AMITBE said:

Hi Roneeth...I'm looking at the daily chart for Aksh as early as you.

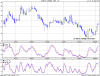

Yes, the rounded bottom very roughly, culminating in a rather long ranging C&H: The right rim and handle is the action taking place now.

Hello Amit,

Thanks a lot for replying,yep good action in greaves ....Now i know when to look at Adx, Rsi And MACD....

Regards

Roneeth

Yes, the rounded bottom very roughly, culminating in a rather long ranging C&H: The right rim and handle is the action taking place now.

Hello Amit,

Thanks a lot for replying,yep good action in greaves ....Now i know when to look at Adx, Rsi And MACD....

Regards

Roneeth