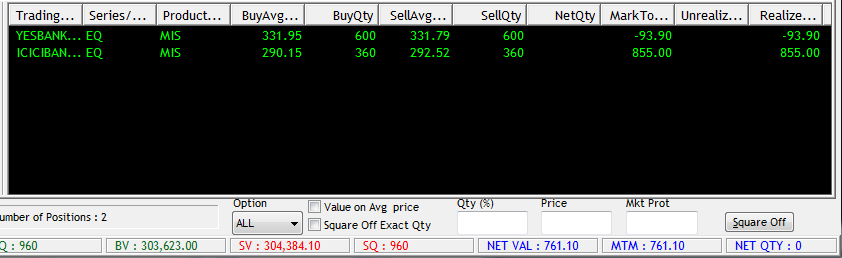

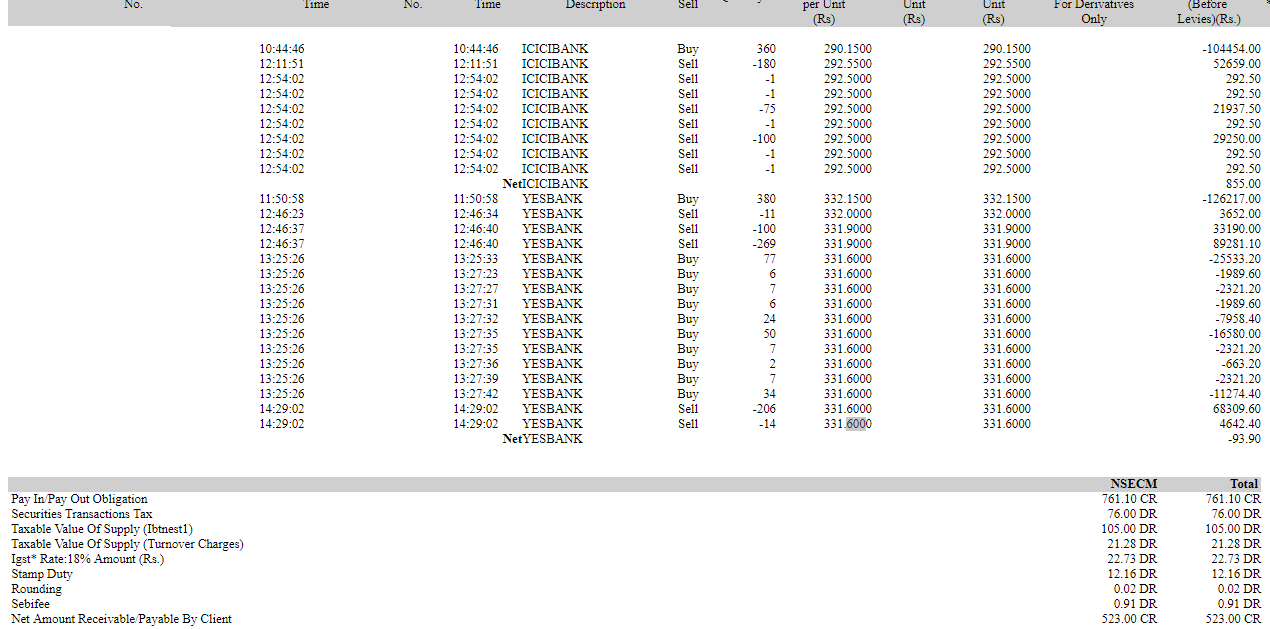

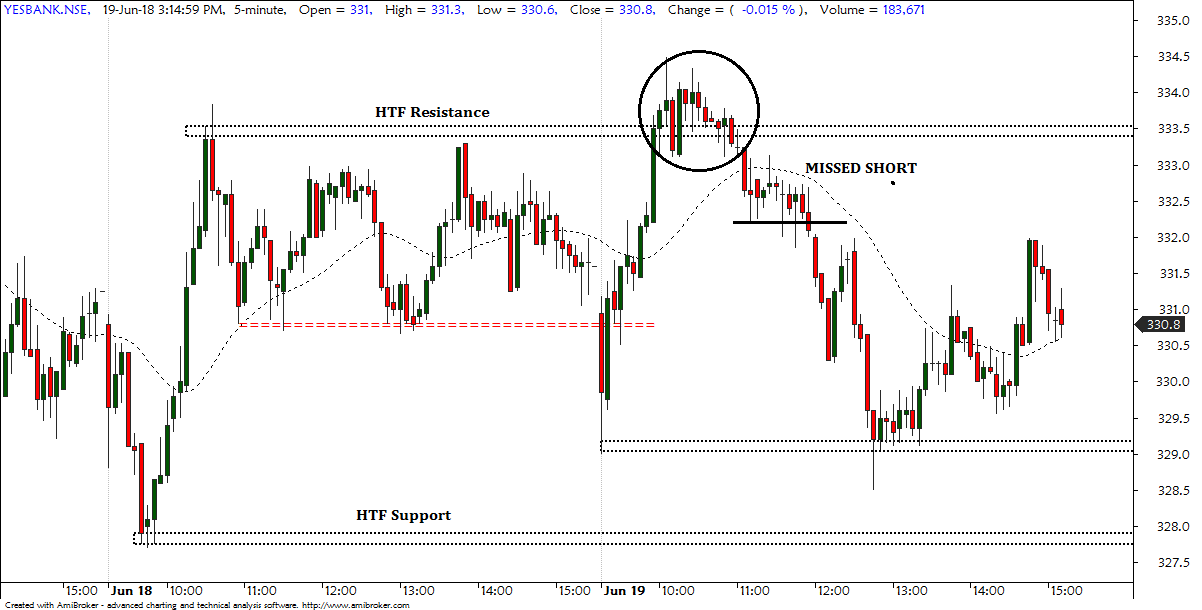

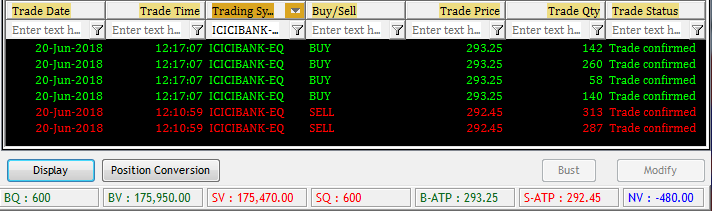

Date 20 Jun 2018

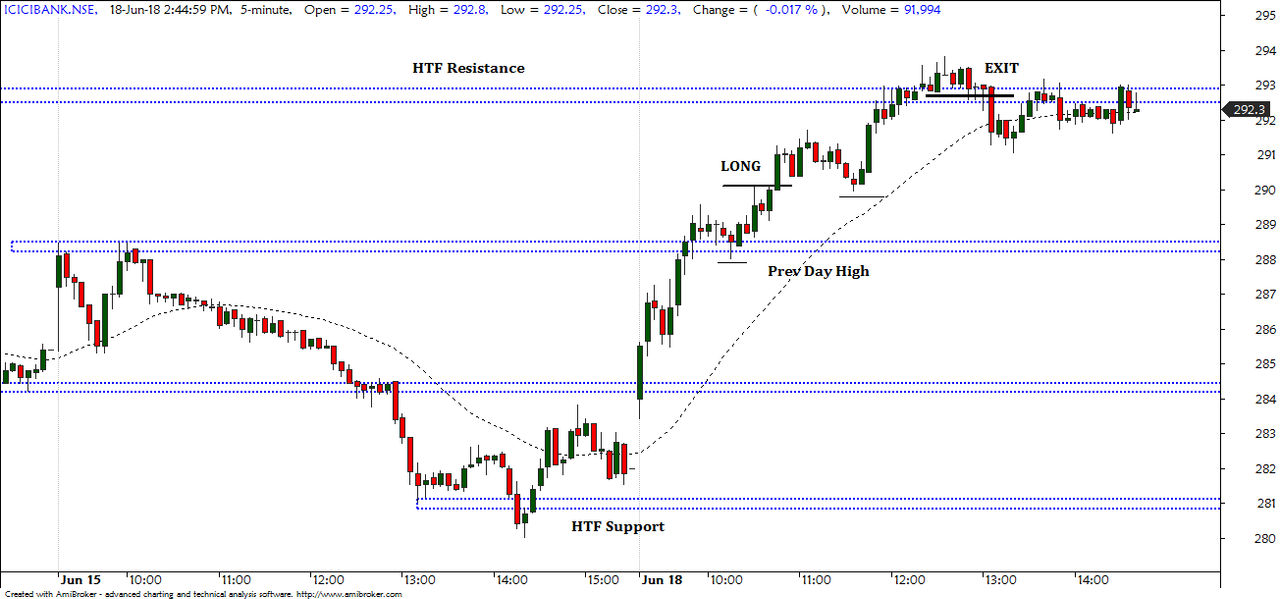

1st trade was a SHORT on ICICIBANK. My trade bias was bearish and price was in a sideways range. I was not fully convinced on the setup and ended up in taking it anyway. But quickly realised my mistake and scratched it over the entry bar itself.

===========

Ever since I have resumed my trading since 14th June after few minor tweaks on my original system I have been being very selective on picking a trade. Now I do not mind missing a trade if I dont understand it but I need to understand the market structure and price action fully before I take a trade. Today I violated this and my emotions got the better of me. Even though I sensed that I was struggling to see a setup in the above trade I took it anyway justifying that I could scratch it for a smaller loss if it does not work. and what if i will miss a good SHORT opportunity. But as soon as the entry candle reversed all the sense came back to me, I felt guilt over my own action and qucikly scratched it.

Market always humbles us, and today I took my lesson.

=============

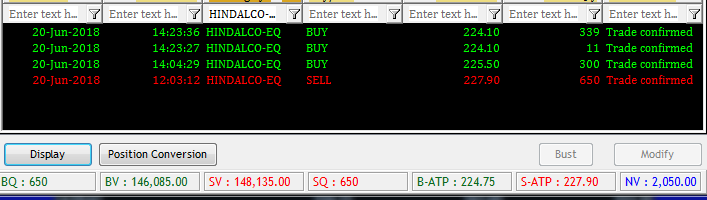

Trade 2 was a SHORT on HINDALCO. A good reversal in trend was caught just near HTF resistance zone and timely exit was also there. Nothing more to add.

3rd trade was a very low probable SHORT on SUNPHARMA. Underlying trading sentiment was bullish with a sideways trading range. When price failed to go past beyind morning high, I took a low probable SHORT on very small risk. Trade did not work, and got scratched in time.

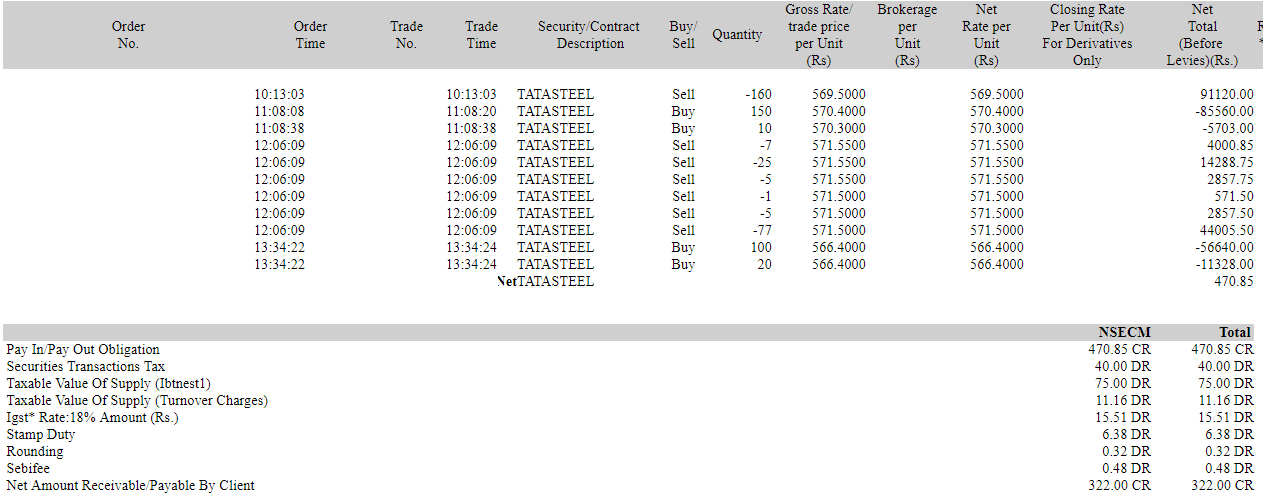

Net Position