Hi,

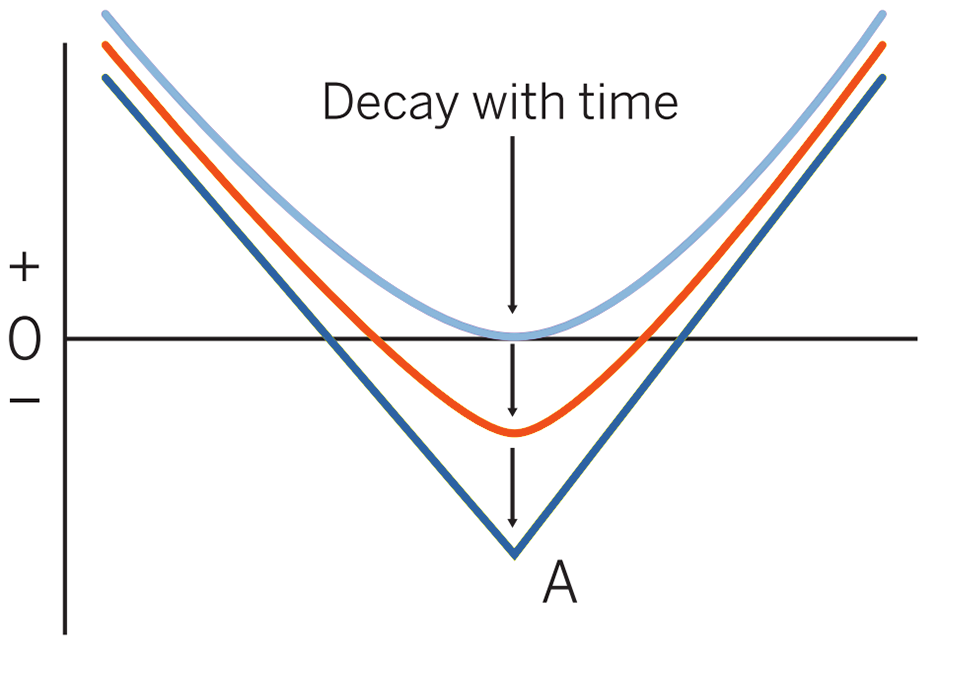

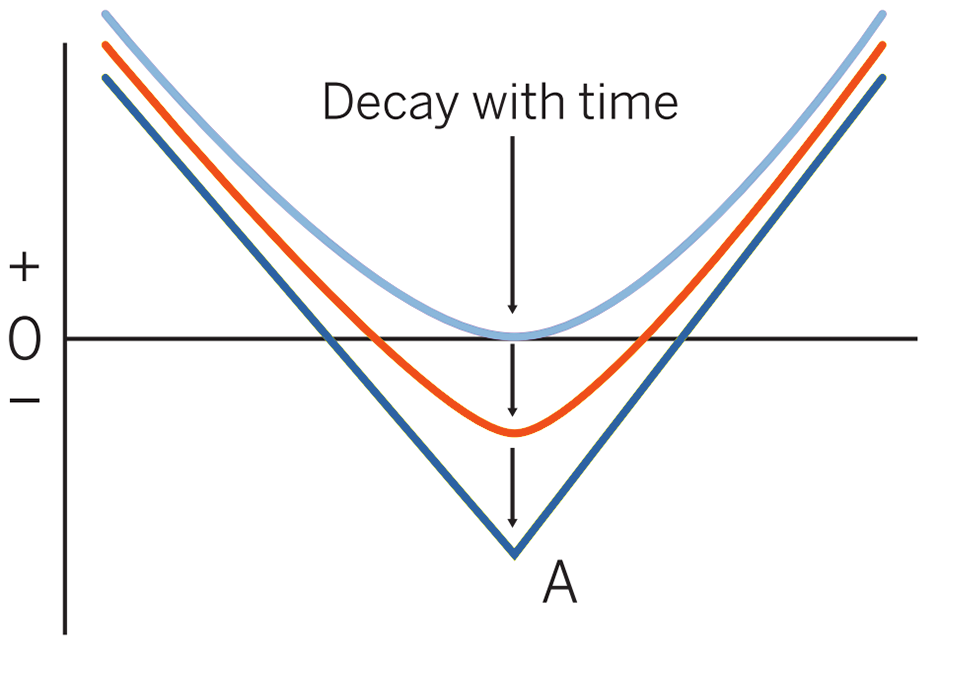

I could see that as delta diminishes, the break even points widen( and losses deepen ) on reaching expiry. So what if straddle is done intraday on the most volatile stocks of the day?

) on reaching expiry. So what if straddle is done intraday on the most volatile stocks of the day?

I know this strategy if used at right times could be profitable. But I want to use it like,

Open computer - Pick the most volatile - Make a straddle - Set Stop loss and target(I think, both will book profits ) at 1% after slippage/Ask price, charges etc.

) at 1% after slippage/Ask price, charges etc.

Please guide me what are the challenges I may face in keeping this as the primary strategy(not occasional) for daily trading?

Thank you

I could see that as delta diminishes, the break even points widen( and losses deepen

I know this strategy if used at right times could be profitable. But I want to use it like,

Open computer - Pick the most volatile - Make a straddle - Set Stop loss and target(I think, both will book profits

Please guide me what are the challenges I may face in keeping this as the primary strategy(not occasional) for daily trading?

Thank you