Date 8 - june -2018

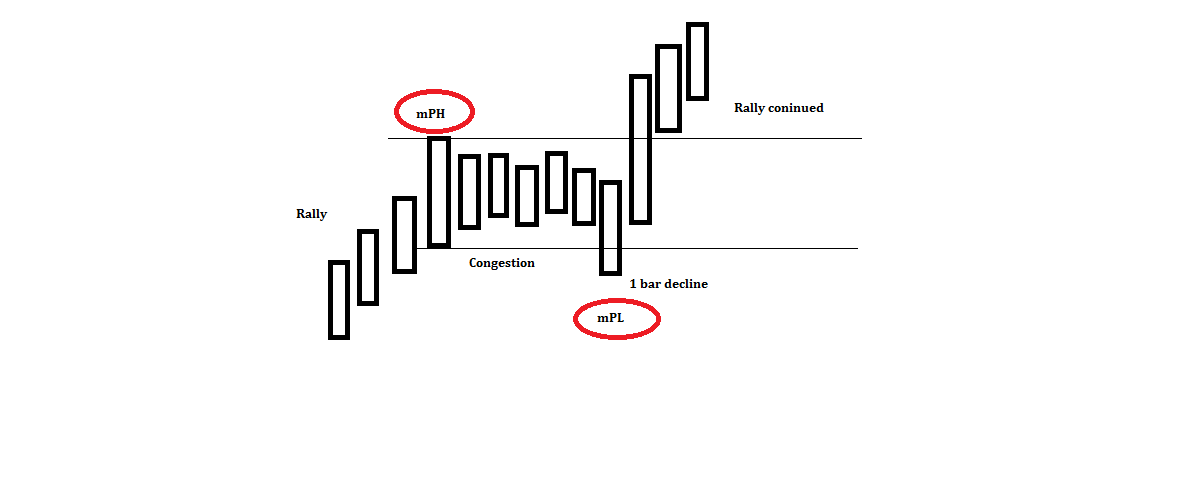

Today I used a trend following system, (The only trend following system I know is the minor-visual trend method, taught by smart-trade and Subhadeep some 2/3 years back). I have not practiced this method for a long time, Today I gave it a try instead of my usual system which was more looking for reversal and I also found out the mismatch between the system and my psychology. A concrete call on this front will be taken over the weekend.

============================

1st trade was a SHORT on AXISBANK, I am not quite sure if this is a valid SHORT or not, as I am little doubtful about the visual trend here, I took the SHORT on a pullback on minor downtrend, Trade did not work, I scracthed

2nd trade was a SHORT on HINDALCO where visual trend had changed to down, and this was a continuation of yesterday's minor downtrend.

Exit was early, need to develop that patience to hold when the trend is still intact.

Trade Book

Net Position

Today I used a trend following system, (The only trend following system I know is the minor-visual trend method, taught by smart-trade and Subhadeep some 2/3 years back). I have not practiced this method for a long time, Today I gave it a try instead of my usual system which was more looking for reversal and I also found out the mismatch between the system and my psychology. A concrete call on this front will be taken over the weekend.

============================

1st trade was a SHORT on AXISBANK, I am not quite sure if this is a valid SHORT or not, as I am little doubtful about the visual trend here, I took the SHORT on a pullback on minor downtrend, Trade did not work, I scracthed

2nd trade was a SHORT on HINDALCO where visual trend had changed to down, and this was a continuation of yesterday's minor downtrend.

Exit was early, need to develop that patience to hold when the trend is still intact.

Trade Book

Net Position