Day Trading Stocks & Futures

- Thread starter TraderRavi

- Start date

- Tags banknifty bnf daytrading nifty future

New Law in US to make Trump President for Life  .

.

.

.

The president of the United States apparently regards the leader of the Chinese Communist Party as a model. “He’s now president for life,” President Trump told supporters this past weekend. “President for life. No, he’s great. And look, he was able to do that. I think it’s great. Maybe we’ll have to give that a shot some day.”

Trump as ‘president for life’? That’s no joke.

The Letter that shocked the country

https://finshots.in/archive/the-letter-that-shocked-the-country/

Sent from my iPad using Tapatalk

https://finshots.in/archive/the-letter-that-shocked-the-country/

Sent from my iPad using Tapatalk

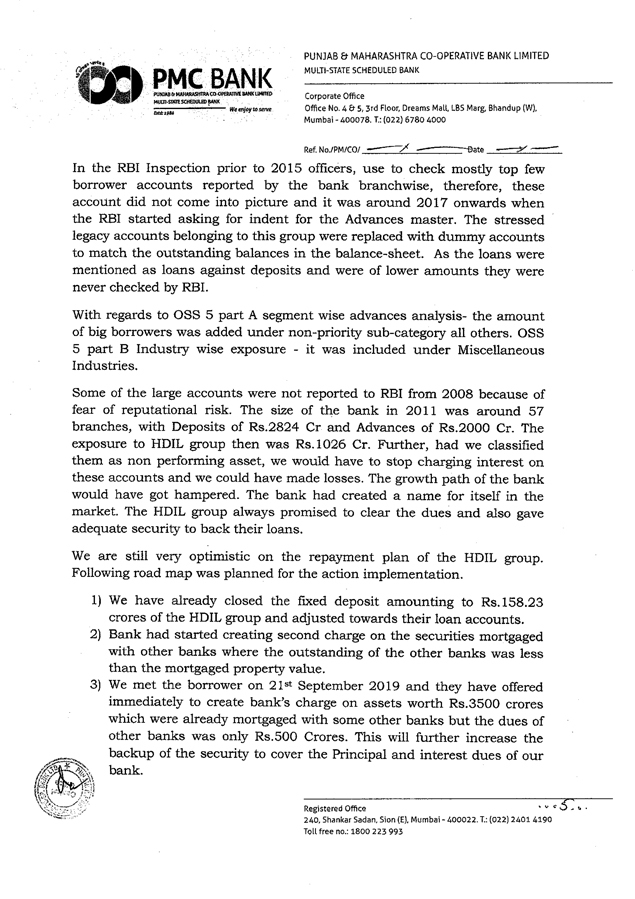

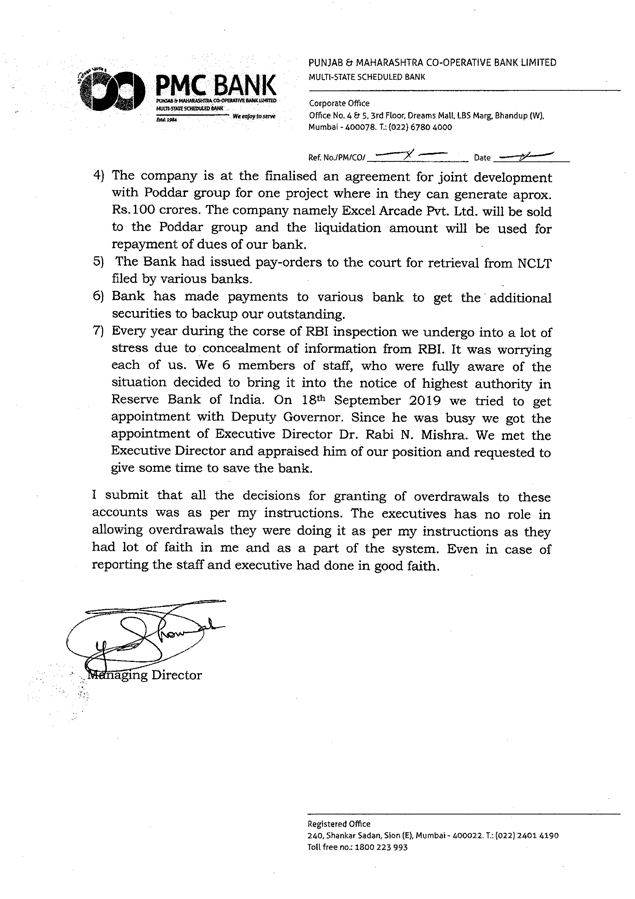

Suspended PMC Bank MD Joy Thomas' letter to RBI: Full text - Times of India

TIMESOFINDIA.COM | Oct 1, 2019, 12:24 IST

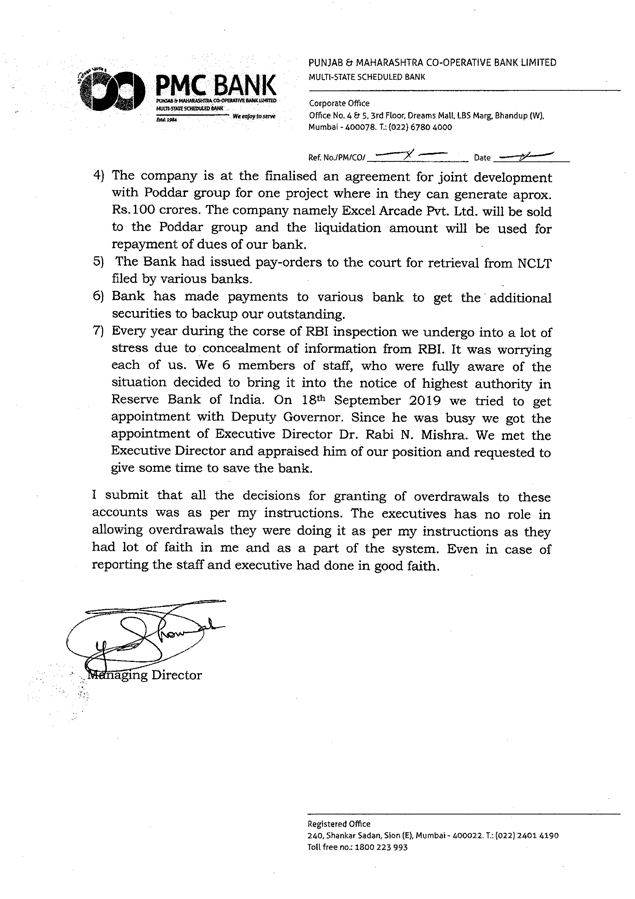

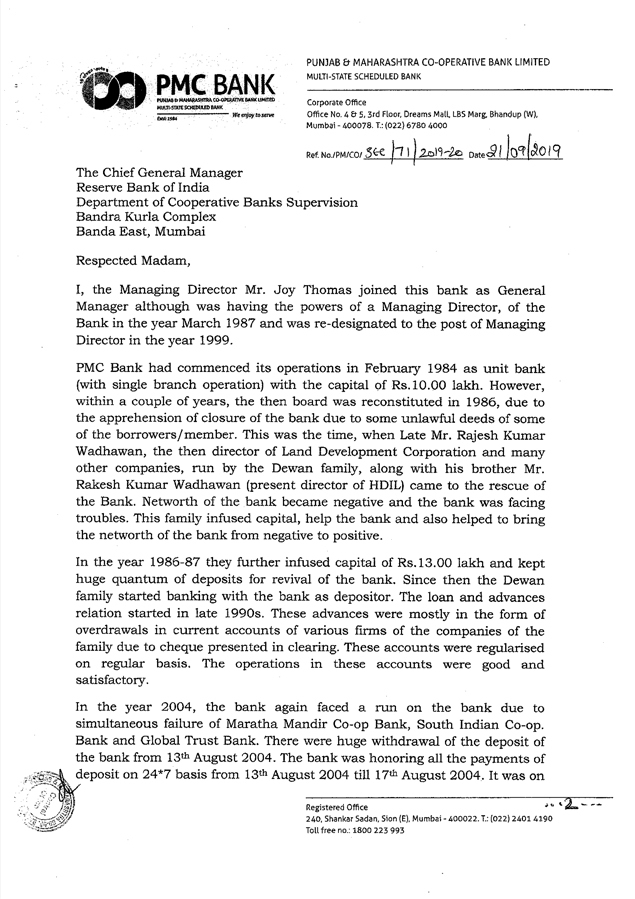

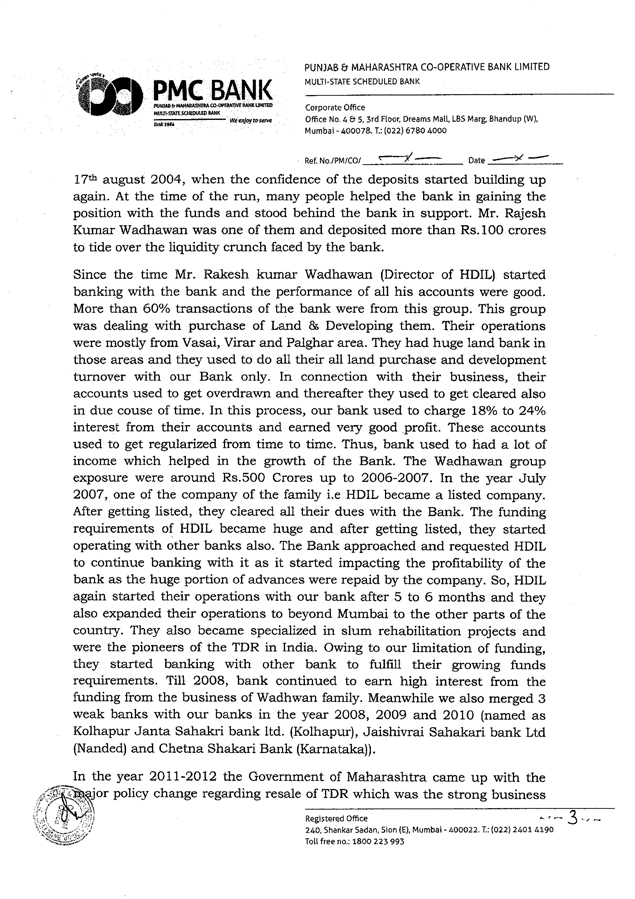

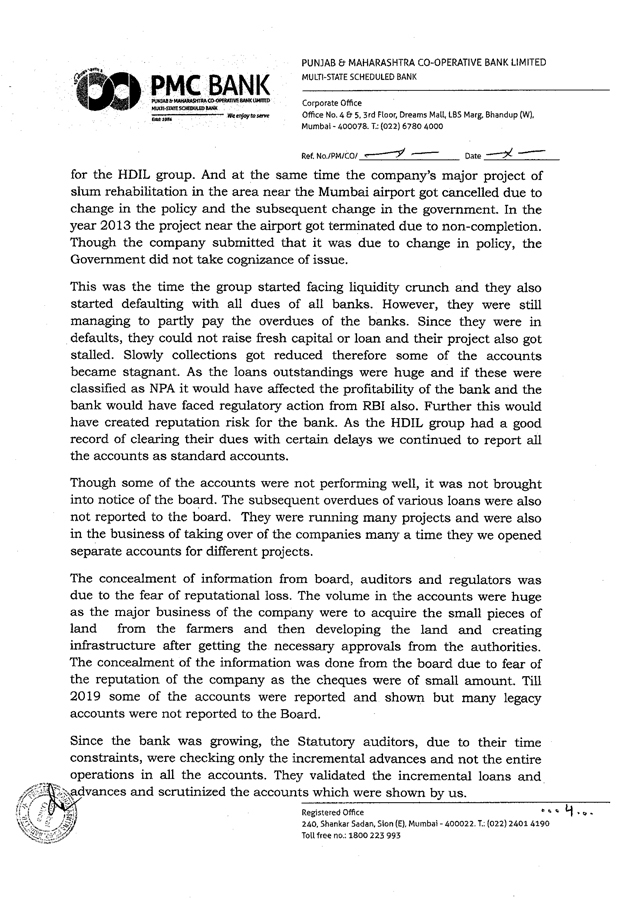

NEW DELHI: Suspended managing director of the crisis-hit Punjab and Maharashtra Cooperative (PMC) Bank Joy Thomas has admitted to the Reserve Bank of India (RBI) that the bank’s actual exposure to the bankrupt HDIL is over Rs 6,500 crore—four times the regulatory cap or 73 per cent of its entire assets of Rs 8,880 crore.

The admission came after a board member leaked the actual balance sheet details to the RBI, a source in know of the details said. Last week, Thomas held a press conference in which he claimed the HDIL group owed the bank Rs 2,500 crore, which was a 31 per cent exposure.

Here's the complete text of Thomas' letter to RBI:

https://timesofindia.indiatimes.com...ter-to-rbi-full-text/articleshow/71388501.cms

TIMESOFINDIA.COM | Oct 1, 2019, 12:24 IST

NEW DELHI: Suspended managing director of the crisis-hit Punjab and Maharashtra Cooperative (PMC) Bank Joy Thomas has admitted to the Reserve Bank of India (RBI) that the bank’s actual exposure to the bankrupt HDIL is over Rs 6,500 crore—four times the regulatory cap or 73 per cent of its entire assets of Rs 8,880 crore.

The admission came after a board member leaked the actual balance sheet details to the RBI, a source in know of the details said. Last week, Thomas held a press conference in which he claimed the HDIL group owed the bank Rs 2,500 crore, which was a 31 per cent exposure.

Here's the complete text of Thomas' letter to RBI:

https://timesofindia.indiatimes.com...ter-to-rbi-full-text/articleshow/71388501.cms

Avenue Supermarts Q2 net profit up 47.5% YoY to Rs 322.6 crore

The net profit remains flat on a sequential basis as Avenue Supermart reported a net profit of Rs 323.06 cr in the June quarter.

Avenue Supermarts, which owns and operates the D-Mart supermarket chain, on October 12 posted a 47.54 percent year-on-year rise in net profit at Rs 322.63 crore for the quarter ended September 2019.

The company reported a net profit of Rs 218.67 crore in the year-ago period. The net profit remains flat on a sequential basis as Avenue Supermart reported a net profit of Rs 323.06 cr in the June quarter. Shares of Avenue Supermart closed 1.2 percent higher at Rs 1,842.25 on October 11.

Total Revenue or total income increased by 22.26 percent on a year-on-year (YoY) basis to Rs 5,998.90 crore for the quarter ended September, compared to Rs 4,906.54 crore reported in the year-ago period.

The company said that it added five stores in Q2FY20.

Earnings before Interest, Tax, Depreciation, and Amortization (EBITDA) in Q2FY20 stood at Rs 517 crores, as compared to Rs 388 crore in the corresponding quarter of last year.

The EBITDA margin improved from 7.9 percent in Q2 FY19 to 8.6 percent in Q2 FY20.

Commenting on the financial performance of the company Neville Noronha, CEO & Managing Director, Avenue Supermarts said, "Revenue growth for the quarter was slightly lower than our estimates while gross margin saw improvement over the corresponding period last year due to better revenue mix."

"PAT margin improvement is in line with revenue growth and also aided by a revision in corporate tax rates," he said.

https://www.moneycontrol.com/news/b...it-up-47-5-yoy-to-rs-322-6-crore-4527651.html

The net profit remains flat on a sequential basis as Avenue Supermart reported a net profit of Rs 323.06 cr in the June quarter.

Avenue Supermarts, which owns and operates the D-Mart supermarket chain, on October 12 posted a 47.54 percent year-on-year rise in net profit at Rs 322.63 crore for the quarter ended September 2019.

The company reported a net profit of Rs 218.67 crore in the year-ago period. The net profit remains flat on a sequential basis as Avenue Supermart reported a net profit of Rs 323.06 cr in the June quarter. Shares of Avenue Supermart closed 1.2 percent higher at Rs 1,842.25 on October 11.

Total Revenue or total income increased by 22.26 percent on a year-on-year (YoY) basis to Rs 5,998.90 crore for the quarter ended September, compared to Rs 4,906.54 crore reported in the year-ago period.

The company said that it added five stores in Q2FY20.

Earnings before Interest, Tax, Depreciation, and Amortization (EBITDA) in Q2FY20 stood at Rs 517 crores, as compared to Rs 388 crore in the corresponding quarter of last year.

The EBITDA margin improved from 7.9 percent in Q2 FY19 to 8.6 percent in Q2 FY20.

Commenting on the financial performance of the company Neville Noronha, CEO & Managing Director, Avenue Supermarts said, "Revenue growth for the quarter was slightly lower than our estimates while gross margin saw improvement over the corresponding period last year due to better revenue mix."

"PAT margin improvement is in line with revenue growth and also aided by a revision in corporate tax rates," he said.

https://www.moneycontrol.com/news/b...it-up-47-5-yoy-to-rs-322-6-crore-4527651.html

IRCTC to debut on bourses Monday: Will the highest-ever PSU IPO subscription mean a bumper listing?

Indian Railway Catering and Tourism Corporation (IRCTC) will make its grand debut on October 14 after its initial public offering (IPO) received the highest ever subscription among PSUs.

The final issue price is fixed at Rs 320 per share, the higher end of the IPO price band. Retail investors and employees of the company received shares at a discount of Rs 10 per share. Hence the final IPO price for them is Rs 310 per share.

The Rs 638-crore public issue was subscribed 112 times from September to October 3, which meant it received Rs 72,000 crore worth of bids, backed by qualified institutional buyers (a category that was subscribed by 109 times), net institutional sales (NIIs) (354.5 times), retail (15 times) and employees (5.82 times).

After such an overwhelming response to the issue, a blockbuster or bumper listing is warranted on Monday (October 14), according to experts who spoke to Moneycontrol. They said the listing price is likely to be more than Rs 500, a premium of 56 percent over the issue price.

The grey market has also indicated a premium of more than 65 percent to IPO price, sources told Moneycontrol.

"Looking at the huge oversubscription – 112x, one can expect at least a 50 percent premium listing on Monday," Siddhartha Khemka, Senior Vice President, Head-Retail Research at Motilal Oswal Financial Services said.

Prashanth Tapse (AVP Research, Mehta Equities), Astha Jain (Senior Research Analyst at Hem Securities) and Rudra Shares & Stock Brokers also expect the listing price around Rs 500-525 per share, i.e. a premium of 56-64 percent over IPO price.

At this expected debut price, IRCTC asks for a market capitalisation of more than Rs 8,000 crore.

https://www.moneycontrol.com/news/b...bscription-mean-a-bumper-listing-4526491.html

Indian Railway Catering and Tourism Corporation (IRCTC) will make its grand debut on October 14 after its initial public offering (IPO) received the highest ever subscription among PSUs.

The final issue price is fixed at Rs 320 per share, the higher end of the IPO price band. Retail investors and employees of the company received shares at a discount of Rs 10 per share. Hence the final IPO price for them is Rs 310 per share.

The Rs 638-crore public issue was subscribed 112 times from September to October 3, which meant it received Rs 72,000 crore worth of bids, backed by qualified institutional buyers (a category that was subscribed by 109 times), net institutional sales (NIIs) (354.5 times), retail (15 times) and employees (5.82 times).

After such an overwhelming response to the issue, a blockbuster or bumper listing is warranted on Monday (October 14), according to experts who spoke to Moneycontrol. They said the listing price is likely to be more than Rs 500, a premium of 56 percent over the issue price.

The grey market has also indicated a premium of more than 65 percent to IPO price, sources told Moneycontrol.

"Looking at the huge oversubscription – 112x, one can expect at least a 50 percent premium listing on Monday," Siddhartha Khemka, Senior Vice President, Head-Retail Research at Motilal Oswal Financial Services said.

Prashanth Tapse (AVP Research, Mehta Equities), Astha Jain (Senior Research Analyst at Hem Securities) and Rudra Shares & Stock Brokers also expect the listing price around Rs 500-525 per share, i.e. a premium of 56-64 percent over IPO price.

At this expected debut price, IRCTC asks for a market capitalisation of more than Rs 8,000 crore.

https://www.moneycontrol.com/news/b...bscription-mean-a-bumper-listing-4526491.html

Avenue Supermarts Q2 net profit up 47.5% YoY to Rs 322.6 crore

The net profit remains flat on a sequential basis as Avenue Supermart reported a net profit of Rs 323.06 cr in the June quarter.

Avenue Supermarts, which owns and operates the D-Mart supermarket chain, on October 12 posted a 47.54 percent year-on-year rise in net profit at Rs 322.63 crore for the quarter ended September 2019.

The company reported a net profit of Rs 218.67 crore in the year-ago period. The net profit remains flat on a sequential basis as Avenue Supermart reported a net profit of Rs 323.06 cr in the June quarter. Shares of Avenue Supermart closed 1.2 percent higher at Rs 1,842.25 on October 11.

Total Revenue or total income increased by 22.26 percent on a year-on-year (YoY) basis to Rs 5,998.90 crore for the quarter ended September, compared to Rs 4,906.54 crore reported in the year-ago period.

The company said that it added five stores in Q2FY20.

Earnings before Interest, Tax, Depreciation, and Amortization (EBITDA) in Q2FY20 stood at Rs 517 crores, as compared to Rs 388 crore in the corresponding quarter of last year.

The EBITDA margin improved from 7.9 percent in Q2 FY19 to 8.6 percent in Q2 FY20.

Commenting on the financial performance of the company Neville Noronha, CEO & Managing Director, Avenue Supermarts said, "Revenue growth for the quarter was slightly lower than our estimates while gross margin saw improvement over the corresponding period last year due to better revenue mix."

"PAT margin improvement is in line with revenue growth and also aided by a revision in corporate tax rates," he said.

https://www.moneycontrol.com/news/b...it-up-47-5-yoy-to-rs-322-6-crore-4527651.html

The net profit remains flat on a sequential basis as Avenue Supermart reported a net profit of Rs 323.06 cr in the June quarter.

Avenue Supermarts, which owns and operates the D-Mart supermarket chain, on October 12 posted a 47.54 percent year-on-year rise in net profit at Rs 322.63 crore for the quarter ended September 2019.

The company reported a net profit of Rs 218.67 crore in the year-ago period. The net profit remains flat on a sequential basis as Avenue Supermart reported a net profit of Rs 323.06 cr in the June quarter. Shares of Avenue Supermart closed 1.2 percent higher at Rs 1,842.25 on October 11.

Total Revenue or total income increased by 22.26 percent on a year-on-year (YoY) basis to Rs 5,998.90 crore for the quarter ended September, compared to Rs 4,906.54 crore reported in the year-ago period.

The company said that it added five stores in Q2FY20.

Earnings before Interest, Tax, Depreciation, and Amortization (EBITDA) in Q2FY20 stood at Rs 517 crores, as compared to Rs 388 crore in the corresponding quarter of last year.

The EBITDA margin improved from 7.9 percent in Q2 FY19 to 8.6 percent in Q2 FY20.

Commenting on the financial performance of the company Neville Noronha, CEO & Managing Director, Avenue Supermarts said, "Revenue growth for the quarter was slightly lower than our estimates while gross margin saw improvement over the corresponding period last year due to better revenue mix."

"PAT margin improvement is in line with revenue growth and also aided by a revision in corporate tax rates," he said.

https://www.moneycontrol.com/news/b...it-up-47-5-yoy-to-rs-322-6-crore-4527651.html

Number of crorepati taxpayers up 20% to 97,689 in AY 2018-19: CBDT data

The Central Board of Direct Taxes on October 11 released time-series data updated up to fiscal year 2018-19 and income-distribution data for AY 2018-19 (fiscal year 2017-18).

The number of crorepati taxpayers shot up 20 per cent to 97,689 during assessment year (AY) 2018-19, as per tax returns data released by the revenue department. The number such individuals having taxable income of over Rs 1 crore stood at 81,344 during AY 2017-18.

If all taxpayers are included, the number of those with taxable income of more than Rs 1 crore per annum rises to about 1.67 lakh, a 19 per cent rise over AY 2017-18.

In all, more than 5.87 crore income tax returns were filled, as per the statistics generated from e-filed returns (digitally signed, e-verified or where ITRV has been received) submitted up to August 15, 2019.

The data revealed that over 5.52 crore individuals, 11.3 lakh HUFs, 12.69 lakh firms and 8.41 lakh companies were among those who filed returns.

https://www.moneycontrol.com/news/b...to-97689-in-ay-2018-19-cbdt-data-4526691.html

The Central Board of Direct Taxes on October 11 released time-series data updated up to fiscal year 2018-19 and income-distribution data for AY 2018-19 (fiscal year 2017-18).

The number of crorepati taxpayers shot up 20 per cent to 97,689 during assessment year (AY) 2018-19, as per tax returns data released by the revenue department. The number such individuals having taxable income of over Rs 1 crore stood at 81,344 during AY 2017-18.

If all taxpayers are included, the number of those with taxable income of more than Rs 1 crore per annum rises to about 1.67 lakh, a 19 per cent rise over AY 2017-18.

In all, more than 5.87 crore income tax returns were filled, as per the statistics generated from e-filed returns (digitally signed, e-verified or where ITRV has been received) submitted up to August 15, 2019.

The data revealed that over 5.52 crore individuals, 11.3 lakh HUFs, 12.69 lakh firms and 8.41 lakh companies were among those who filed returns.

https://www.moneycontrol.com/news/b...to-97689-in-ay-2018-19-cbdt-data-4526691.html

Similar threads

-

-

Collective Investment Scheme in stocks and futures trading?

- Started by rakamaka

- Replies: 7

-

Trading Futures: Indices Vs Individual Stocks

- Started by Trade_Artist

- Replies: 9

-

-