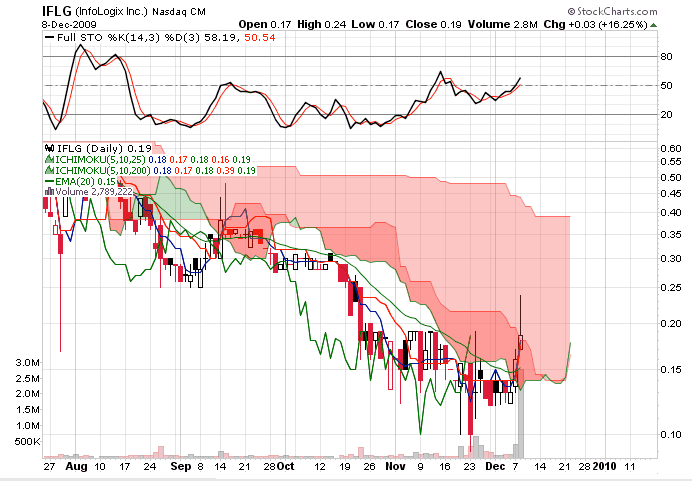

Stockcharts can do this hahaha. Just figured it out the other day and it's sweet.

The added depth it gives is awesome. It's multidimensional. It's helpful to me if I can see all three settings at once. 9,26,52 is giving me little information at the moment. They may be giving me TS/KS signals for support, but that's it. 5,10,20 and 10,20,200 are both giving me TS/KS signals as well as kumo's support/resistance.

The added depth it gives is awesome. It's multidimensional. It's helpful to me if I can see all three settings at once. 9,26,52 is giving me little information at the moment. They may be giving me TS/KS signals for support, but that's it. 5,10,20 and 10,20,200 are both giving me TS/KS signals as well as kumo's support/resistance.

Last edited: