Yes

This is what I wanted to point out

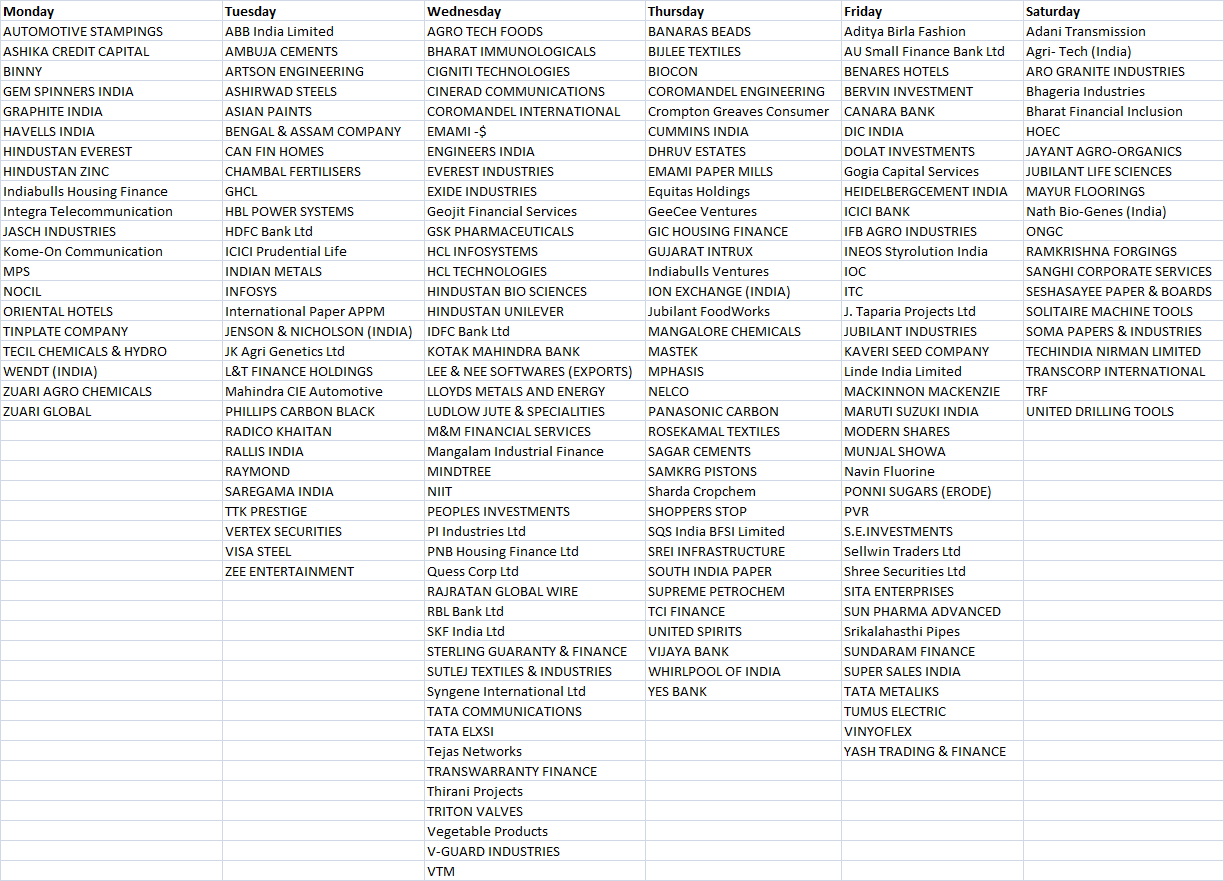

What does this indicate ???

Never heard of this much difference.

Any view or reasoning

This is what I wanted to point out

What does this indicate ???

Never heard of this much difference.

Any view or reasoning

However, in the context of Muhurat Trading ........ there is nothing much to be read in this aberration ....

In a normal trading of 6.25 hours of trading last 30 mins is 8% of trading time .....

In Muhurat Trading of 1 Hour, ..... 30 Mins is 50% of trading time and that also for BNF .... most of that downward move happened in last 30 Mins ...... so the weighted average will throw a freak value .......

Last edited: