S/G 1 - Trade one scrip perfectly for 1 week.

- From tomorrow till next Friday I am going to trade only 1 symbol. i.e. TATASTEEL future.

- The goal is to maintain the level of concentration and focus from 9am to 3:30PM, and take all the trades exactly as per the system.

- in evening post 2 charts one with trades marked as per the strategy and one with actual trades taken by me. Study them both and note down where and why I deviated and check the scopes for improvement.

- If at least for a single day I loose focus because I was not attentive and for that if I miss signal/or take wrong entry (again for lack of focus), then it will be counted as a failure and the challenge will be repeated for one more week.

- Always come with a trade plan to market. and maintain trade journal and log file after the market.

This will test my patience, level of concentration and how well I understand and execute my strategy in live market. No more excuses from tomorrow. ( Now I am getting the feel like the real game is ON.

)

Last week I gave myself a challenge for trading and tracking just 1 symbol for 1 week. The week being a truncated one with one holiday and only 4 trading session here its time to review my goal.

For the entire week I tracked and traded only TATASTEEL. I am not just satisfied with my performance but more surprised for I did not at all struggled for the said issues of boredom and loss of focus. All the time I was saying to myself that with one symbol I get bored and loose focus but in real for last 4 session I was fully focused and highly concentrated in applying the newly learned knowledge in real market. I just realised how I create my own reality by giving attention to some particular kind of thoughts. I was living with a version of myself where my reality was with this statement that - "1 Symbol -> Boredom". And with that reality even if I have not got actually bored I started looking at other symbols. So I am quietly amazed to find out how our thoughts manipulate us and how our subconscious create our reality with out any judgement solely based on what kind of thoughts we are giving attention to. This is the true motive behind my trading challenge to become a better version of myself every day, every week and so on.. Now with this understanding I am slowly getting aware of my own thoughts and taking their reigns in my hand. A question for everybody to ask themselves, not just in trading but in everyday life. "Whats the story that you are telling yourself?"

Performance Analysis

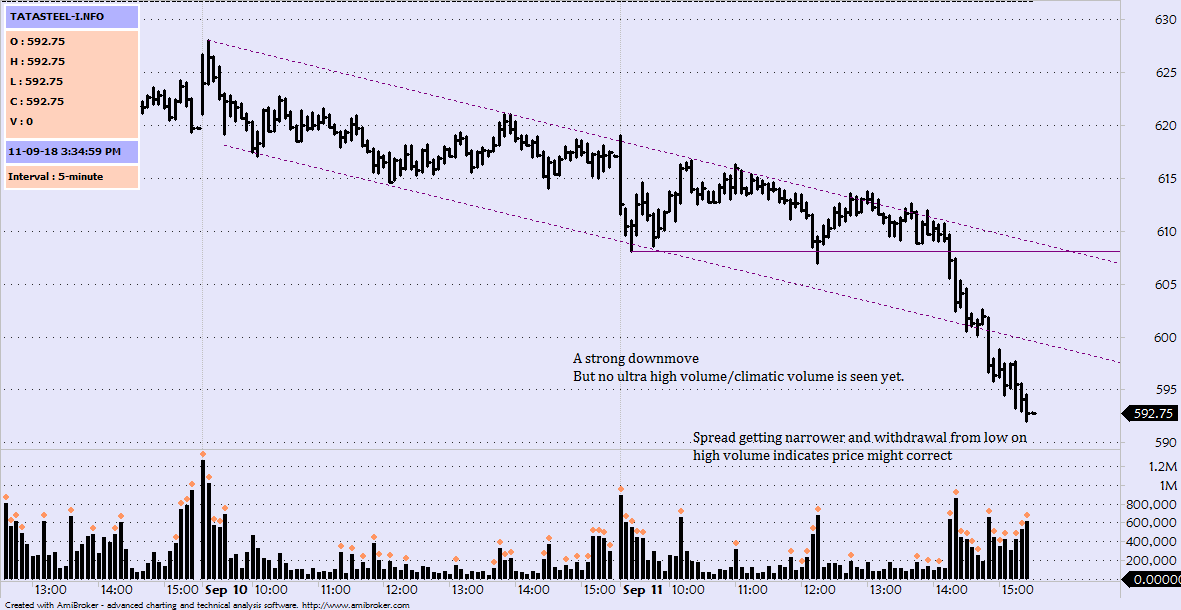

I spent most of the time last week in reading various stuffs about VSA and seeing how they were applied in various charts trying to understand them. I have also applied them in live with TATASTEEL. I still have not started testing myself based on this strategy. Cause after all its not how much I know, but how well I can use the learned knowledge thats going to make money. For that I have to start testing it on several historical charts to gain confidence and to understand it better.

On friday there was only one trade opportunity where my 1st attempt to enter LONG was shaken out and then I waited for a clean breakout and pullback for re-entry, but market gave a strong breakout and almost vertical rally. Monday was a no trade day. Tuesday was a repetition of Friday where price formed multiple test and then crashed. I was again looking for a break below day low and pullback to enter. This was something habitual practice from my pivot trading days where I used to get a pullback on 1m almost every time. But now here I can see that true effort to break a trading range is not seen at the range but when price approaches the range. I am sure I will also look for this setup during my testing and also looking forward to use it on future trading sessions. I also struggled sometimes with trend-lines and trend channels. Wednesday was one such day where I got confused on trading bias as higher timeframe had no clear trend. SO I had just one trade done so far. I will update the trade log file in weekend.

Now moving on to the 2nd sub goal -

S/G 2 -

- Trade TATASTEEL and BANKNIFTY on 5m chart using VSA

- Start backtesting for both the symbols and finish atleast 1 month of trading by next Thursday night.

The main focus will be on -

- Maintaining and Continuing the focus and concentration during live trading session with 2 symbols only.

- Back-test and make note of all the setups from VSA that I want to trade and in live take those trade setups with no hesitation.

- Keep maintaining trade journal and trade log

- Everyday come to trading with a clear trade plan.

- If I fail to maintain my concentration and again slip back to previous zone of lack of focus then I will have to trade again with 1 symbol like S/G -1

- If I fail to finish backtesting of atleast 1 month by next Thursday then live trading will be stopped and will be resumed only after backtesting target is met.

This will help me to continue on my journey by stepping on the positive improvement from last week plus this will push me to achieve a better understanding of this new concept by bactesting bar by bar and how fairly I can apply them in real market.

>>> NEVER GIVE UP <<<