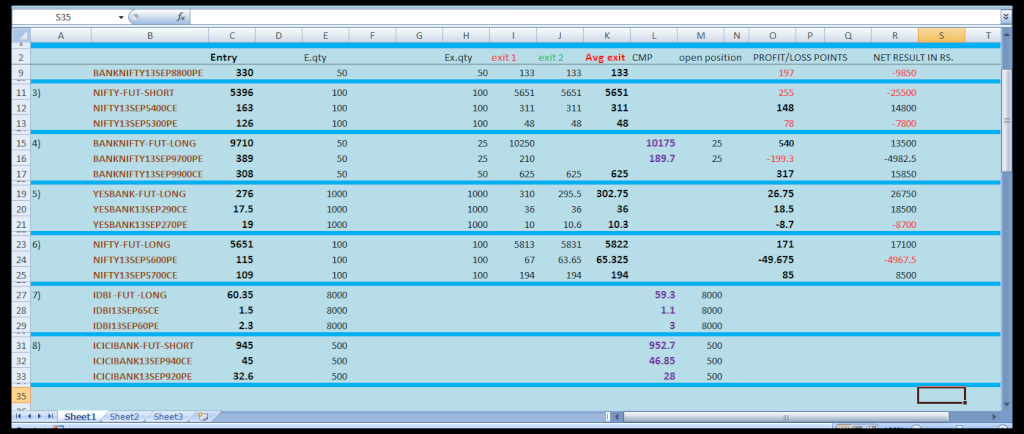

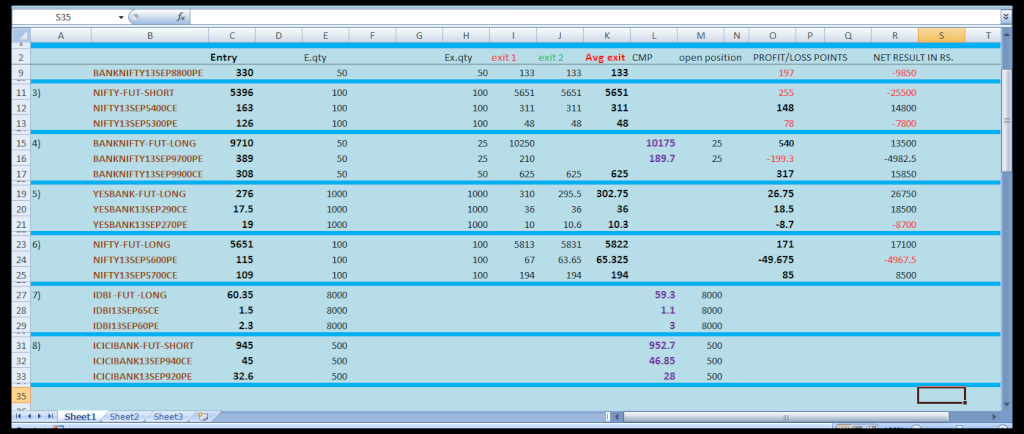

Closed position update :-

Nifty future long 1 lot(5651) - Exited (5831) = + 180 points

Nifty 5600 pe long 1 lot (115.00) - Exited (65.35) = - 49.65 points

Fresh position entry update :-

Idbi future long 2 lots (60.35)

Idbi 65 call option 2 lots (1.50)

Idbi 60 put option 2 lots (2.30)

Icicibank fut short 2 lots (945.00)

Icicibank 940 call option 2 lots (45.00)

Icicibank 920 call option 2 lots (32.60)

Open positions update :-

Download link :-

http://goo.gl/GZ5Vzx

Nifty future long 1 lot(5651) - Exited (5831) = + 180 points

Nifty 5600 pe long 1 lot (115.00) - Exited (65.35) = - 49.65 points

Fresh position entry update :-

Idbi future long 2 lots (60.35)

Idbi 65 call option 2 lots (1.50)

Idbi 60 put option 2 lots (2.30)

Icicibank fut short 2 lots (945.00)

Icicibank 940 call option 2 lots (45.00)

Icicibank 920 call option 2 lots (32.60)

Open positions update :-

Download link :-

http://goo.gl/GZ5Vzx