315 Strategy on Crude Oil & NG Trade on Intraday Result

- Thread starter rpsvinod

- Start date

You are right Mr. Vinod. Happy trading. I just trade 10-20 points a day, some times 30-50. Today my trade closed, i sold at 6281 closed at 6231.

Thanks..u teach me a new thing.really amazing..My position closed @6200.but current low 6196 @ 2.15 pm..profit doesn't matter. but doing trade with right trend.:thumb:

26.02.14 Trade 1 - Signal 1 - Total Lots : 1 Net Profit - 77 Points

27.02.14 Trade 2 - Signal 1 - Total Lots : 3 Net Profit - 33 Points

28.02.14 Trade 3 - Signal 2 - Total Lots : 2 Net Profit - 35 Points

03.03.14 Trade 4 - Signal 1 - Total Lots : 1 Net Profit - 50 Points

04.03.14 Trade 5 - Signal 1 - Total Lots : 1 Net Profit - 72 Points (This date cross over gave above 350 points upto 06.03.14)

05.03.14 Trade 6 - Signal 1 - Total Lots : 1 Net Profit - 80 Points

06.03.14 Trade 7 - Signal 1 - Total Lots : 1 Net Profit - 90 Points

07.03.14 Trade 8 - Signal 1 - Total Lots : 1 Net Profit - 76 Points

10.03.14 Trade 9 - Signal 1 - Total Lots : 1 Net Profit - 85 Points

Regards,

VINOD. RPS

Last edited:

Hi Arunnair,

Thanks..u teach me a new thing.really amazing..My position closed @6200.but current low 6196 @ 2.15 pm..profit doesn't matter. but doing trade with right trend.:thumb:

26.02.14 Trade 1 - Signal 1 - Total Lots : 1 Net Profit - 77 Points

27.02.14 Trade 2 - Signal 1 - Total Lots : 3 Net Profit - 33 Points

28.02.14 Trade 3 - Signal 2 - Total Lots : 2 Net Profit - 35 Points

03.03.14 Trade 4 - Signal 1 - Total Lots : 1 Net Profit - 50 Points

04.03.14 Trade 5 - Signal 1 - Total Lots : 1 Net Profit - 72 Points (This date cross over gave above 350 points upto 06.03.14)

05.03.14 Trade 6 - Signal 1 - Total Lots : 1 Net Profit - 80 Points

06.03.14 Trade 7 - Signal 1 - Total Lots : 1 Net Profit - 90 Points

07.03.14 Trade 8 - Signal 1 - Total Lots : 1 Net Profit - 76 Points

10.03.14 Trade 9 - Signal 1 - Total Lots : 1 Net Profit - 85 Points

Regards,

VINOD. RPS

Thanks..u teach me a new thing.really amazing..My position closed @6200.but current low 6196 @ 2.15 pm..profit doesn't matter. but doing trade with right trend.:thumb:

26.02.14 Trade 1 - Signal 1 - Total Lots : 1 Net Profit - 77 Points

27.02.14 Trade 2 - Signal 1 - Total Lots : 3 Net Profit - 33 Points

28.02.14 Trade 3 - Signal 2 - Total Lots : 2 Net Profit - 35 Points

03.03.14 Trade 4 - Signal 1 - Total Lots : 1 Net Profit - 50 Points

04.03.14 Trade 5 - Signal 1 - Total Lots : 1 Net Profit - 72 Points (This date cross over gave above 350 points upto 06.03.14)

05.03.14 Trade 6 - Signal 1 - Total Lots : 1 Net Profit - 80 Points

06.03.14 Trade 7 - Signal 1 - Total Lots : 1 Net Profit - 90 Points

07.03.14 Trade 8 - Signal 1 - Total Lots : 1 Net Profit - 76 Points

10.03.14 Trade 9 - Signal 1 - Total Lots : 1 Net Profit - 85 Points

Regards,

VINOD. RPS

Current Low - 6161 @ 05.15 pm

Last edited:

Hi Arunnair,

Thanks..u teach me a new thing.really amazing..My position closed @6200.but current low 6196 @ 2.15 pm..profit doesn't matter. but doing trade with right trend.:thumb:

26.02.14 Trade 1 - Signal 1 - Total Lots : 1 Net Profit - 77 Points

27.02.14 Trade 2 - Signal 1 - Total Lots : 3 Net Profit - 33 Points

28.02.14 Trade 3 - Signal 2 - Total Lots : 2 Net Profit - 35 Points

03.03.14 Trade 4 - Signal 1 - Total Lots : 1 Net Profit - 50 Points

04.03.14 Trade 5 - Signal 1 - Total Lots : 1 Net Profit - 72 Points (This date cross over gave above 350 points upto 06.03.14)

05.03.14 Trade 6 - Signal 1 - Total Lots : 1 Net Profit - 80 Points

06.03.14 Trade 7 - Signal 1 - Total Lots : 1 Net Profit - 90 Points

07.03.14 Trade 8 - Signal 1 - Total Lots : 1 Net Profit - 76 Points

10.03.14 Trade 9 - Signal 1 - Total Lots : 1 Net Profit - 85 Points

Regards,

VINOD. RPS

Thanks..u teach me a new thing.really amazing..My position closed @6200.but current low 6196 @ 2.15 pm..profit doesn't matter. but doing trade with right trend.:thumb:

26.02.14 Trade 1 - Signal 1 - Total Lots : 1 Net Profit - 77 Points

27.02.14 Trade 2 - Signal 1 - Total Lots : 3 Net Profit - 33 Points

28.02.14 Trade 3 - Signal 2 - Total Lots : 2 Net Profit - 35 Points

03.03.14 Trade 4 - Signal 1 - Total Lots : 1 Net Profit - 50 Points

04.03.14 Trade 5 - Signal 1 - Total Lots : 1 Net Profit - 72 Points (This date cross over gave above 350 points upto 06.03.14)

05.03.14 Trade 6 - Signal 1 - Total Lots : 1 Net Profit - 80 Points

06.03.14 Trade 7 - Signal 1 - Total Lots : 1 Net Profit - 90 Points

07.03.14 Trade 8 - Signal 1 - Total Lots : 1 Net Profit - 76 Points

10.03.14 Trade 9 - Signal 1 - Total Lots : 1 Net Profit - 85 Points

Regards,

VINOD. RPS

Last edited:

Hi Arunnair,

Thanks..u teach me a new thing.really amazing..My position closed @6200.but current low 6196 @ 2.15 pm..profit doesn't matter. but doing trade with right trend.:thumb:

26.02.14 Trade 1 - Signal 1 - Total Lots : 1 Net Profit - 77 Points

27.02.14 Trade 2 - Signal 1 - Total Lots : 3 Net Profit - 33 Points

28.02.14 Trade 3 - Signal 2 - Total Lots : 2 Net Profit - 35 Points

03.03.14 Trade 4 - Signal 1 - Total Lots : 1 Net Profit - 50 Points

04.03.14 Trade 5 - Signal 1 - Total Lots : 1 Net Profit - 72 Points (This date cross over gave above 350 points upto 06.03.14)

05.03.14 Trade 6 - Signal 1 - Total Lots : 1 Net Profit - 80 Points

06.03.14 Trade 7 - Signal 1 - Total Lots : 1 Net Profit - 90 Points

07.03.14 Trade 8 - Signal 1 - Total Lots : 1 Net Profit - 76 Points

10.03.14 Trade 9 - Signal 1 - Total Lots : 1 Net Profit - 85 Points

Regards,

VINOD. RPS

Thanks..u teach me a new thing.really amazing..My position closed @6200.but current low 6196 @ 2.15 pm..profit doesn't matter. but doing trade with right trend.:thumb:

26.02.14 Trade 1 - Signal 1 - Total Lots : 1 Net Profit - 77 Points

27.02.14 Trade 2 - Signal 1 - Total Lots : 3 Net Profit - 33 Points

28.02.14 Trade 3 - Signal 2 - Total Lots : 2 Net Profit - 35 Points

03.03.14 Trade 4 - Signal 1 - Total Lots : 1 Net Profit - 50 Points

04.03.14 Trade 5 - Signal 1 - Total Lots : 1 Net Profit - 72 Points (This date cross over gave above 350 points upto 06.03.14)

05.03.14 Trade 6 - Signal 1 - Total Lots : 1 Net Profit - 80 Points

06.03.14 Trade 7 - Signal 1 - Total Lots : 1 Net Profit - 90 Points

07.03.14 Trade 8 - Signal 1 - Total Lots : 1 Net Profit - 76 Points

10.03.14 Trade 9 - Signal 1 - Total Lots : 1 Net Profit - 85 Points

Regards,

VINOD. RPS

Last edited:

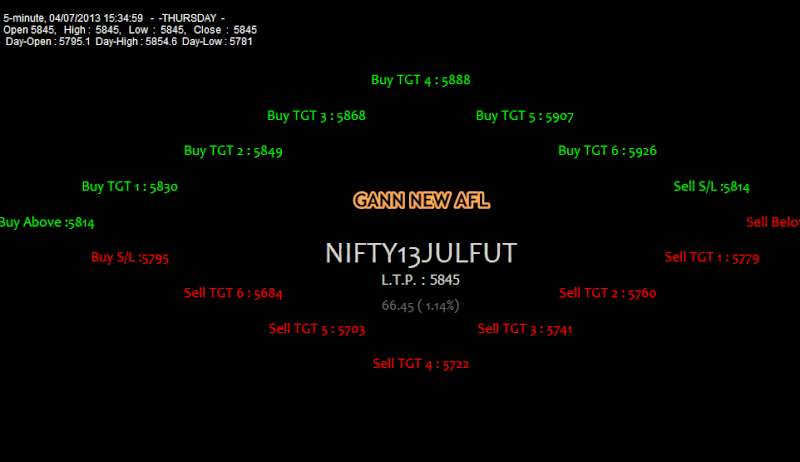

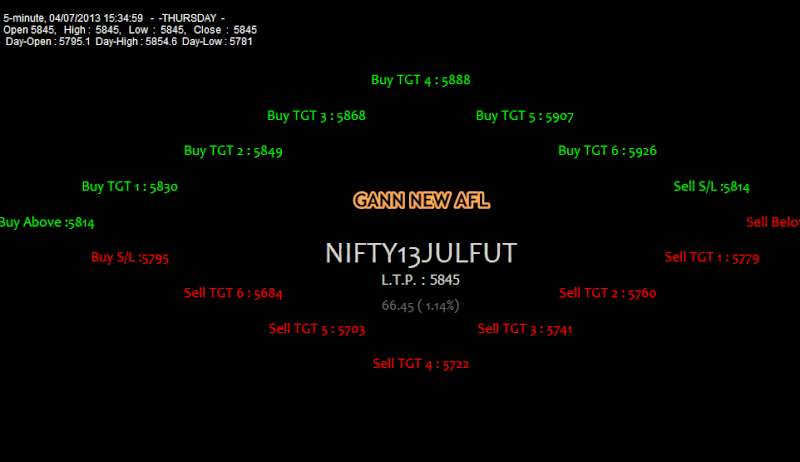

Gann Square of Nine afl :-

PHP:

_SECTION_BEGIN("GaNN Square of Nine");

BarsToday = 1 + BarsSince( Day() != Ref(Day(), -1));

StartBar =Open;

RefOpen = ValueWhen(TimeNum() == Param("Stock/",092000,092000,100500,8500), Open,1);

BaseNum = (int(sqrt(RefOpen))-1);

sBelow = BaseNum + BaseNum;

sBelowI = 1;

//Calculate levels for GANN Square of Nine

for( i = 1; i < 50; i++ )

{

VarSet( "GANN"+i, (BaseNum * BaseNum) );

BaseNum = BaseNum + 0.125;

sBelowI = IIf( VarGet("GANN"+i)< RefOpen, i, sBelowI);

bAboveI = sBelowI + 1;

sBelow = round(VarGet("GANN"+sBelowI));

bAbove = round(VarGet("GANN"+bAboveI));

}

// Resistance Levels (or Targets for Buy trade)

BTgt1 = 0.9995 * VarGet("Gann"+(bAboveI+1));

BTgt2 = 0.9995 * VarGet("Gann"+(bAboveI+2));

BTgt3 = 0.9995 * VarGet("Gann"+(bAboveI+3));

BTgt4 = 0.9995 * VarGet("Gann"+(baboveI+4));

BTgt5 = 0.9995 * VarGet("Gann"+(bAboveI+5));

BTgt6 = 0.9995 * VarGet("Gann"+(baboveI+6));

// Support Levels (or Targets for Short trade)

STgt1 = 1.0005 * VarGet("Gann"+(sBelowI-1));

STgt2 = 1.0005 * VarGet("Gann"+(sBelowI-2));

STgt3 = 1.0005 * VarGet("Gann"+(sBelowI-3));

STgt4 = 1.0005 * VarGet("Gann"+(sbelowI-4));

STgt5 = 1.0005 * VarGet("Gann"+(sBelowI-5));

STgt6 = 1.0005 * VarGet("Gann"+(sBelowI-6));

Sstop= babove-((babove-sbelow)/3) ;

Bstop= sbelow+((babove-sbelow)/3) ;

BuySignal = TimeNum()>092000 AND Cross(C,babove);

ShortSignal = TimeNum()>092000 AND Cross(Sbelow,C);

BuySignal = ExRem(BuySignal,ShortSignal);

ShortSignal = ExRem(ShortSignal,BuySignal);

ShortProfitStop= (STgt1 AND L<=Stgt1 AND C>Stgt1) OR (STgt2 AND L<=Stgt2 AND C>Stgt2) OR (STgt3 AND L<=Stgt3 AND C>Stgt3) OR (STgt4 AND L<=Stgt4 AND C>Stgt4) OR (STgt5 AND L<=Stgt5 AND C>Stgt5) OR (STgt6 AND L<=Stgt6 AND C>Stgt6);

BuyProfitStop= (Btgt1 AND H>=btgt1 AND C<Btgt1) OR (Btgt2 AND H>=Btgt2 AND C<btgt2) OR (Btgt3 AND H>=Btgt3 AND C<btgt3) OR (Btgt4 AND H>=Btgt4 AND C<btgt4) OR (Btgt5 AND H>=Btgt5 AND C<btgt5) OR (Btgt6 AND H>=Btgt6 AND C<btgt6);

Buy = BuySignal;

Sell = C<Bstop ;

Short = ShortSignal;

Cover = C>SStop ;

Buy = ExRem(Buy,Sell);

Sell = ExRem(Sell,Buy);

Short = ExRem(Short,Cover);

Cover = ExRem(Cover,Short);

Sstop= round(babove) ;

Bstop= round(sbelow) ;

_SECTION_BEGIN("Background text");

SetChartBkColor(colorBlack);

strWeekday = StrMid("---SUNDAY---MONDAY--TUESDAYWEDNESDAY-THURSDAY--FRIDAY--SATURDAY", SelectedValue(DayOfWeek())*9,9);

GraphXSpace=Param("GraphXSpace",0,-55,200,1);

C13=Param("fonts",20,10,30,1 );

C14=Param("left-right",2.1,1.0,5.0,0.1 );

C15=Param("up-down",12,1,20,1 );

Miny = Status("axisminy");

Maxy = Status("axismaxy");

lvb = Status("lastvisiblebar");

fvb = Status("firstvisiblebar");

pxwidth = Status("pxwidth");

pxheight = Status("pxheight");

YC=TimeFrameGetPrice("C",inDaily,-1);

DD=Prec(C-YC,2);

xx=Prec((DD/YC)*100,2);

GfxSetBkMode(transparent=1);

GfxSetOverlayMode(1);

GfxSelectFont("Candara", Status("pxheight")/C13 );

GfxSetTextAlign( 6 );

GfxSetTextColor( ColorRGB (217,217,213));

GfxTextOut( Name(), Status("pxwidth")/C14, Status("pxheight")/C15+200);

GfxSelectFont("Tahoma", Status("pxheight")/C13*0.5 );

GfxSetTextColor(ColorRGB (217,217,213));

GfxTextOut( "L.T.P. : "+ C +"", Status("pxwidth")/C14, Status("pxheight")/C15*2+200 );

GfxSelectFont("Candara", Status("pxheight")/C13*0.5 );

GfxSetTextColor( ColorRGB (103,103,103));

GfxTextOut( ""+DD+ " ( "+xx+"%)", Status("pxwidth")/C14, Status("pxheight")/C15*2.5+200);

GfxTextOut( "Sai Stock Broking", Status("pxwidth")/C14, Status("pxheight")/C15*2.5+220);

GfxTextOut( "09825340778", Status("pxwidth")/C14, Status("pxheight")/C15*2.5+240);

GfxSelectFont("Candara", Status("pxheight")/C13*0.5 );

GfxSetTextColor( ColorRGB (0,265,0));

GfxTextOut( "Buy Above :"+sstop+"", Status("pxwidth")/C14-450, Status("pxheight")/C15*6);

GfxSetTextColor( ColorRGB (255,74,74));

GfxTextOut( "Buy S/L :"+Bstop+"", Status("pxwidth")/C14-350, Status("pxheight")/C15*7);

GfxSetTextColor( ColorRGB (265,0,0));

GfxTextOut( "Sell Below :"+bstop+"", Status("pxwidth")/C14+450, Status("pxheight")/C15*6);

GfxSetTextColor( ColorRGB (100,255,100));

GfxTextOut( "Sell S/L :"+sstop+"", Status("pxwidth")/C14+350, Status("pxheight")/C15*5);

GfxSetTextColor( ColorRGB (0,265,0));

GfxTextOut( "Buy TGT 1 : "+BTgt1+"", Status("pxwidth")/C14-350, Status("pxheight")/C15*5);

GfxTextOut( "Buy TGT 6 : "+BTgt6+"", Status("pxwidth")/C14+225, Status("pxheight")/C15*4);

GfxTextOut( "Buy TGT 2 : "+BTgt2+"", Status("pxwidth")/C14-225, Status("pxheight")/C15*4);

GfxTextOut( "Buy TGT 5 : "+BTgt5+"", Status("pxwidth")/C14+125, Status("pxheight")/C15*3);

GfxTextOut( "Buy TGT 3 : "+BTgt3+"", Status("pxwidth")/C14-125, Status("pxheight")/C15*3);

GfxTextOut( "Buy TGT 4 : "+BTgt4+"", Status("pxwidth")/C14, Status("pxheight")/C15*2);

GfxSetTextColor( ColorRGB (265,0,0));

GfxTextOut( "Sell TGT 1 : "+STgt1+"", Status("pxwidth")/C14+350, Status("pxheight")/C15*7);

GfxTextOut( "Sell TGT 6 : "+STgt6+"", Status("pxwidth")/C14-225, Status("pxheight")/C15*8);

GfxTextOut( "Sell TGT 2 : "+STgt2+"", Status("pxwidth")/C14+225, Status("pxheight")/C15*8);

GfxTextOut( "Sell TGT 5 : "+STgt5+"", Status("pxwidth")/C14-125, Status("pxheight")/C15*9);

GfxTextOut( "Sell TGT 3 : "+STgt3+"", Status("pxwidth")/C14+125, Status("pxheight")/C15*9);

GfxTextOut( "Sell TGT 4 : "+STgt4+"", Status("pxwidth")/C14, Status("pxheight")/C15*10);

_SECTION_END();

_SECTION_BEGIN("Title");

DODay = TimeFrameGetPrice("O", inDaily);

DHiDay = TimeFrameGetPrice("H", inDaily);

DLoDay = TimeFrameGetPrice("L", inDaily);

Title = EncodeColor(colorWhite)+EncodeColor(colorCustom8)+ "|| Sai Stock Broking - 09825340778 || "+EncodeColor(colorCustom10)+ Interval(2) + ", " + EncodeColor(colorCustom11)+Date() + EncodeColor(colorCustom14)+" - "+strWeekday + " - " +

EncodeColor(colorBlue) + "Open " + EncodeColor(colorWhite) + O +

EncodeColor(colorRed)+ " High : " +EncodeColor(colorWhite) + H +

EncodeColor(colorBrightGreen)+ " Low : " +EncodeColor(colorWhite) + L +

EncodeColor(colorCustom16) +" Close : " + EncodeColor(colorWhite) +C +

EncodeColor(colorBlue)+ " Day-Open : " +DODay + EncodeColor(colorBrightGreen)+" Day-High : " +DHiDay +EncodeColor(colorRed)+ " Day-Low : " + DLoDay

;

Current Price - 6137 @ 10.30 am

26.02.14 Trade 1 - Signal 1 - Total Lots : 1 Net Profit - 77 Points

27.02.14 Trade 2 - Signal 1 - Total Lots : 3 Net Profit - 33 Points

28.02.14 Trade 3 - Signal 2 - Total Lots : 2 Net Profit - 35 Points

03.03.14 Trade 4 - Signal 1 - Total Lots : 1 Net Profit - 50 Points

04.03.14 Trade 5 - Signal 1 - Total Lots : 1 Net Profit - 72 Points (This date cross over gave above 350 points upto 06.03.14)

05.03.14 Trade 6 - Signal 1 - Total Lots : 1 Net Profit - 80 Points

06.03.14 Trade 7 - Signal 1 - Total Lots : 1 Net Profit - 90 Points

07.03.14 Trade 8 - Signal 1 - Total Lots : 1 Net Profit - 76 Points

10.03.14 Trade 9 - Signal 1 - Total Lots : 1 Net Profit - 85 Points (This date cross over gave above 150 points upto 11.03.14)

Regards,

VINOD. RPS

Last edited:

Similar threads

-

Help Me to Create AFL for Karthik's 315 Pullback Strategy

- Started by Profittaker

- Replies: 2

-

Karthik's 315 Pullback Strategy (Intraday & EOD)

- Started by karthik_sri

- Replies: 81

-

Help Needed : Modified SH's 315 Strategy with Supertrend

- Started by Profittaker

- Replies: 2

-

-