Thanks, I see that you explored a lot of brokers. Could you please suggest which is best at the moment

I am trading only crude oil at the moment, with fyers web ( somehow I don't like Nest Trader and I like the browser ), and I did not see any issues till now, charts seem to update. Obviously we don't receive contract notes and their back office sucks.

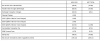

I compared my contract notes and I see that the charges for the fyers are on the higher side, this might be due to the clearing charges as highlighted below

Also, I did check Zerodha and Finavaisa, they don't seem to have Clearing charges.

Please suggest by comparing these

This is for trading 5 mega lots

we can see the more clearing charges when we trade multiple transactions, like in the below screenshot, I have traded 4 times, over all covering 50 Mega lots ( 10 Lots in first three trades, and 20 lots in last trade)

I am trading only crude oil at the moment, with fyers web ( somehow I don't like Nest Trader and I like the browser ), and I did not see any issues till now, charts seem to update. Obviously we don't receive contract notes and their back office sucks.

I compared my contract notes and I see that the charges for the fyers are on the higher side, this might be due to the clearing charges as highlighted below

Also, I did check Zerodha and Finavaisa, they don't seem to have Clearing charges.

Please suggest by comparing these

This is for trading 5 mega lots

we can see the more clearing charges when we trade multiple transactions, like in the below screenshot, I have traded 4 times, over all covering 50 Mega lots ( 10 Lots in first three trades, and 20 lots in last trade)

I am trading from 2006, you will not get a perfect and reliable broker.

My journey so far:

ICICI Direct> Religare>Zerodha>SASonline> Fyers

Currently I am trading in all the last 3.

On voltility days, I like to trade with SAS. None of them are guranteed, but due small customer pool, SAS is very supportive, fast and not seen an issue till now.