2. Capstone hires people every month. The advertisements are put-up on job search sites. Moreover, it has organized a walk-in on 18th of November, 2013. If you are interested then you can directly come to its office. The joining date is 2nd December, 2013.

My Trading Journal @ Capstone Securities Analysis Pvt. Ltd.

- Thread starter anirudh_singh87

- Start date

4. Please donot feel offended by the answer to this question, just try to broaden your perspective. I have been asked this question many times by different people. Such people need to broaden their perspective regarding the business model followed by intraday trading firms and how they use leverage. First of all, in intraday trading the traders are allocated a certain buying power by Capstone. In intraday trading no money is exchanged while making the trades. Intraday trading firms just need sufficient money to pay for the losses of their traders at the end of the settlement cycle. Since, in intraday trading their is no risk of gap-up/gap-down opening the risk for loss is very low. Capstone has deposited a particular capital with its broker and in turn they have provided a leveraged buying power as a whole for the company. It is this buying power which is further allocated to the traders, i.e. traders derive their buying power from capital which is already leveraged. In a nut shell, there is not question of leverage since traders are not given any real capital but buying power because in intraday trading no real money exchange takes place.

Initially a trader is given 2000$.So what is the max leverage a trader is allowed to use.Say Indian brokers allow 4 times.

Does this mean that one can take a position of 8000$ per trade ?

Regarding the risk ?

Regarding the brokerage - 6$ per trade - buy and sell - 12$.

Assuming a trader can take 1% risk per trade.

So a trader with 2000$ has to shell out 12$ per trade just to brokerage out of the 20$ risk per trade.

Means a trader is forced to take more than 1% risk per trade.

Do you think with the brokerage structure and capital given one has a better chance of survival ?

What's the daily risk limit ?

Whats the weekly risk limit ?

Whats the monthly risk limit ?

Is the profit accrued to the Trading account ?

When a Trader will be fired or what is the loss limit for a trader ?

The question is - about the leverage allowed for the trader.

Initially a trader is given 2000$.So what is the max leverage a trader is allowed to use.Say Indian brokers allow 4 times.

Does this mean that one can take a position of 8000$ per trade ?

Regarding the risk ?

Regarding the brokerage - 6$ per trade - buy and sell - 12$.

Assuming a trader can take 1% risk per trade.

So a trader with 2000$ has to shell out 12$ per trade just to brokerage out of the 20$ risk per trade.

Means a trader is forced to take more than 1% risk per trade.

Do you think with the brokerage structure and capital given one has a better chance of survival ?

What's the daily risk limit ?

Whats the weekly risk limit ?

Whats the monthly risk limit ?

Is the profit accrued to the Trading account ?

When a Trader will be fired or what is the loss limit for a trader ?

Initially a trader is given 2000$.So what is the max leverage a trader is allowed to use.Say Indian brokers allow 4 times.

Does this mean that one can take a position of 8000$ per trade ?

Regarding the risk ?

Regarding the brokerage - 6$ per trade - buy and sell - 12$.

Assuming a trader can take 1% risk per trade.

So a trader with 2000$ has to shell out 12$ per trade just to brokerage out of the 20$ risk per trade.

Means a trader is forced to take more than 1% risk per trade.

Do you think with the brokerage structure and capital given one has a better chance of survival ?

What's the daily risk limit ?

Whats the weekly risk limit ?

Whats the monthly risk limit ?

Is the profit accrued to the Trading account ?

When a Trader will be fired or what is the loss limit for a trader ?

Let me just spoon-feed you.......mentioning each and every thing.......even the minute insignificant detail......

First of all that long paragraph was about leverage only. Let me first start by stating what do you mean by leverage. Conceptually it is defined as ASSETS/EQUITY or simply TOTAL HOLDING/ PERSONAL CONTRIBUTION. If someone contributes $20 and buys shares worth $100 then his leverage would be 5. the remaining $80 will be provided by the broker/other institutions as a loan.

Now, you are thinking that Capstone is providing us with Capital. That is not the case. They are providing us with buying power. The question which arises now is that what is the difference between CAPITAL and BUYING POWER. To answer this question we need to understand the mechanism of Buying and Selling in Stock Markets at an intraday level. When you buy any share then you do not have to pay for it immediately. There is a settlement cycle. It is T+2 for Indian markets and T+3 for US markets, i.e. in US markets the money to be paid(assuming that you have a buying position or are simply LONG) by you will be charged on the 2nd day after the trading day and you will receive the shares on the 3rd day after the trading day. When you buy and sell anything on the same day(intraday trading) then the question of the mechanism doesn't arise. You simply have to pay the for the difference in the buying value(No. of Shares * Buying Price) and the selling value(No. of Shares * Selling Price), if you are making a loss. In case you make a profit then you will receive the amount equal to the difference between selling value and buying value. Now the point which comes is that when we donot need any CAPITAL for intraday trading why will the broker allow us to trade when he faces the risk that if there is a major loss then the company may default on its commitment to pay for the losses. For this, Capstone has deposited some money with the broker and has already leveraged on this deposit and has achieved a particular BUYING POWER. Put it simply, the amount of money that the trader can trade with is being provided by Capstone on an already leveraged capital. Let me make it clear with an example......If capstone deposits $1000 withe broker and the broker allows it to take open positions worth $10000 and then Capstone divides this BUYING POWER among its 4 traders on an equal basis. Then each trader will get to take open position worth $2500. Since, the leverage was 10($10000/$1000), hence, the traders are being provided with BUYING POWER with ALREADY LEVERAGED CAPITAL. Hence, there is no question of LEVERAGE since traders are not provided with actual capital but BUYING POWER.

Now come to brokerage. The value of $6 if for one tick, i.e. 1000 shares, irrespective of the price of the share, and not per trade. If you buy 100 share then you pay a brokerage of 60 cents. If you buy 10 shares then you pay a brokerage of 6 cent. If you buy 1 share then you pay a brokerage of 0.6cents or $0.006. If with the allocated capital of $2000 you buy one share of $2000 you pay a brokerage of $0.006. If you buy 100 shares of $20 then you pay a brokerage of 60 cents or $0.6. The total worth of shares bought in both cases is same but the brokerage charged is different. The brokerage is dependent upon the no. of shares irrespective of the price of the share. If you buy costly shares then your brokerage will be low and if you buy cheap shares your brokerage will be high as a percentage of the total worth of shares bought.

Risk limit is different for person to person. Even with two people having the same buying power, risk limit will be different depending upon the trading style of the trader, which is monitored by the Risk Managers. They have their own criteria to determine the risk limit of each trader.

Profit will not get directly accrued to your trading account, but if you make consistent profit for 2-3months then the BUYING POWER will be increased and that too by huge amount.

There is no fixed loss limit for the trader. If suppose a trader makes a profit of say $10000 consistently for 3 months and then in the fourth month makes a loss of $50000, then the Risk Managers will look into the cause of the loss. If the loss was due to one bad trade, or due to some rumor in the market(e.g. the white house bomb blast rumor which hit the market 3-4 months back), or due to a rare event(e.g. the Flash Crash of 2010), etc. then he will be given a warning and will be asked to recover the losses. However, if the trader is making losses consistently, even though they may be small, he might be asked to leave. However, in the training phase you are given a lot of leeway. In the training phase almost everyone makes losses.

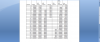

Assuming a Trader is given 2000 $ initially and 20000$ 6 months later.

I have assumed the trader making 10% profit Month on month with the capital given.

Summary of Findings attached.

I have assumed the trader making 10% profit Month on month with the capital given.

Summary of Findings attached.

Consistent profit of 10% is a bit of exaggerated expectation from your side. Normally, one earns the return of 4-5% each month. That too there are period of losses with each trader, even the best ones.

Further, if you manage to even give a "CONSISTENT" return of say 4% for 3-4 months then you will achieve an exponential growth in the allocated BUYING POWER to you. In your excel sheet the buying power was the same for most of the period. The senior traders have buying power of multi million dollars. Some have even refused to accept more buying power because they think that they will not be able to utilize it efficiently.

Hey Bhagwan mujhe utha le...............after all this gyan you are not understanding what I am trying to tell you.......I think something is drastically wrong with my writing/drafting skills.

Let me just spoon-feed you.......mentioning each and every thing.......even the minute insignificant detail......

First of all that long paragraph was about leverage only. Let me first start by stating what do you mean by leverage. Conceptually it is defined as ASSETS/EQUITY or simply TOTAL HOLDING/ PERSONAL CONTRIBUTION. If someone contributes $20 and buys shares worth $100 then his leverage would be 5. the remaining $80 will be provided by the broker/other institutions as a loan.

Now, you are thinking that Capstone is providing us with Capital. That is not the case. They are providing us with buying power. The question which arises now is that what is the difference between CAPITAL and BUYING POWER. To answer this question we need to understand the mechanism of Buying and Selling in Stock Markets at an intraday level. When you buy any share then you do not have to pay for it immediately. There is a settlement cycle. It is T+2 for Indian markets and T+3 for US markets, i.e. in US markets the money to be paid(assuming that you have a buying position or are simply LONG) by you will be charged on the 2nd day after the trading day and you will receive the shares on the 3rd day after the trading day. When you buy and sell anything on the same day(intraday trading) then the question of the mechanism doesn't arise. You simply have to pay the for the difference in the buying value(No. of Shares * Buying Price) and the selling value(No. of Shares * Selling Price), if you are making a loss. In case you make a profit then you will receive the amount equal to the difference between selling value and buying value. Now the point which comes is that when we donot need any CAPITAL for intraday trading why will the broker allow us to trade when he faces the risk that if there is a major loss then the company may default on its commitment to pay for the losses. For this, Capstone has deposited some money with the broker and has already leveraged on this deposit and has achieved a particular BUYING POWER. Put it simply, the amount of money that the trader can trade with is being provided by Capstone on an already leveraged capital. Let me make it clear with an example......If capstone deposits $1000 withe broker and the broker allows it to take open positions worth $10000 and then Capstone divides this BUYING POWER among its 4 traders on an equal basis. Then each trader will get to take open position worth $2500. Since, the leverage was 10($10000/$1000), hence, the traders are being provided with BUYING POWER with ALREADY LEVERAGED CAPITAL. Hence, there is no question of LEVERAGE since traders are not provided with actual capital but BUYING POWER.

Now come to brokerage. The value of $6 if for one tick, i.e. 1000 shares, irrespective of the price of the share, and not per trade. If you buy 100 share then you pay a brokerage of 60 cents. If you buy 10 shares then you pay a brokerage of 6 cent. If you buy 1 share then you pay a brokerage of 0.6cents or $0.006. If with the allocated capital of $2000 you buy one share of $2000 you pay a brokerage of $0.006. If you buy 100 shares of $20 then you pay a brokerage of 60 cents or $0.6. The total worth of shares bought in both cases is same but the brokerage charged is different. The brokerage is dependent upon the no. of shares irrespective of the price of the share. If you buy costly shares then your brokerage will be low and if you buy cheap shares your brokerage will be high as a percentage of the total worth of shares bought.

Risk limit is different for person to person. Even with two people having the same buying power, risk limit will be different depending upon the trading style of the trader, which is monitored by the Risk Managers. They have their own criteria to determine the risk limit of each trader.

Profit will not get directly accrued to your trading account, but if you make consistent profit for 2-3months then the BUYING POWER will be increased and that too by huge amount.

There is no fixed loss limit for the trader. If suppose a trader makes a profit of say $10000 consistently for 3 months and then in the fourth month makes a loss of $50000, then the Risk Managers will look into the cause of the loss. If the loss was due to one bad trade, or due to some rumor in the market(e.g. the white house bomb blast rumor which hit the market 3-4 months back), or due to a rare event(e.g. the Flash Crash of 2010), etc. then he will be given a warning and will be asked to recover the losses. However, if the trader is making losses consistently, even though they may be small, he might be asked to leave. However, in the training phase you are given a lot of leeway. In the training phase almost everyone makes losses.

Let me just spoon-feed you.......mentioning each and every thing.......even the minute insignificant detail......

First of all that long paragraph was about leverage only. Let me first start by stating what do you mean by leverage. Conceptually it is defined as ASSETS/EQUITY or simply TOTAL HOLDING/ PERSONAL CONTRIBUTION. If someone contributes $20 and buys shares worth $100 then his leverage would be 5. the remaining $80 will be provided by the broker/other institutions as a loan.

Now, you are thinking that Capstone is providing us with Capital. That is not the case. They are providing us with buying power. The question which arises now is that what is the difference between CAPITAL and BUYING POWER. To answer this question we need to understand the mechanism of Buying and Selling in Stock Markets at an intraday level. When you buy any share then you do not have to pay for it immediately. There is a settlement cycle. It is T+2 for Indian markets and T+3 for US markets, i.e. in US markets the money to be paid(assuming that you have a buying position or are simply LONG) by you will be charged on the 2nd day after the trading day and you will receive the shares on the 3rd day after the trading day. When you buy and sell anything on the same day(intraday trading) then the question of the mechanism doesn't arise. You simply have to pay the for the difference in the buying value(No. of Shares * Buying Price) and the selling value(No. of Shares * Selling Price), if you are making a loss. In case you make a profit then you will receive the amount equal to the difference between selling value and buying value. Now the point which comes is that when we donot need any CAPITAL for intraday trading why will the broker allow us to trade when he faces the risk that if there is a major loss then the company may default on its commitment to pay for the losses. For this, Capstone has deposited some money with the broker and has already leveraged on this deposit and has achieved a particular BUYING POWER. Put it simply, the amount of money that the trader can trade with is being provided by Capstone on an already leveraged capital. Let me make it clear with an example......If capstone deposits $1000 withe broker and the broker allows it to take open positions worth $10000 and then Capstone divides this BUYING POWER among its 4 traders on an equal basis. Then each trader will get to take open position worth $2500. Since, the leverage was 10($10000/$1000), hence, the traders are being provided with BUYING POWER with ALREADY LEVERAGED CAPITAL. Hence, there is no question of LEVERAGE since traders are not provided with actual capital but BUYING POWER.

Now come to brokerage. The value of $6 if for one tick, i.e. 1000 shares, irrespective of the price of the share, and not per trade. If you buy 100 share then you pay a brokerage of 60 cents. If you buy 10 shares then you pay a brokerage of 6 cent. If you buy 1 share then you pay a brokerage of 0.6cents or $0.006. If with the allocated capital of $2000 you buy one share of $2000 you pay a brokerage of $0.006. If you buy 100 shares of $20 then you pay a brokerage of 60 cents or $0.6. The total worth of shares bought in both cases is same but the brokerage charged is different. The brokerage is dependent upon the no. of shares irrespective of the price of the share. If you buy costly shares then your brokerage will be low and if you buy cheap shares your brokerage will be high as a percentage of the total worth of shares bought.

Risk limit is different for person to person. Even with two people having the same buying power, risk limit will be different depending upon the trading style of the trader, which is monitored by the Risk Managers. They have their own criteria to determine the risk limit of each trader.

Profit will not get directly accrued to your trading account, but if you make consistent profit for 2-3months then the BUYING POWER will be increased and that too by huge amount.

There is no fixed loss limit for the trader. If suppose a trader makes a profit of say $10000 consistently for 3 months and then in the fourth month makes a loss of $50000, then the Risk Managers will look into the cause of the loss. If the loss was due to one bad trade, or due to some rumor in the market(e.g. the white house bomb blast rumor which hit the market 3-4 months back), or due to a rare event(e.g. the Flash Crash of 2010), etc. then he will be given a warning and will be asked to recover the losses. However, if the trader is making losses consistently, even though they may be small, he might be asked to leave. However, in the training phase you are given a lot of leeway. In the training phase almost everyone makes losses.

Since intraday no t+2 or t+3 settlement etc comes to picture.

No need to explain the leverage from company's perspective.

With NSE a broker is given 33% leverage of its deposits.

And the broker in turn gives 3 to 4% leverage to the capital invested with him.

Why I should be worried with the leverage or the "Buying power" of the broker with the exchange.

The trader in capstone given 2000$.

There should be risk mechanism with the risk manager monitoring the position.

So what limit he can take position intraday ?

Pls give a straight answer.

1. What computer hardware is provided to traders? One screen or two?

2. Does the software provided have scanning capability?

3. Are traders permitted to use their own software?

4. A trader may not want to load his system/method on office computers. Can he use his own computer?

5. Does the provided software cater to all types of analysis? Some may prefer using Ichimoku, P&F, Market Profile, standard TA, astro or quantitative.

2. Does the software provided have scanning capability?

3. Are traders permitted to use their own software?

4. A trader may not want to load his system/method on office computers. Can he use his own computer?

5. Does the provided software cater to all types of analysis? Some may prefer using Ichimoku, P&F, Market Profile, standard TA, astro or quantitative.

My question is very simple - regarding the leverage is from the Trader's perspective.

Since intraday no t+2 or t+3 settlement etc comes to picture.

No need to explain the leverage from company's perspective.

With NSE a broker is given 33% leverage of its deposits.

And the broker in turn gives 3 to 4% leverage to the capital invested with him.

Why I should be worried with the leverage or the "Buying power" of the broker with the exchange.

The trader in capstone given 2000$.

There should be risk mechanism with the risk manager monitoring the position.

So what limit he can take position intraday ?

Pls give a straight answer.

Since intraday no t+2 or t+3 settlement etc comes to picture.

No need to explain the leverage from company's perspective.

With NSE a broker is given 33% leverage of its deposits.

And the broker in turn gives 3 to 4% leverage to the capital invested with him.

Why I should be worried with the leverage or the "Buying power" of the broker with the exchange.

The trader in capstone given 2000$.

There should be risk mechanism with the risk manager monitoring the position.

So what limit he can take position intraday ?

Pls give a straight answer.

There is a risk mechanism indeed. If a trader makes a loss more than his loss limit for the day, his account gets locked for the day. He will not be able to trade anymore on that single day. If the limit is reached consistently on several days he will get a letter of warning. If his performance doesn't improve then he will be fired. The daily loss limit is determined by the Risk Managers for the trader. The criteria for the same is not known to me. It is also possible that two traders with same buying power may have different daily loss limits. For eg if a trader trader on low volume stock he will have a low daily loss limit. If someone traders in high volume stocks he will be given a high daily loss limit. This is because there are high fluctuations during the day in high volume stocks, and the traders are usually able to recover their losses during the intraday trading. If their account gets locked if the reach the loss limit(assuming that they have a low loss limit) then they will not be able to recover their losses during the day. That is why they are given high daily loss limit so as to empower them to be able to deal with high fluctuations in prices of high volume stock.

There were lot of questions and patiently answered by You.

can you give details on the training you get from there. Does the tape reading/order flow classes started? (I know in the proprietary world it is the most important thing, reading the tape)

More importantly can you shed light on the order flow/tape reading tactics practiced/trained there ?

can you give details on the training you get from there. Does the tape reading/order flow classes started? (I know in the proprietary world it is the most important thing, reading the tape)

More importantly can you shed light on the order flow/tape reading tactics practiced/trained there ?

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Creating a Trading Journal. | Trading Diary | 6 | |

| O | Options Scalping Trading journal (option.seas) | Trading Diary | 2 | |

| A | AKJ trading journal | Trading Diary | 84 | |

|

|

My trading journal in CEFs | Trading Diary | 0 | |

| S | How to create a trading journal | Trading Diary | 4 |