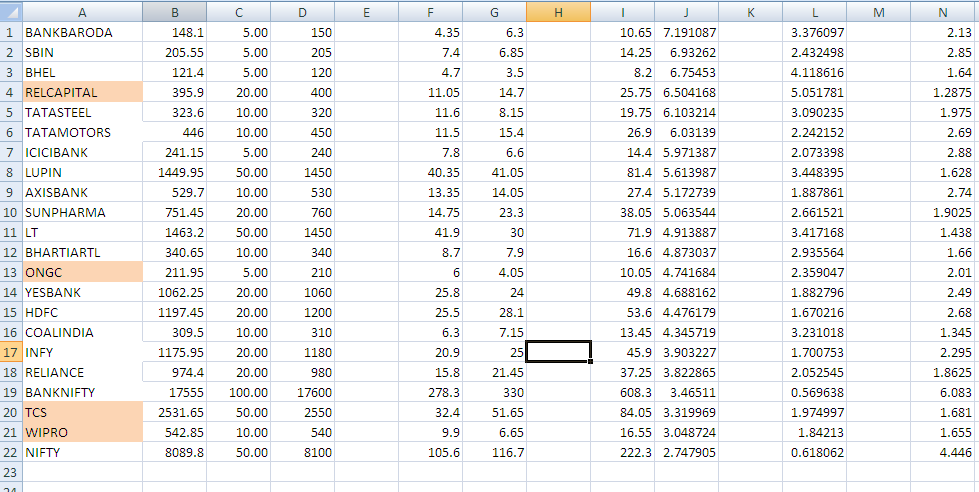

I think I have not explained clearly the purpose is to compare todays straddle with yesterdays, last months and average price of straddle. Today straddle price is 5% of future price. Last month it was 7% of future price. Hence straddle is cheaper. We have VIX for nifty but nothing for stocks. Hence I ve done this jugad........

I dont mind posting the screenshot for every 1-2 days for straddle price % of future price. In that way we know straddle is cheap or expensive compared to last few months and compared to other stocks ....

Again then generally high price short strategy/ low price long strategy. you use the data the way you want..... run the strategies you want up to you

I dont mind posting the screenshot for every 1-2 days for straddle price % of future price. In that way we know straddle is cheap or expensive compared to last few months and compared to other stocks ....

Again then generally high price short strategy/ low price long strategy. you use the data the way you want..... run the strategies you want up to you