Hi,

I calculate bollinger based RSI by passing the RSI for 14 days into bollinger band for 50 days (just like closing price is used to calculate bollinger bands). My strategy is:

My stop loss is -7.5%.

As, it is apparent from my sell condition I intend to close all trades at the end of the year, only to start fresh trading next year.

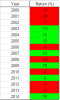

Currently, this approach is doing wonders in bull years, however it fails in a bear year. Your take?

I calculate bollinger based RSI by passing the RSI for 14 days into bollinger band for 50 days (just like closing price is used to calculate bollinger bands). My strategy is:

- Buy when:

- Bollinger based RSI is below bollinger bottom

- MACD with slow=12 and fast=26 is greater than 0

- Volume is more than 10000

- Price is above 100 rupees

- Sell when:

- Bollinger based RSI is above bollinger top

- 25 December comes

My stop loss is -7.5%.

As, it is apparent from my sell condition I intend to close all trades at the end of the year, only to start fresh trading next year.

Currently, this approach is doing wonders in bull years, however it fails in a bear year. Your take?

Attachments

-

6.6 KB Views: 175