Date 14 June 2018

Few tweaks are applied on how I was choosing stocks for intraday trade setups and also few modification were done on entry timing. How much they are going to help in live only time will tell, but everything depends on me on how consistently I apply them in real time with a calm, unattached and unaffected mind.

Maximum trade risk was only 500rs today, 30% of my usual trade risk. Will increase the risk after consistent profit.

Today I was tracking only 6 stocks to focus better on my execution rather than catching more profit. Will increase it gradually.

==========================

1st Trade was a SHORT on ICICIBANK. Trading sentiment was rangebound, and price was appearing weak near HTF resistance zone. 5m trend turned down, and I entered SHORT. Did not take any add here since it was a rangebound setup with slightly lesser probability. Exited near HTF support when price turned in to a range.

But price was lacking any bullish action, so I was expecting attempt for a break below it. But unfortunately I missed the re-entry SHORT after my exit from 1st trade.

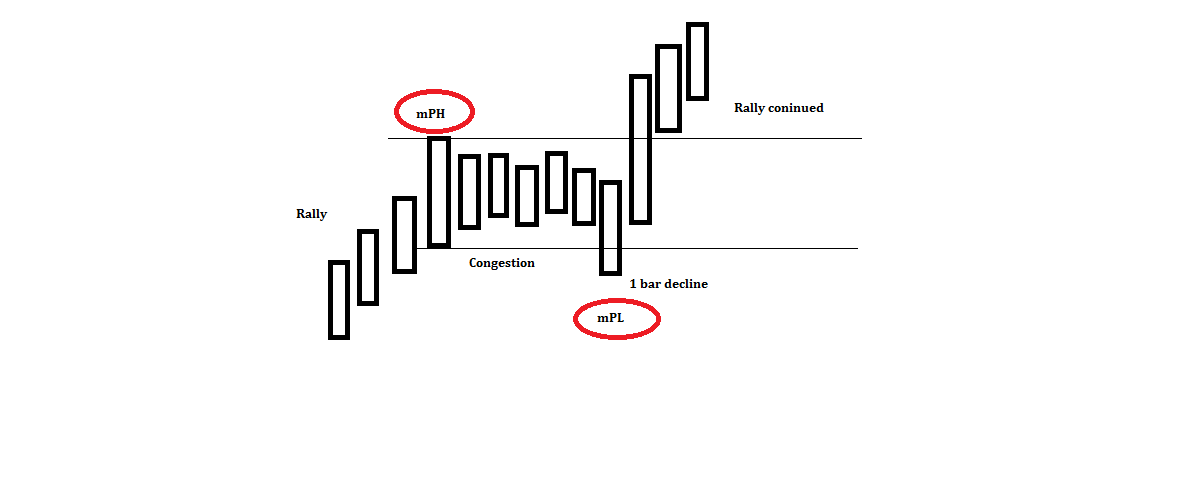

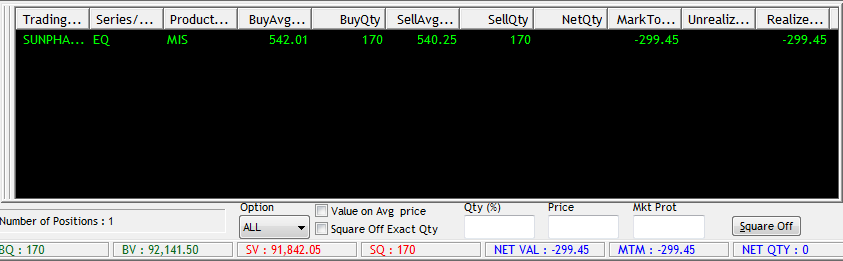

2nd trade was a LONG in SUNPHARMA. Here the trading sentiment was bearish and I was looking for SHORT in morning with a expectation of price breaking below the HTF support, But price started turning bullish, so I entered a counter trend LONG for a quick move target previous session high, Luckily the trade worked and exited when price entered in congestion near top. There again I was looking for bearish reversal but no setup formed.

Net Position