Re: Modified Strategy to earn 15%-20% a month (Strategy inspired by Linkon7's strateg

Thanks for all your answers with patience

Keeping everything the same (Short Straddle + Wings to hedge)

You can also use a simple SAR Swing System for Nifty future part of the trade

All the Best :thumb:

Happy

This is just my 2nd month of this  but I closed last month 2 days prior to expiry and I aim to do the same this month.

but I closed last month 2 days prior to expiry and I aim to do the same this month.

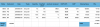

I do not adjust the strike price of the straddle, I adjust the strike price of my intra-day PE/CE buying. As I said I also keep the NF leg forever now until it hits SL or we get to expiry. This is accompanied by an OTM hedge of ce/pe. The money made intraday on CE/PE is used at EOD to buy the hedge.

So my goals are these.

1. Generate enough points intra-day over 20 days to pay for the OTM hedge on NF so taht I can hold it overnight forever or till SL hits or even if market gaps down or up against me.

2. Use the NF to just cover the losing leg - NF will give some profit as delta of NF is 1 always but delta of ITM will not be more than 0.5 to start with.

I do not adjust the strike price of the straddle, I adjust the strike price of my intra-day PE/CE buying. As I said I also keep the NF leg forever now until it hits SL or we get to expiry. This is accompanied by an OTM hedge of ce/pe. The money made intraday on CE/PE is used at EOD to buy the hedge.

So my goals are these.

1. Generate enough points intra-day over 20 days to pay for the OTM hedge on NF so taht I can hold it overnight forever or till SL hits or even if market gaps down or up against me.

2. Use the NF to just cover the losing leg - NF will give some profit as delta of NF is 1 always but delta of ITM will not be more than 0.5 to start with.

Keeping everything the same (Short Straddle + Wings to hedge)

You can also use a simple SAR Swing System for Nifty future part of the trade

All the Best :thumb:

Happy