Day Trading Stocks & Futures

- Thread starter TraderRavi

- Start date

- Tags banknifty bnf daytrading nifty future

Yes bank Group president Rajat Monga has quit. The development comes after reports of Monga and a few other executives selling the bank's shares in the open market over the past few sessions.

Also, in an interview with CNBCTV-18, the bank's CEO Ravneet Gill informed that the bank's exposure to Indiabulls Housing Finance has gone down about 30 percent over the last few months.

https://www.moneycontrol.com/news/b...ar-low-on-sale-of-pledged-shares-4497211.html

Also, in an interview with CNBCTV-18, the bank's CEO Ravneet Gill informed that the bank's exposure to Indiabulls Housing Finance has gone down about 30 percent over the last few months.

https://www.moneycontrol.com/news/b...ar-low-on-sale-of-pledged-shares-4497211.html

Smart_trade

30 % risk in any one account is an insane risk.....it is like a trader risking 30 % of his capital on a trade...if few such trades go bad, the trader goes belly up.....30 % risk means bank was at mercy of India Bulls group...wonder how such prudent bankers take such risks...

Smart_trade

Smart_trade

and the ultimate question that always arises, ye compliance wale kidhar gaye ?

satyam hogaya lekin PWC nahi sudhra

Nice read

https://www.cnbctv18.com/economy/jp...stic-demand-than-by-global-forces-4465071.htm

JP Morgan’s Sajjid Chinoy: India’s slowdown driven by sharp drop in domestic demand than by global forces

Slowing economic growth has been a concern all over the world on the back of ongoing trade wars, protectionism and geopolitical tensions. The International Monetary Fund and the World Trade Organisation have warned that these issues pose further downside risks to global growth. India, the world's fastest-growing economy, is also struggling to maintain the pace, with GDP growth slowing to a six-year low of 5 percent during the April-June period.

However, global trends reflect only a fraction of the slowdown in India's economy, argued JPMorgan emerging markets economists Sajjid Chinoy and Toshi Jain. The real culprit is consumption.

"While export growth has slowed to less than 6 percent in 3Q19 from double-digit growth in previous quarters, the percentage-point contribution of exports to slowing headline GDP growth across the latest two quarters—at 0.8 percentage point in 3Q19—was less than one-third of the downshift caused by slowing private consumption growth," they said in a research note dated September 27. Below are the vital points of their research note:

Consumption slowdown

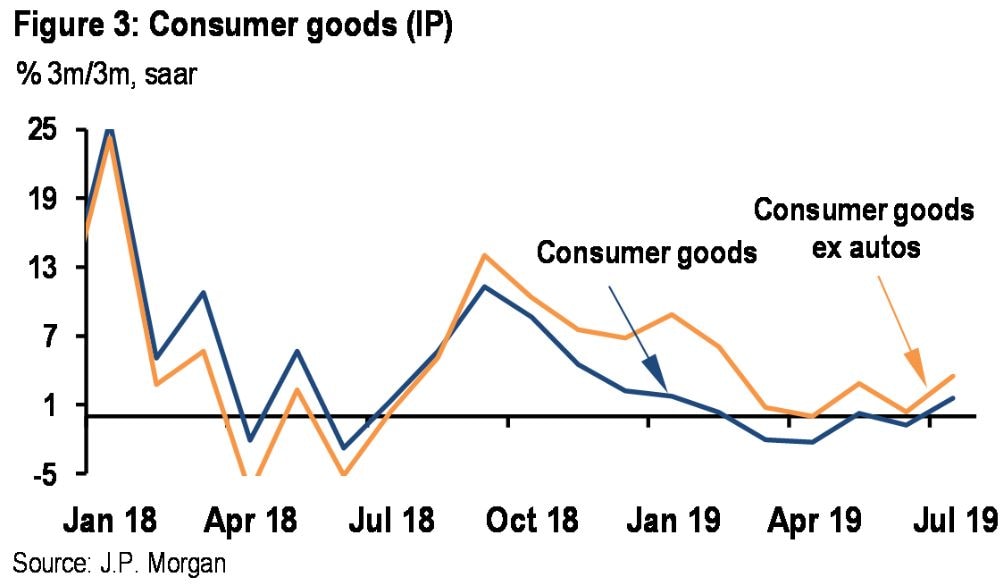

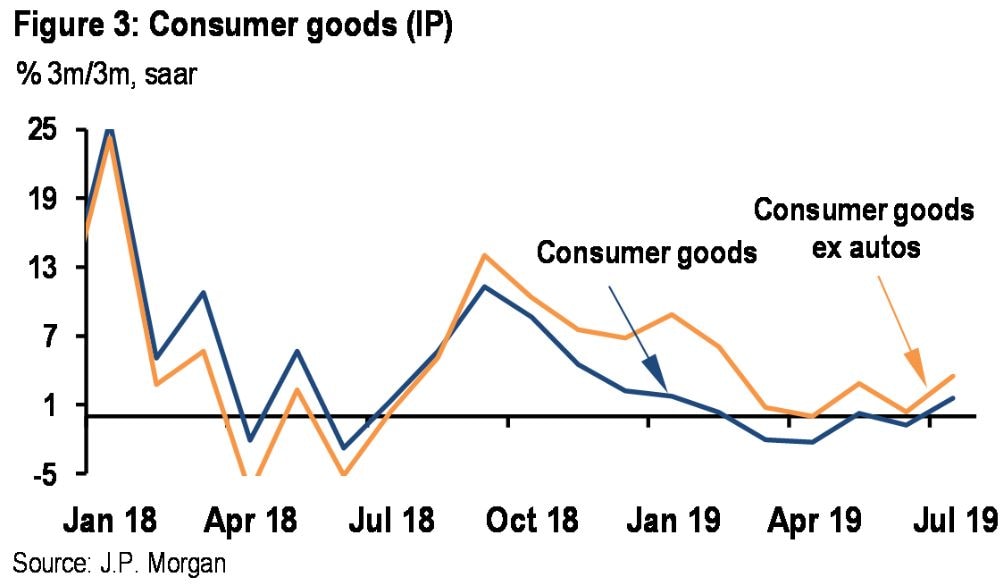

Private consumption has been a key contributor to India’s growth over the last four years, with an average growth of around 7 percent to 8 percent since 2015, according to JPMorgan. The consumption growth slowed to a five-year low of 3.1 percent in 3Q19. While the sudden downshift may have been a surprise, the direction shouldn’t have been as the consumption has been slowing for the last year, noted the report.

The auto sector faced a severe slowdown in the last one year, with sales falling over decade lows, due to a rise in the goods and service tax and higher costs of registration and insurance. A liquidity crunch and rising bad loans in the non-banking financial companies have also squeezed credit availability to auto dealers.

Income growth

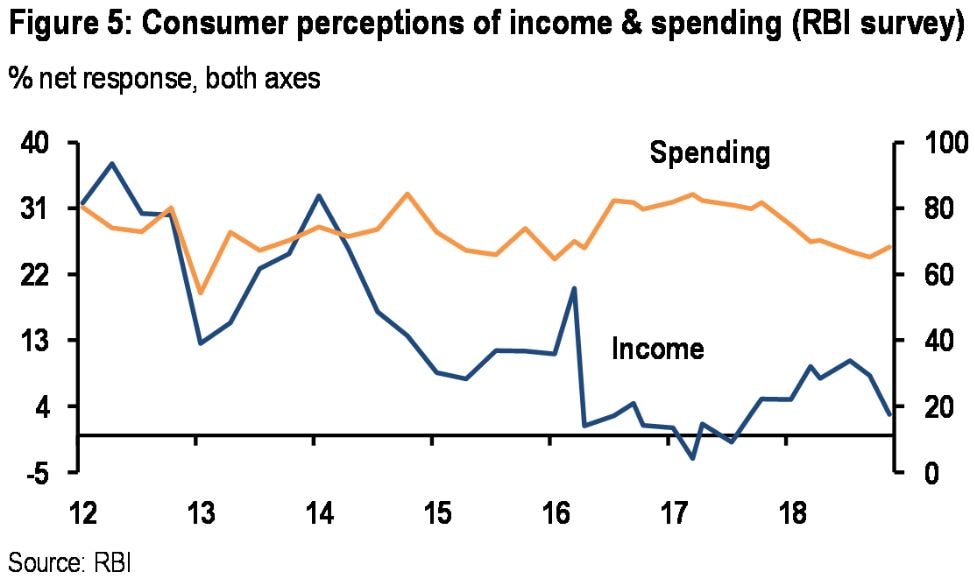

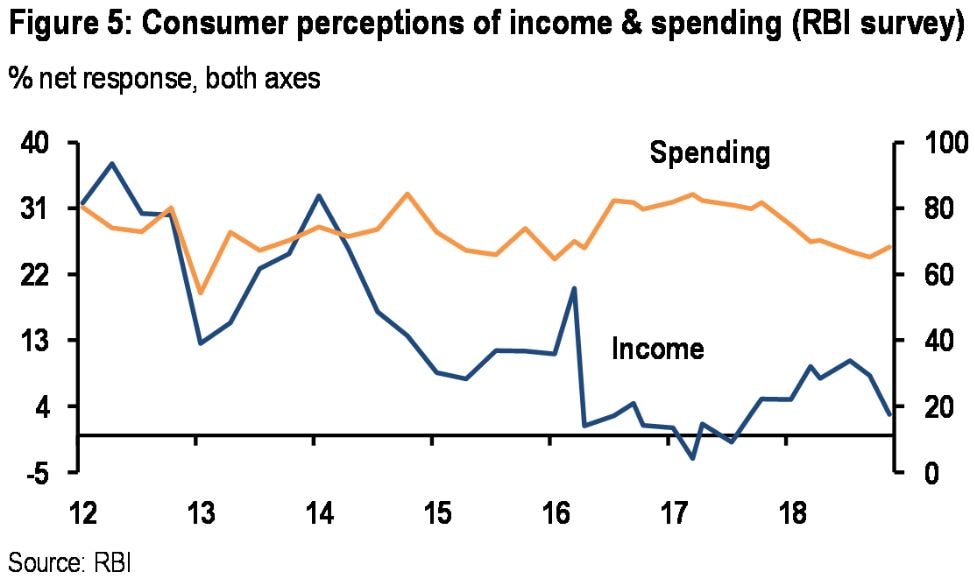

Consumer debt also has been climbing, with Credit Bureau data suggesting that “individual debt” has risen by 10 percentage points of GDP in just four years, pointed out the report. The latest RBI Consumer Household Survey reveals that income perceptions have continued to fall but spending perceptions haven’t. In other words, JPMorgan said, income growth has not kept pace with consumption.

"These dynamics are sustainable in good times. However, when the economy is hit by a negative shock followed by a sustained slowdown, households may begin to mark down future income expectations. If so, households could begin tightening their belts by slowing the pace of debt accumulation or increasing precautionary savings," noted the economists in the report.

Monetary transmission

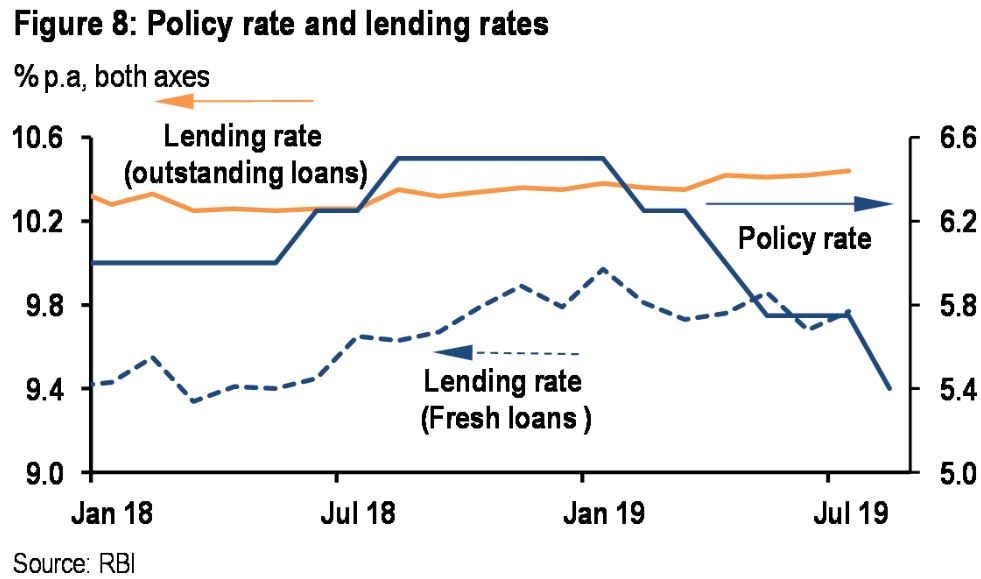

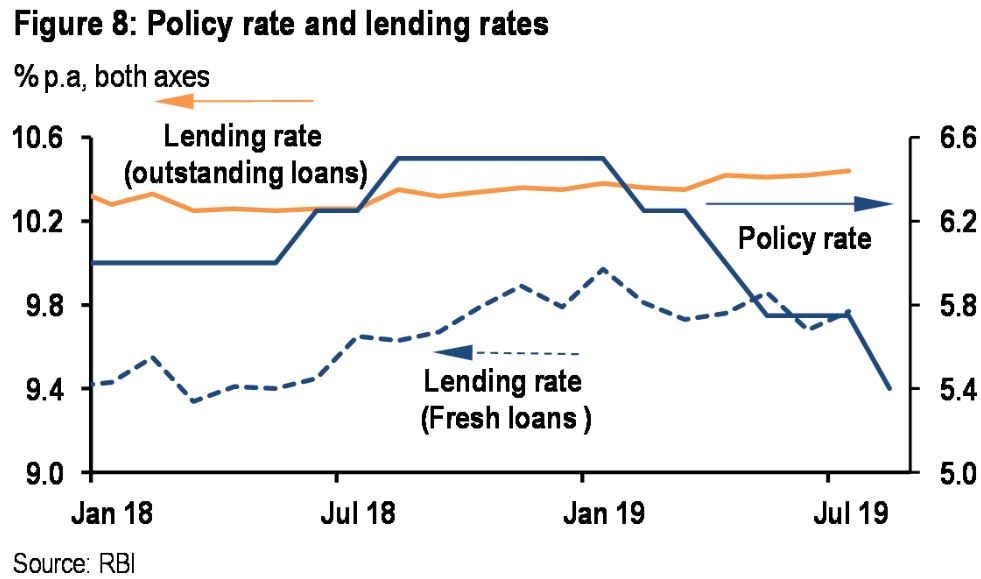

Despite the Reserve Bank of India cutting rates by 110 basis points in 2019 and inter-bank liquidity in a meaningful surplus, bank lending rates showed very limited transmission from the RBI policy rates, noted the report.

Financial intermediaries also have been plagued by risk aversion and with rates on small savings much higher than bank deposit rates, it is hard for banks to cut deposit rates and, therefore, lending rates, said the economists.

Fiscal pressure

Finance minister Nirmala Sitharaman has reduced the corporate tax rate on domestic companies by at least 5 percentage points, which could result in a revenue loss of Rs 1.45 lakh crore per year. The tax cuts are expected to increase the consolidated fiscal deficit by 0.5 percent to 0.7 percent of GDP, according to JPMorgan.

Along with falling tax collections due to slowing economic activity, the tax cuts meaningfully increase the likelihood of the government missing its 3.3 percent of GDP deficit target, noted the report.

JPMorgan expects the government's fiscal slippage could be less than the 0.5 percent of GDP. "We believe the Center will limit the slippage potentially through a combination of expenditure cuts, and pushing some subsidies off the balance sheet—like last year—to assuage bond market concerns," it said.

Growth forecast

JPMorgan believes that the direct near-term impact on growth from the tax cuts is expected to be limited. "The corporate tax cut should be thought of as boosting the supply side at a time when much of the slowdown is on account of weak demand. Therefore, how much investment firms will undertake in the near term in response to the tax cut remains to be seen," noted the report.

JPMorgan said there were meaningful downside risks to its previous growth forecast of 6.4 percent, with growth on track to print closer to 6 percent. "After the tax cuts, however, the markdown to growth is more modest, to 6.2 percent in 2019-20," it said.

https://www.cnbctv18.com/economy/jp...stic-demand-than-by-global-forces-4465071.htm

JP Morgan’s Sajjid Chinoy: India’s slowdown driven by sharp drop in domestic demand than by global forces

Slowing economic growth has been a concern all over the world on the back of ongoing trade wars, protectionism and geopolitical tensions. The International Monetary Fund and the World Trade Organisation have warned that these issues pose further downside risks to global growth. India, the world's fastest-growing economy, is also struggling to maintain the pace, with GDP growth slowing to a six-year low of 5 percent during the April-June period.

However, global trends reflect only a fraction of the slowdown in India's economy, argued JPMorgan emerging markets economists Sajjid Chinoy and Toshi Jain. The real culprit is consumption.

"While export growth has slowed to less than 6 percent in 3Q19 from double-digit growth in previous quarters, the percentage-point contribution of exports to slowing headline GDP growth across the latest two quarters—at 0.8 percentage point in 3Q19—was less than one-third of the downshift caused by slowing private consumption growth," they said in a research note dated September 27. Below are the vital points of their research note:

Consumption slowdown

Private consumption has been a key contributor to India’s growth over the last four years, with an average growth of around 7 percent to 8 percent since 2015, according to JPMorgan. The consumption growth slowed to a five-year low of 3.1 percent in 3Q19. While the sudden downshift may have been a surprise, the direction shouldn’t have been as the consumption has been slowing for the last year, noted the report.

The auto sector faced a severe slowdown in the last one year, with sales falling over decade lows, due to a rise in the goods and service tax and higher costs of registration and insurance. A liquidity crunch and rising bad loans in the non-banking financial companies have also squeezed credit availability to auto dealers.

Income growth

Consumer debt also has been climbing, with Credit Bureau data suggesting that “individual debt” has risen by 10 percentage points of GDP in just four years, pointed out the report. The latest RBI Consumer Household Survey reveals that income perceptions have continued to fall but spending perceptions haven’t. In other words, JPMorgan said, income growth has not kept pace with consumption.

"These dynamics are sustainable in good times. However, when the economy is hit by a negative shock followed by a sustained slowdown, households may begin to mark down future income expectations. If so, households could begin tightening their belts by slowing the pace of debt accumulation or increasing precautionary savings," noted the economists in the report.

Monetary transmission

Despite the Reserve Bank of India cutting rates by 110 basis points in 2019 and inter-bank liquidity in a meaningful surplus, bank lending rates showed very limited transmission from the RBI policy rates, noted the report.

Financial intermediaries also have been plagued by risk aversion and with rates on small savings much higher than bank deposit rates, it is hard for banks to cut deposit rates and, therefore, lending rates, said the economists.

Fiscal pressure

Finance minister Nirmala Sitharaman has reduced the corporate tax rate on domestic companies by at least 5 percentage points, which could result in a revenue loss of Rs 1.45 lakh crore per year. The tax cuts are expected to increase the consolidated fiscal deficit by 0.5 percent to 0.7 percent of GDP, according to JPMorgan.

Along with falling tax collections due to slowing economic activity, the tax cuts meaningfully increase the likelihood of the government missing its 3.3 percent of GDP deficit target, noted the report.

JPMorgan expects the government's fiscal slippage could be less than the 0.5 percent of GDP. "We believe the Center will limit the slippage potentially through a combination of expenditure cuts, and pushing some subsidies off the balance sheet—like last year—to assuage bond market concerns," it said.

Growth forecast

JPMorgan believes that the direct near-term impact on growth from the tax cuts is expected to be limited. "The corporate tax cut should be thought of as boosting the supply side at a time when much of the slowdown is on account of weak demand. Therefore, how much investment firms will undertake in the near term in response to the tax cut remains to be seen," noted the report.

JPMorgan said there were meaningful downside risks to its previous growth forecast of 6.4 percent, with growth on track to print closer to 6 percent. "After the tax cuts, however, the markdown to growth is more modest, to 6.2 percent in 2019-20," it said.

30 % risk in any one account is an insane risk.....it is like a trader risking 30 % of his capital on a trade...if few such trades go bad, the trader goes belly up.....30 % risk means bank was at mercy of India Bulls group...wonder how such prudent bankers take such risks...

Smart_trade

Smart_trade

30 % risk in any one account is an insane risk.....it is like a trader risking 30 % of his capital on a trade...if few such trades go bad, the trader goes belly up.....30 % risk means bank was at mercy of India Bulls group...wonder how such prudent bankers take such risks...

Smart_trade

Smart_trade

somewhere sab mili bhagat. look at HDIL - PMC. they bailed them out then sunk them. idhar bhi ibul ne initial days mein bahut dala hoga paisa ya bade transaction kiye honge. ajayega paisa sochta reh gaya bhai

and the ultimate question that always arises, ye compliance wale kidhar gaye ?

satyam hogaya lekin PWC nahi sudhra

and the ultimate question that always arises, ye compliance wale kidhar gaye ?

satyam hogaya lekin PWC nahi sudhra

SAT quashes Sebi order of banning PwC for two years from auditing

SAT ruling went on to add that Sebi in fact has no jurisdiction banning any audit firm.

By

Sachin Dave

SAT = The Securities Appellate Tribunal

Read more at:

https://economictimes.indiatimes.co...-years-from-auditing/articleshow/71044512.cms

Similar threads

-

-

Collective Investment Scheme in stocks and futures trading?

- Started by rakamaka

- Replies: 7

-

Trading Futures: Indices Vs Individual Stocks

- Started by Trade_Artist

- Replies: 9

-

-