I didnot quite understand the dates for which you have put the data. It would be good if you can elaborate. That brings me to the next point which I am posting next.

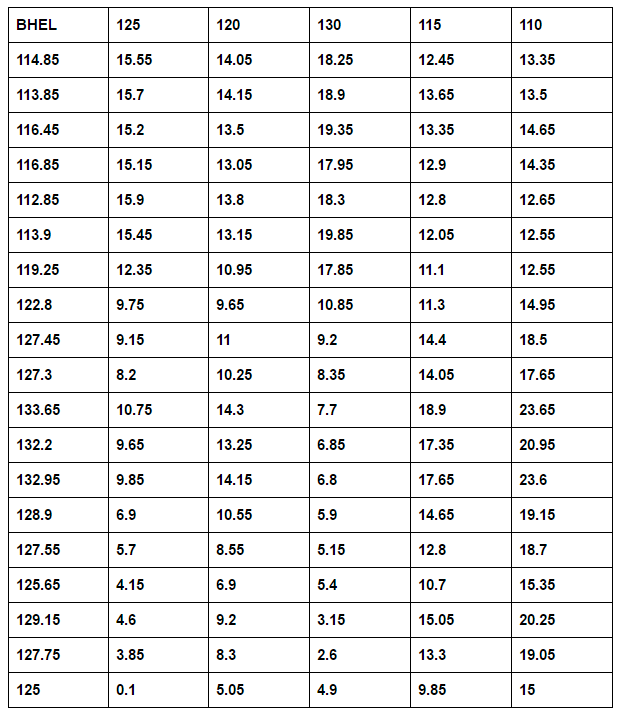

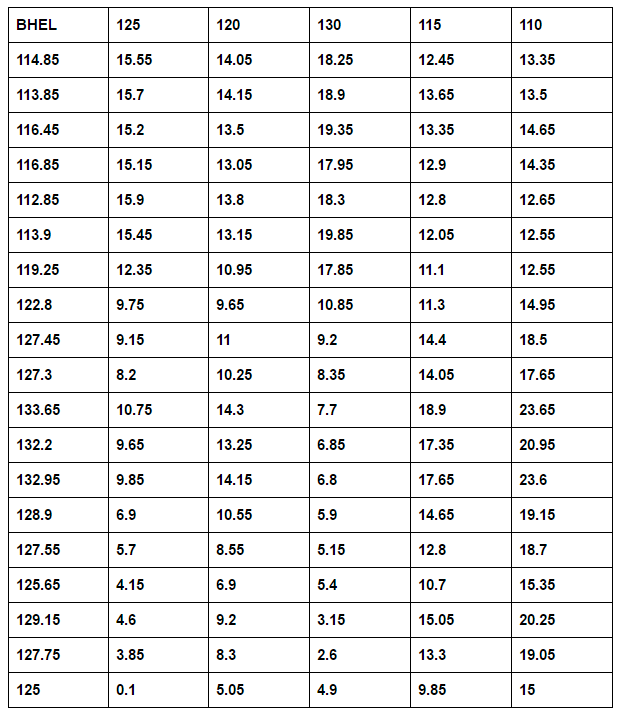

First column shows the underlying price.Other columns shows the premium of call and put options combined for the strike price mentioned in the top.

For 125 strike price, the combined premium went from 15.55 to 0.1.

For strike price 120, 125 and 130, combined premium = 47.85

and at expiry premium = 10.05.

For 125 strike price, the combined premium went from 15.55 to 0.1.

For strike price 120, 125 and 130, combined premium = 47.85

and at expiry premium = 10.05.