HI SAINT AND TRADER 123,

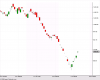

There is a difference in your weekly charts. The difference is around july 2004. In saints chart there is no major fall but trader in your chart there is a long black candle. The fall could be cause of a split or x bonus. I do not know. Maybe that would also make a difference in drawing the trendline. I am not sure. I have not seen if the fall has made us shift the trendline a bit lower. I saw on the charts of BSEINDIA.com and the long black candle was there. So it might be cause of a split or bonus.

Rgds

Rahul

There is a difference in your weekly charts. The difference is around july 2004. In saints chart there is no major fall but trader in your chart there is a long black candle. The fall could be cause of a split or x bonus. I do not know. Maybe that would also make a difference in drawing the trendline. I am not sure. I have not seen if the fall has made us shift the trendline a bit lower. I saw on the charts of BSEINDIA.com and the long black candle was there. So it might be cause of a split or bonus.

Rgds

Rahul