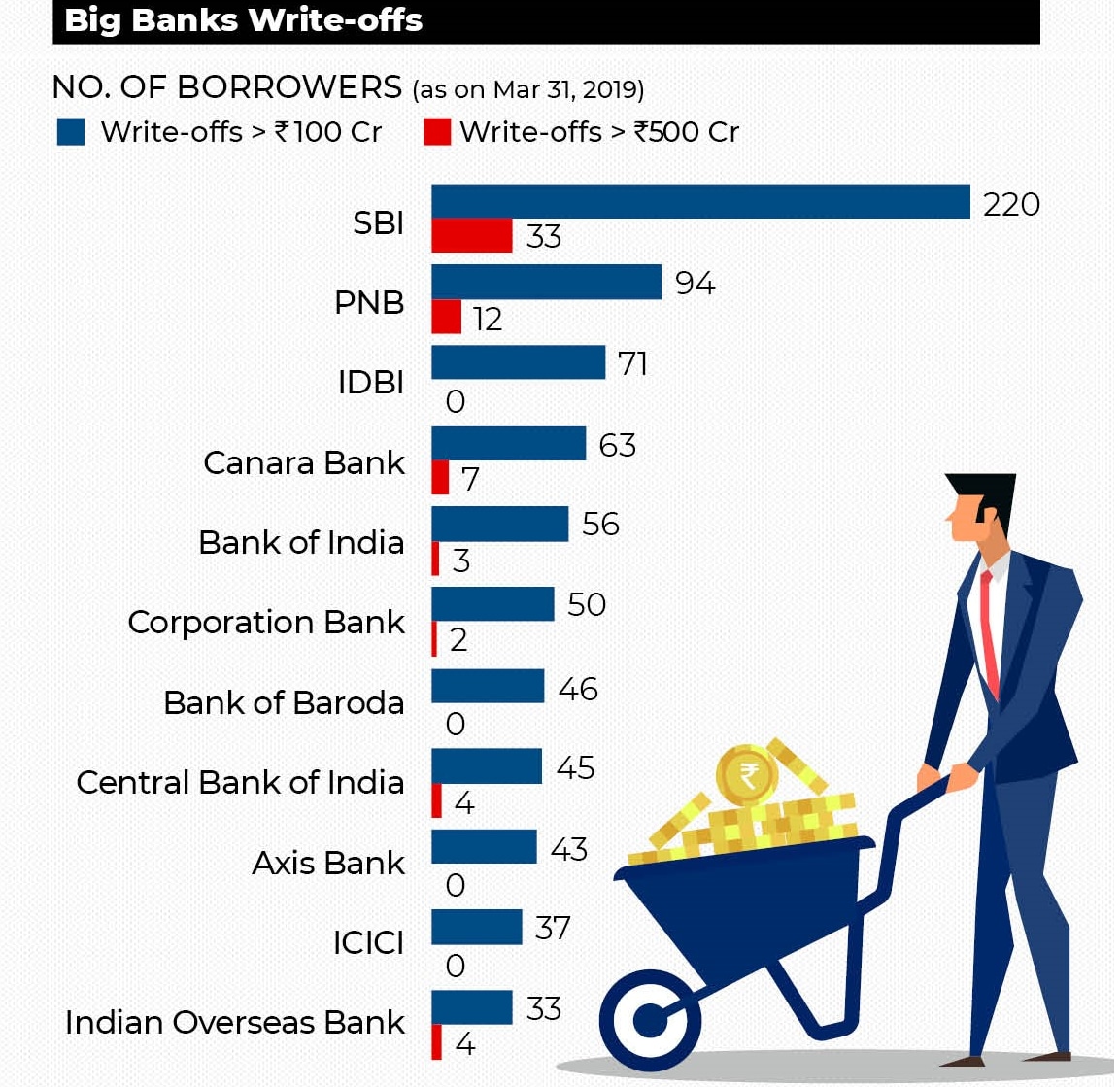

India’s largest bank, State Bank of India (SBI) has written off bad loans worth Rs 76,600 crore of 220 defaulters, who owed more than Rs 100 crore each.

As on March 31, 2019, the SBI has declared as unrecoverable outstanding worth Rs 37,700 crore that 33 borrowers, with loans of Rs 500 crore and more, owed to it.

In a first, the latest information, furnished by the RBI to CNN-News18 under the Right To Information Act, has disclosed the bank-wise break up where loans more than Rs 100 crore and Rs 500 crore were written off by the banks as on March 31, 2019.

A total of Rs 2.75 lakh crore has been written off for entities that borrowed Rs 100 crore or more from scheduled commercial banks. The latest statistics divulge that Rs 67,600 crore were declared as bad debts for those given loans of Rs 500 crore and more.

As on March 31, 2019, the SBI has declared as unrecoverable outstanding worth Rs 37,700 crore that 33 borrowers, with loans of Rs 500 crore and more, owed to it.

As many as 980 borrowers have been enlisted by the RBI whose debts of more than Rs 100 crore each had to be written off by the banks. Out of these, 220 accounts – more than one-fifth of the total number – belonged to SBI. An average of Rs 348 crore was waived off in respect of each such account.

Out of 71 total accounts reported as having defaulted in loans of over and above Rs 500 crore each, SBI’s share turned out to be 33 to 46 per cent of the total.

Similarly, as on March 31, Punjab National Bank (PNB) had waived off debts of at least Rs 100 crore each in respect of 94 borrowers. The gross amount came out to be Rs 27,024 crore, with an average of Rs 287 crore per account.

PNB also wrote off loans of Rs 500 crore or more for 12 biggest defaulters, totaling Rs 9,037 crore.

While SBI and PNB topped the list among the public sector banks, IDBI stood at the top among the private banks. IDBI also came third among all the scheduled commercial banks in declaring bad debts of Rs 100 crore or more.

IDBI had 71 borrowers of Rs 100 crore and more, with a total outstanding of Rs 26,219 crore written off.

Canara Bank too had 63 accounts with outstanding of Rs 100 crore and more, and another 7 accounts with borrowings of Rs 500 crore and more, in respect of which loans worth Rs 27,382 crore.

The list of borrowers with Rs 100 crore and more as outstanding having been declared as bad loans is followed by Bank of India with 56 accounts, Corporation Bank with 50 accounts, Bank of Baroda with 46 accounts and Central Bank of India with 45 accounts.

Among the private banks, Axis Bank had 43 such borrowers, followed by ICICI Bank having 37 such accounts.

Similarly, Central Bank of India and Indian Overseas Bank had 4 defaulters each, owing more than Rs 500 crore when their loans were written off.

The data has been accessed by the CNN-News18 through a series of RTI applications, following the Supreme Court judgments that directed the RBI to disclose relevant information on the NPAs and bad debts under the RTI Act.