General Trading Chat

- Thread starter timepass

- Start date

- Tags idle thoughts trading talk only

A lengthy article, but here is a bouncer from the RBI, which should have an effect on the banks and currency tomorrow.

https://www.moneycontrol.com/news/e...-monetary-policy-operation-twist-4749641.html

Welcome to the new World of RBI Monetary Policy: Operation Twist!

There are precedents for Operation Twist in the US and in Japan

Moneycontrol Contributor@moneycontrolcom

Amol Agrawal

The Reserve Bank of India (RBI) yesterday (December 19, 2019) announced a rather odd policy that will have a bearing on interest rates.

The press release said: “On a review of the current liquidity and market situation and an assessment of the evolving financial conditions, the Reserve Bank has decided to conduct simultaneous purchase and sale of government securities under Open Market Operations (OMO) for Rs 10,000 crores each on December 23, 2019 (Monday).”

RBI intends to purchase Rs 10,000 crore worth of one security -- the 6.45 percent GS 2029. This is a long term 10 year bond. On the sell side, it plans to offload 4 securities for a total of Rs 10,000 cr: 6.65 percent GS 2020, 7.80 percent GS 2020, 8.27 percent GS 2020 and 8.12 percent GS 2020. All the 4 securities are short term, maturing in 2020.

This policy measure of buying long-term bonds and selling short-term ones is known as Operation Twist (OT). As the central bank buys long term securities, the rise in demand for them leads to lower long-term yields. Eventually, it is long term interest rates that matter for investment and growth in the economy. This way the yield curve becomes “twisted” as short-term rates are pushed up and long-term rates are pushed down. The central banks opt for this measure when despite lowering interest rates, the long-term interest rates remain high.

The US has announced OT twice, the first time in 1961 and the second in 2011. In 1961, US President John F. Kennedy was voted to power when the economy was in a recession. In the 1960s, as the world was under the Bretton Woods (BW) fixed exchange rate system, the Fed could not change policy rates. The US was running current account deficits and facing gold outflows to balance its external account. If the Fed lowered the policy rates, it would have led to more gold outflows leading to instability. Based on this constraint, the government and Fed cooperated where the latter bought longer term securities and the former issued (sold) more short-term bonds. At that time, the Twist was a dance craze in the US and the name Operation Twist stuck.

Eric Swanson of San Francisco Fed in a research piece in 2011 showed that the Fed bought around $8.8 bn of longer term bonds and reduced its short-term treasuries by $7.4 bn. OT caused long-term interest rates to fall by about 0.15 percent and was short-lived. The yields on corporate bonds eased by 2-4 bps and Agency securities (Fannie Mae etc) by 13 bps.

In September 2011, Fed announced OT-II as long-term interest rates remained elevated despite Fed’s near policy rates and quantitative easing. This led the Federal Reserve to announce that it would buy $400bn of long dated securities in the bucket of 6-30 years and sell short dated securities in the 3 years and lower bucket. It planned to finish this maturity extension program by Jun 2012. Torsten Ehlers of BIS evaluated OT-II and found similar effects as OT-I, the impact lasted barely a month. This was expected as unlike 1961, this time around US Treasury continued to issue long-term bonds, dampening the buying program of the central bank.

Japan also announced its own version of OT called as Qualitiative and Quantitative Easing program (QQE) in 2013. Under this, Bank of Japan planned to not just buy Government Bonds but also extend the maturity of its portfolio from slightly less than three years to about seven years. In a way, OT also ensures that central banks end up having a portfolio of longer tenures.

Coming to the RBI, there are a couple of questions. First why OT at this time? RBI’s MPC Resolution released on Dec 5th, 2019 mentioned that RBI has eased repo rate by 135 bps during February-October 2019. However, transmission to debt markets varied for various money and corporate bonds ranging from 137 bps (overnight call money market) to 218 bps (3-month CPs of non-banking finance companies). In the government securities market, interest rates have eased partially by 113 bps in the 5-year tenure and 89 bps in the 10-year tenure.

Post RBI’s surprise pause in the Dec 2019 policy, this transmission worsened (see accompanying table 1). On Dec 5, 2019, yields increased across tenors and continued to rise till December 18th. The highest rise has been seen in 5 year and 10 year tenures. This rise in yields has clearly influenced the RBI decision to go for its own OT.

Table 1:

RBI’s pause stance has been vindicated as CPI inflation in Nov 2019 was reported at 5.54 percent, marking a third straight month of rising inflation. This has made RBI’s job tougher to convince markets that there will be rate cuts in future. This too has led to rise in yields, prompting RBI to engage in OT.

Second, would OT be effective? The benchmark 10 year bond, 6.45 percent GS 2029, which RBI will purchase closed at 6.75 percent yesterday (Dec 18, 2019) and was trading around 6.61 percent levels at the time of writing this piece. Thus, the announcement has worked immediately. However, it has to be seen whether the impact will last longer. RBI has just announced one such transaction and it has to be seen whether there will be more in future. Ideally, if RBI wanted a longer-term impact it should have announced a calendar of such OTs but this would have invited criticism for yield management and helping the government. Like most RBI policies, this one is also doing things first in a small way and then gradually building a base. However, if inflation remains elevated then calming markets via OT will not be effective.

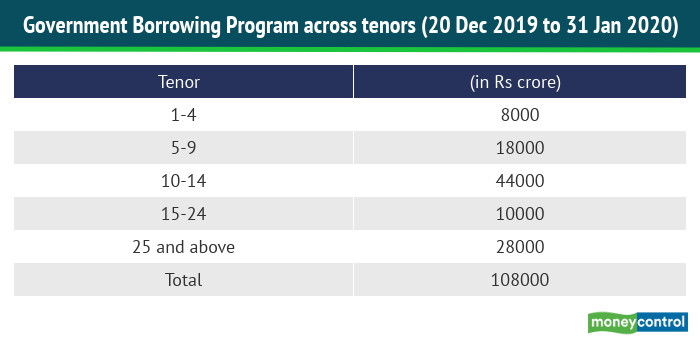

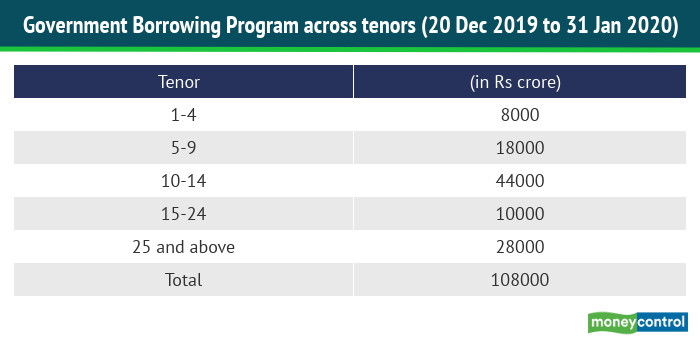

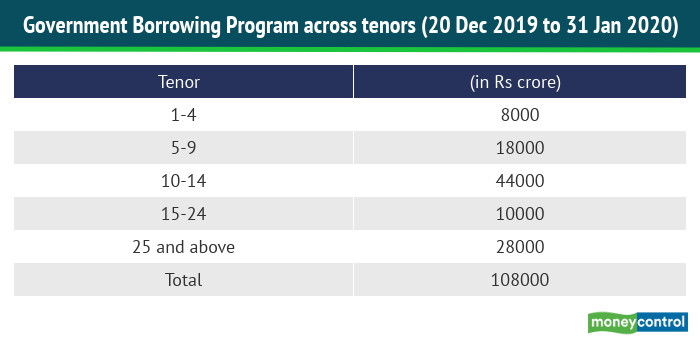

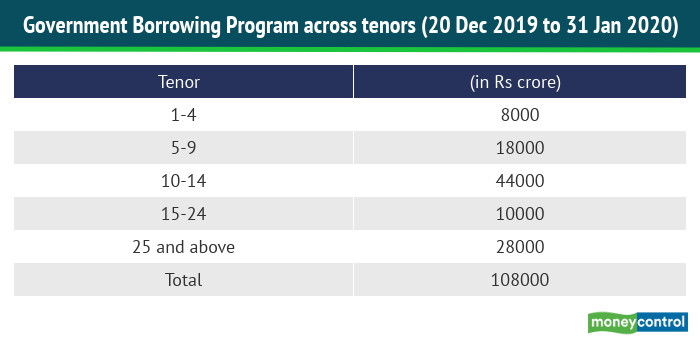

Third, the Government will also have to ensure that it does not issue long-term bonds as it will reduce the impact of OT. However, this is not the case. The Government had announced that it will borrow Rs 2.68 lakh crore in the Oct 19-Jan 20 period of which Rs 1.6 lakh crore has already been completed. Of the remaining Rs 1.08 lakh cr, Rs 82,000 crores is going to be under securities of more than 10 years tenor. Thus, even if RBI plans to engage in OT in future, the government borrowing program will limit its impact. With markets expecting a wider fiscal deficit, the problems could be compounded if the government chooses to do extra borrowing from the markets.

Table 2:

Fourth, the choice of securities is interesting. The four securities RBI plans to sell are basically going to mature next year and have large outstanding amounts.

Table 3:

Scanning the data shows that barring 6.65 percent GS 2020, the other three securities have not traded regularly in the recent fortnight. Whether the markets are interested in buying these securities from RBI will be interesting to see. On the other side, one could also see some regular trading in these securities post the RBI intervention.

Overall, to see RBI venture into OT is quite interesting. A few analysts did mention the idea but hardly anyone expected the central bank to take it up. This is because RBI still had a lot of room to cut policy rates. In fact, if RBI actually had cut rates in December 2019 policy the yields would have not hardened and there would have been no need for this new policy twist. The earlier cases of OT in US in 1961 and 2011 were done as other options were not there or were exhausted.

Just a few days ago, the markets thought RBI has an easier path compared to other central banks as all it has to do is lower policy rates, for which there is significant room. All this has changed very quickly in a matter of few days with rising inflation and expectations of a wider fiscal deficit. OT is at best going to serve as a short-term relief in such times.

https://www.moneycontrol.com/news/e...-monetary-policy-operation-twist-4749641.html

Welcome to the new World of RBI Monetary Policy: Operation Twist!

There are precedents for Operation Twist in the US and in Japan

Moneycontrol Contributor@moneycontrolcom

Amol Agrawal

The Reserve Bank of India (RBI) yesterday (December 19, 2019) announced a rather odd policy that will have a bearing on interest rates.

The press release said: “On a review of the current liquidity and market situation and an assessment of the evolving financial conditions, the Reserve Bank has decided to conduct simultaneous purchase and sale of government securities under Open Market Operations (OMO) for Rs 10,000 crores each on December 23, 2019 (Monday).”

RBI intends to purchase Rs 10,000 crore worth of one security -- the 6.45 percent GS 2029. This is a long term 10 year bond. On the sell side, it plans to offload 4 securities for a total of Rs 10,000 cr: 6.65 percent GS 2020, 7.80 percent GS 2020, 8.27 percent GS 2020 and 8.12 percent GS 2020. All the 4 securities are short term, maturing in 2020.

This policy measure of buying long-term bonds and selling short-term ones is known as Operation Twist (OT). As the central bank buys long term securities, the rise in demand for them leads to lower long-term yields. Eventually, it is long term interest rates that matter for investment and growth in the economy. This way the yield curve becomes “twisted” as short-term rates are pushed up and long-term rates are pushed down. The central banks opt for this measure when despite lowering interest rates, the long-term interest rates remain high.

The US has announced OT twice, the first time in 1961 and the second in 2011. In 1961, US President John F. Kennedy was voted to power when the economy was in a recession. In the 1960s, as the world was under the Bretton Woods (BW) fixed exchange rate system, the Fed could not change policy rates. The US was running current account deficits and facing gold outflows to balance its external account. If the Fed lowered the policy rates, it would have led to more gold outflows leading to instability. Based on this constraint, the government and Fed cooperated where the latter bought longer term securities and the former issued (sold) more short-term bonds. At that time, the Twist was a dance craze in the US and the name Operation Twist stuck.

Eric Swanson of San Francisco Fed in a research piece in 2011 showed that the Fed bought around $8.8 bn of longer term bonds and reduced its short-term treasuries by $7.4 bn. OT caused long-term interest rates to fall by about 0.15 percent and was short-lived. The yields on corporate bonds eased by 2-4 bps and Agency securities (Fannie Mae etc) by 13 bps.

In September 2011, Fed announced OT-II as long-term interest rates remained elevated despite Fed’s near policy rates and quantitative easing. This led the Federal Reserve to announce that it would buy $400bn of long dated securities in the bucket of 6-30 years and sell short dated securities in the 3 years and lower bucket. It planned to finish this maturity extension program by Jun 2012. Torsten Ehlers of BIS evaluated OT-II and found similar effects as OT-I, the impact lasted barely a month. This was expected as unlike 1961, this time around US Treasury continued to issue long-term bonds, dampening the buying program of the central bank.

Japan also announced its own version of OT called as Qualitiative and Quantitative Easing program (QQE) in 2013. Under this, Bank of Japan planned to not just buy Government Bonds but also extend the maturity of its portfolio from slightly less than three years to about seven years. In a way, OT also ensures that central banks end up having a portfolio of longer tenures.

Coming to the RBI, there are a couple of questions. First why OT at this time? RBI’s MPC Resolution released on Dec 5th, 2019 mentioned that RBI has eased repo rate by 135 bps during February-October 2019. However, transmission to debt markets varied for various money and corporate bonds ranging from 137 bps (overnight call money market) to 218 bps (3-month CPs of non-banking finance companies). In the government securities market, interest rates have eased partially by 113 bps in the 5-year tenure and 89 bps in the 10-year tenure.

Post RBI’s surprise pause in the Dec 2019 policy, this transmission worsened (see accompanying table 1). On Dec 5, 2019, yields increased across tenors and continued to rise till December 18th. The highest rise has been seen in 5 year and 10 year tenures. This rise in yields has clearly influenced the RBI decision to go for its own OT.

Table 1:

RBI’s pause stance has been vindicated as CPI inflation in Nov 2019 was reported at 5.54 percent, marking a third straight month of rising inflation. This has made RBI’s job tougher to convince markets that there will be rate cuts in future. This too has led to rise in yields, prompting RBI to engage in OT.

Second, would OT be effective? The benchmark 10 year bond, 6.45 percent GS 2029, which RBI will purchase closed at 6.75 percent yesterday (Dec 18, 2019) and was trading around 6.61 percent levels at the time of writing this piece. Thus, the announcement has worked immediately. However, it has to be seen whether the impact will last longer. RBI has just announced one such transaction and it has to be seen whether there will be more in future. Ideally, if RBI wanted a longer-term impact it should have announced a calendar of such OTs but this would have invited criticism for yield management and helping the government. Like most RBI policies, this one is also doing things first in a small way and then gradually building a base. However, if inflation remains elevated then calming markets via OT will not be effective.

Third, the Government will also have to ensure that it does not issue long-term bonds as it will reduce the impact of OT. However, this is not the case. The Government had announced that it will borrow Rs 2.68 lakh crore in the Oct 19-Jan 20 period of which Rs 1.6 lakh crore has already been completed. Of the remaining Rs 1.08 lakh cr, Rs 82,000 crores is going to be under securities of more than 10 years tenor. Thus, even if RBI plans to engage in OT in future, the government borrowing program will limit its impact. With markets expecting a wider fiscal deficit, the problems could be compounded if the government chooses to do extra borrowing from the markets.

Table 2:

Fourth, the choice of securities is interesting. The four securities RBI plans to sell are basically going to mature next year and have large outstanding amounts.

Table 3:

Scanning the data shows that barring 6.65 percent GS 2020, the other three securities have not traded regularly in the recent fortnight. Whether the markets are interested in buying these securities from RBI will be interesting to see. On the other side, one could also see some regular trading in these securities post the RBI intervention.

Overall, to see RBI venture into OT is quite interesting. A few analysts did mention the idea but hardly anyone expected the central bank to take it up. This is because RBI still had a lot of room to cut policy rates. In fact, if RBI actually had cut rates in December 2019 policy the yields would have not hardened and there would have been no need for this new policy twist. The earlier cases of OT in US in 1961 and 2011 were done as other options were not there or were exhausted.

Just a few days ago, the markets thought RBI has an easier path compared to other central banks as all it has to do is lower policy rates, for which there is significant room. All this has changed very quickly in a matter of few days with rising inflation and expectations of a wider fiscal deficit. OT is at best going to serve as a short-term relief in such times.

Please post the source of the news also.

Reliance-BP petrol pumps to dent PSU market share, says Morgan Stanley

3 min read . Updated: 22 Dec 2019, 11:50 AM ISTPTI

https://www.livemint.com/industry/e...share-says-morgan-stanley-11576994811486.html

https://www.outlookindia.com/newssc...set-up-petrol-pumps-under-jiobp-brand/1687188

Reliance-BP petrol pumps to dent PSU market share, says Morgan Stanley

3 min read . Updated: 22 Dec 2019, 11:50 AM ISTPTI

- The tie-up will see RIL's 1,400 existing pump stations being ramped up to 5,500 over five years

- RIL and BP expect to form their partnership by first half of 2020

https://www.livemint.com/industry/e...share-says-morgan-stanley-11576994811486.html

https://www.outlookindia.com/newssc...set-up-petrol-pumps-under-jiobp-brand/1687188

A lengthy article, but here is a bouncer from the RBI, which should have an effect on the banks and currency tomorrow.

https://www.moneycontrol.com/news/e...-monetary-policy-operation-twist-4749641.html

Welcome to the new World of RBI Monetary Policy: Operation Twist!

There are precedents for Operation Twist in the US and in Japan

Moneycontrol Contributor@moneycontrolcom

Amol Agrawal

The Reserve Bank of India (RBI) yesterday (December 19, 2019) announced a rather odd policy that will have a bearing on interest rates.

The press release said: “On a review of the current liquidity and market situation and an assessment of the evolving financial conditions, the Reserve Bank has decided to conduct simultaneous purchase and sale of government securities under Open Market Operations (OMO) for Rs 10,000 crores each on December 23, 2019 (Monday).”

RBI intends to purchase Rs 10,000 crore worth of one security -- the 6.45 percent GS 2029. This is a long term 10 year bond. On the sell side, it plans to offload 4 securities for a total of Rs 10,000 cr: 6.65 percent GS 2020, 7.80 percent GS 2020, 8.27 percent GS 2020 and 8.12 percent GS 2020. All the 4 securities are short term, maturing in 2020.

This policy measure of buying long-term bonds and selling short-term ones is known as Operation Twist (OT). As the central bank buys long term securities, the rise in demand for them leads to lower long-term yields. Eventually, it is long term interest rates that matter for investment and growth in the economy. This way the yield curve becomes “twisted” as short-term rates are pushed up and long-term rates are pushed down. The central banks opt for this measure when despite lowering interest rates, the long-term interest rates remain high.

The US has announced OT twice, the first time in 1961 and the second in 2011. In 1961, US President John F. Kennedy was voted to power when the economy was in a recession. In the 1960s, as the world was under the Bretton Woods (BW) fixed exchange rate system, the Fed could not change policy rates. The US was running current account deficits and facing gold outflows to balance its external account. If the Fed lowered the policy rates, it would have led to more gold outflows leading to instability. Based on this constraint, the government and Fed cooperated where the latter bought longer term securities and the former issued (sold) more short-term bonds. At that time, the Twist was a dance craze in the US and the name Operation Twist stuck.

Eric Swanson of San Francisco Fed in a research piece in 2011 showed that the Fed bought around $8.8 bn of longer term bonds and reduced its short-term treasuries by $7.4 bn. OT caused long-term interest rates to fall by about 0.15 percent and was short-lived. The yields on corporate bonds eased by 2-4 bps and Agency securities (Fannie Mae etc) by 13 bps.

In September 2011, Fed announced OT-II as long-term interest rates remained elevated despite Fed’s near policy rates and quantitative easing. This led the Federal Reserve to announce that it would buy $400bn of long dated securities in the bucket of 6-30 years and sell short dated securities in the 3 years and lower bucket. It planned to finish this maturity extension program by Jun 2012. Torsten Ehlers of BIS evaluated OT-II and found similar effects as OT-I, the impact lasted barely a month. This was expected as unlike 1961, this time around US Treasury continued to issue long-term bonds, dampening the buying program of the central bank.

Japan also announced its own version of OT called as Qualitiative and Quantitative Easing program (QQE) in 2013. Under this, Bank of Japan planned to not just buy Government Bonds but also extend the maturity of its portfolio from slightly less than three years to about seven years. In a way, OT also ensures that central banks end up having a portfolio of longer tenures.

Coming to the RBI, there are a couple of questions. First why OT at this time? RBI’s MPC Resolution released on Dec 5th, 2019 mentioned that RBI has eased repo rate by 135 bps during February-October 2019. However, transmission to debt markets varied for various money and corporate bonds ranging from 137 bps (overnight call money market) to 218 bps (3-month CPs of non-banking finance companies). In the government securities market, interest rates have eased partially by 113 bps in the 5-year tenure and 89 bps in the 10-year tenure.

Post RBI’s surprise pause in the Dec 2019 policy, this transmission worsened (see accompanying table 1). On Dec 5, 2019, yields increased across tenors and continued to rise till December 18th. The highest rise has been seen in 5 year and 10 year tenures. This rise in yields has clearly influenced the RBI decision to go for its own OT.

Table 1:

RBI’s pause stance has been vindicated as CPI inflation in Nov 2019 was reported at 5.54 percent, marking a third straight month of rising inflation. This has made RBI’s job tougher to convince markets that there will be rate cuts in future. This too has led to rise in yields, prompting RBI to engage in OT.

Second, would OT be effective? The benchmark 10 year bond, 6.45 percent GS 2029, which RBI will purchase closed at 6.75 percent yesterday (Dec 18, 2019) and was trading around 6.61 percent levels at the time of writing this piece. Thus, the announcement has worked immediately. However, it has to be seen whether the impact will last longer. RBI has just announced one such transaction and it has to be seen whether there will be more in future. Ideally, if RBI wanted a longer-term impact it should have announced a calendar of such OTs but this would have invited criticism for yield management and helping the government. Like most RBI policies, this one is also doing things first in a small way and then gradually building a base. However, if inflation remains elevated then calming markets via OT will not be effective.

Third, the Government will also have to ensure that it does not issue long-term bonds as it will reduce the impact of OT. However, this is not the case. The Government had announced that it will borrow Rs 2.68 lakh crore in the Oct 19-Jan 20 period of which Rs 1.6 lakh crore has already been completed. Of the remaining Rs 1.08 lakh cr, Rs 82,000 crores is going to be under securities of more than 10 years tenor. Thus, even if RBI plans to engage in OT in future, the government borrowing program will limit its impact. With markets expecting a wider fiscal deficit, the problems could be compounded if the government chooses to do extra borrowing from the markets.

Table 2:

Fourth, the choice of securities is interesting. The four securities RBI plans to sell are basically going to mature next year and have large outstanding amounts.

Table 3:

Scanning the data shows that barring 6.65 percent GS 2020, the other three securities have not traded regularly in the recent fortnight. Whether the markets are interested in buying these securities from RBI will be interesting to see. On the other side, one could also see some regular trading in these securities post the RBI intervention.

Overall, to see RBI venture into OT is quite interesting. A few analysts did mention the idea but hardly anyone expected the central bank to take it up. This is because RBI still had a lot of room to cut policy rates. In fact, if RBI actually had cut rates in December 2019 policy the yields would have not hardened and there would have been no need for this new policy twist. The earlier cases of OT in US in 1961 and 2011 were done as other options were not there or were exhausted.

Just a few days ago, the markets thought RBI has an easier path compared to other central banks as all it has to do is lower policy rates, for which there is significant room. All this has changed very quickly in a matter of few days with rising inflation and expectations of a wider fiscal deficit. OT is at best going to serve as a short-term relief in such times.

https://www.moneycontrol.com/news/e...-monetary-policy-operation-twist-4749641.html

Welcome to the new World of RBI Monetary Policy: Operation Twist!

There are precedents for Operation Twist in the US and in Japan

Moneycontrol Contributor@moneycontrolcom

Amol Agrawal

The Reserve Bank of India (RBI) yesterday (December 19, 2019) announced a rather odd policy that will have a bearing on interest rates.

The press release said: “On a review of the current liquidity and market situation and an assessment of the evolving financial conditions, the Reserve Bank has decided to conduct simultaneous purchase and sale of government securities under Open Market Operations (OMO) for Rs 10,000 crores each on December 23, 2019 (Monday).”

RBI intends to purchase Rs 10,000 crore worth of one security -- the 6.45 percent GS 2029. This is a long term 10 year bond. On the sell side, it plans to offload 4 securities for a total of Rs 10,000 cr: 6.65 percent GS 2020, 7.80 percent GS 2020, 8.27 percent GS 2020 and 8.12 percent GS 2020. All the 4 securities are short term, maturing in 2020.

This policy measure of buying long-term bonds and selling short-term ones is known as Operation Twist (OT). As the central bank buys long term securities, the rise in demand for them leads to lower long-term yields. Eventually, it is long term interest rates that matter for investment and growth in the economy. This way the yield curve becomes “twisted” as short-term rates are pushed up and long-term rates are pushed down. The central banks opt for this measure when despite lowering interest rates, the long-term interest rates remain high.

The US has announced OT twice, the first time in 1961 and the second in 2011. In 1961, US President John F. Kennedy was voted to power when the economy was in a recession. In the 1960s, as the world was under the Bretton Woods (BW) fixed exchange rate system, the Fed could not change policy rates. The US was running current account deficits and facing gold outflows to balance its external account. If the Fed lowered the policy rates, it would have led to more gold outflows leading to instability. Based on this constraint, the government and Fed cooperated where the latter bought longer term securities and the former issued (sold) more short-term bonds. At that time, the Twist was a dance craze in the US and the name Operation Twist stuck.

Eric Swanson of San Francisco Fed in a research piece in 2011 showed that the Fed bought around $8.8 bn of longer term bonds and reduced its short-term treasuries by $7.4 bn. OT caused long-term interest rates to fall by about 0.15 percent and was short-lived. The yields on corporate bonds eased by 2-4 bps and Agency securities (Fannie Mae etc) by 13 bps.

In September 2011, Fed announced OT-II as long-term interest rates remained elevated despite Fed’s near policy rates and quantitative easing. This led the Federal Reserve to announce that it would buy $400bn of long dated securities in the bucket of 6-30 years and sell short dated securities in the 3 years and lower bucket. It planned to finish this maturity extension program by Jun 2012. Torsten Ehlers of BIS evaluated OT-II and found similar effects as OT-I, the impact lasted barely a month. This was expected as unlike 1961, this time around US Treasury continued to issue long-term bonds, dampening the buying program of the central bank.

Japan also announced its own version of OT called as Qualitiative and Quantitative Easing program (QQE) in 2013. Under this, Bank of Japan planned to not just buy Government Bonds but also extend the maturity of its portfolio from slightly less than three years to about seven years. In a way, OT also ensures that central banks end up having a portfolio of longer tenures.

Coming to the RBI, there are a couple of questions. First why OT at this time? RBI’s MPC Resolution released on Dec 5th, 2019 mentioned that RBI has eased repo rate by 135 bps during February-October 2019. However, transmission to debt markets varied for various money and corporate bonds ranging from 137 bps (overnight call money market) to 218 bps (3-month CPs of non-banking finance companies). In the government securities market, interest rates have eased partially by 113 bps in the 5-year tenure and 89 bps in the 10-year tenure.

Post RBI’s surprise pause in the Dec 2019 policy, this transmission worsened (see accompanying table 1). On Dec 5, 2019, yields increased across tenors and continued to rise till December 18th. The highest rise has been seen in 5 year and 10 year tenures. This rise in yields has clearly influenced the RBI decision to go for its own OT.

Table 1:

RBI’s pause stance has been vindicated as CPI inflation in Nov 2019 was reported at 5.54 percent, marking a third straight month of rising inflation. This has made RBI’s job tougher to convince markets that there will be rate cuts in future. This too has led to rise in yields, prompting RBI to engage in OT.

Second, would OT be effective? The benchmark 10 year bond, 6.45 percent GS 2029, which RBI will purchase closed at 6.75 percent yesterday (Dec 18, 2019) and was trading around 6.61 percent levels at the time of writing this piece. Thus, the announcement has worked immediately. However, it has to be seen whether the impact will last longer. RBI has just announced one such transaction and it has to be seen whether there will be more in future. Ideally, if RBI wanted a longer-term impact it should have announced a calendar of such OTs but this would have invited criticism for yield management and helping the government. Like most RBI policies, this one is also doing things first in a small way and then gradually building a base. However, if inflation remains elevated then calming markets via OT will not be effective.

Third, the Government will also have to ensure that it does not issue long-term bonds as it will reduce the impact of OT. However, this is not the case. The Government had announced that it will borrow Rs 2.68 lakh crore in the Oct 19-Jan 20 period of which Rs 1.6 lakh crore has already been completed. Of the remaining Rs 1.08 lakh cr, Rs 82,000 crores is going to be under securities of more than 10 years tenor. Thus, even if RBI plans to engage in OT in future, the government borrowing program will limit its impact. With markets expecting a wider fiscal deficit, the problems could be compounded if the government chooses to do extra borrowing from the markets.

Table 2:

Fourth, the choice of securities is interesting. The four securities RBI plans to sell are basically going to mature next year and have large outstanding amounts.

Table 3:

Scanning the data shows that barring 6.65 percent GS 2020, the other three securities have not traded regularly in the recent fortnight. Whether the markets are interested in buying these securities from RBI will be interesting to see. On the other side, one could also see some regular trading in these securities post the RBI intervention.

Overall, to see RBI venture into OT is quite interesting. A few analysts did mention the idea but hardly anyone expected the central bank to take it up. This is because RBI still had a lot of room to cut policy rates. In fact, if RBI actually had cut rates in December 2019 policy the yields would have not hardened and there would have been no need for this new policy twist. The earlier cases of OT in US in 1961 and 2011 were done as other options were not there or were exhausted.

Just a few days ago, the markets thought RBI has an easier path compared to other central banks as all it has to do is lower policy rates, for which there is significant room. All this has changed very quickly in a matter of few days with rising inflation and expectations of a wider fiscal deficit. OT is at best going to serve as a short-term relief in such times.

'Oxygen Parlour' at Nashik Railway Station to combat air pollution

https://www.livemint.com/news/india...n-to-combat-air-pollution-11577073726886.html

https://www.livemint.com/news/india...n-to-combat-air-pollution-11577073726886.html

Yeah, one opened in Delhi a month ago.

https://indianexpress.com/videos/li...-pure-air-for-rs-300-videonews-6108220489001/

https://indianexpress.com/videos/li...-pure-air-for-rs-300-videonews-6108220489001/

Disruptive decade: 10 things the teen years brought world markets

https://www.livemint.com/news/world...ars-brought-world-markets-11577131814917.html

https://www.livemint.com/news/world...ars-brought-world-markets-11577131814917.html

Similar threads

-

-

What are some general and basic price-volume action pattern one should know?

- Started by shyttrader

- Replies: 1

-

-

-