To determine the P/E ratio of Sensex or any company, investors can divide the stock price by EPS (Earnings per share)

Price to Earning (PE) = Stock price / Earnings per share (EPS)

By determine PE we can know whether Sensex or any stock is Cheap, Reasonable or Costly.

Sensex PE = Sensex Current Value / EPS (30 Companies in Sensex)

By knowing Sensex PE Ratio we get whether Market is at Under Value, Fair value or Over Value so we can decide our Investment.

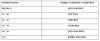

In general Sensex PE and Market Condition are as follows:

Now Sensex is at 25000 and its PE Ratio is 20.

IN Jan. 2008 when Sensex was at 21000 its PE Ratio gone to 27/28 and after that bubble was blast and investors lost huge money.

By study of more than 15 years Sensex PE Ratio, I made following chart and it works.

Below chart shows Sensex PE Ratio Its yearly Return and Chances of loss.

This chart clearly indicates that if Sensex PE is below 12 be Greedy and BUY because loss chances are 0-2% only and return is 56 – 67 %.

And it also indicates that if Sensex PE Ratio is going above 24 then start selling because Loss chances are 100%.

Now Sensex PE is 20 so yearly returns may be 2.56% and Loss chances are 45%.

Make your own investment decision according to below table.

Don't waste your hard earned money to take advice from so called Gurus.

Thank You

Nimish Shah

"Wall Street is the only place that people ride to in a Rolls Royce to get advice from those who take the subway." - Warren Buffett

Price to Earning (PE) = Stock price / Earnings per share (EPS)

By determine PE we can know whether Sensex or any stock is Cheap, Reasonable or Costly.

Sensex PE = Sensex Current Value / EPS (30 Companies in Sensex)

By knowing Sensex PE Ratio we get whether Market is at Under Value, Fair value or Over Value so we can decide our Investment.

In general Sensex PE and Market Condition are as follows:

Now Sensex is at 25000 and its PE Ratio is 20.

IN Jan. 2008 when Sensex was at 21000 its PE Ratio gone to 27/28 and after that bubble was blast and investors lost huge money.

By study of more than 15 years Sensex PE Ratio, I made following chart and it works.

Below chart shows Sensex PE Ratio Its yearly Return and Chances of loss.

This chart clearly indicates that if Sensex PE is below 12 be Greedy and BUY because loss chances are 0-2% only and return is 56 – 67 %.

And it also indicates that if Sensex PE Ratio is going above 24 then start selling because Loss chances are 100%.

Now Sensex PE is 20 so yearly returns may be 2.56% and Loss chances are 45%.

Make your own investment decision according to below table.

Don't waste your hard earned money to take advice from so called Gurus.

Thank You

Nimish Shah

"Wall Street is the only place that people ride to in a Rolls Royce to get advice from those who take the subway." - Warren Buffett

Attachments

-

25.8 KB Views: 252

-

40.9 KB Views: 254