Nirvana - The Discussion

- Thread starter sr114

- Start date

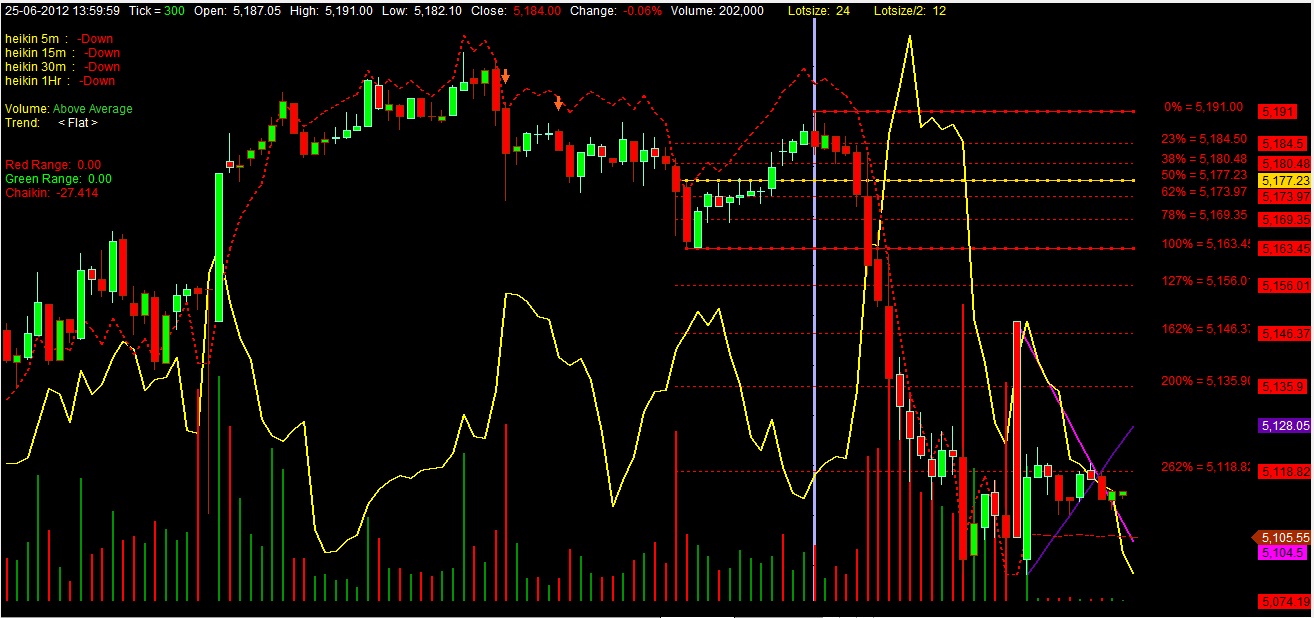

Here Is Above Fib System Afl Hope All Fibbo Lover Like It

Thank You

Thank You

_SECTION_BEGIN("Background");

SetChartOptions(0,chartShowArrows|chartShowDates|chartWrapTitle|chartHideQuoteMarker);

dy=ParamToggle("NR calc for", "RT SCAN|EOD SCAN", 0);

TT=IIf(dy==0,in15Minute,inDaily);

no=Param("NR days filter",0,0,4,1);

Limit=Param(" Trade Till (Hour)(Min)(Sec)",153000,103000,153000,100);

since=(TimeNum() >= 084500 AND TimeNum()<= Limit) AND (DateNum()==LastValue(DateNum()));

perc= Param("Red-Green ratio % Set", 35, 0, 100, 1 );

inv=Param("INVEST CAPITAL", 23000,1000, 1000000, 500 );

SetChartBkColor(ParamColor("Outer panel",colorBlack)); // color of outer border

SetChartBkGradientFill( ParamColor("Inner panel upper",colorBlack),ParamColor("Inner panel lower",colorBlack));

tchoice=Param("Title Selection ",2,1,2,1);

_SECTION_BEGIN("Haiken");

Show_color = ParamToggle("Display CandleColor", "No|Yes", 0);

r1 = Param( "ColorFast avg", 5, 2, 200, 1 );

r2 = Param( "ColorSlow avg", 10, 2, 200, 1 );

r3 = Param( "ColorSignal avg", 5, 2, 200, 1 );

Prd1=Param("ATR Period",4,1,20,1);

Prd2=Param("Look Back",7,1,20,1);

greenD = HHV(LLV(L,Prd1)+ATR(Prd1),Prd2);

redD = LLV(HHV(H,Prd1)-ATR(Prd1),Prd2);

HaClose =EMA((O+H+L+C)/4,3); // Woodie

HaOpen = AMA( Ref( HaClose, -1 ), 0.5 );

HaHigh = Max( H, Max( HaClose, HaOpen ) );

HaLow = Min( L, Min( HaClose, HaOpen ) );

Temp = Max(High, HaOpen);

Temp = Min(Low,HaOpen);

m1=MACD(r1,r2);

s1=Signal(r1,r2,r3);

mycolor=IIf(m1<0 AND m1>s1, ColorRGB(230,230,0),IIf(m1>0 AND m1>s1,colorLime,IIf(m1>0 AND m1<s1,colorOrange,colorDarkRed)));

if(Show_color)

{

ColorHighliter = myColor;

SetBarFillColor( ColorHighliter );

}

//////////

barColor=IIf(C>GreenD ,colorBrightGreen,IIf(C < REDD,colorRed,colorYellow));

barColor2=IIf(CCI(14) > ((Ref(CCI(14),-1)+Ref(CCI(14),-2))/2),colorAqua,colorBrown);

if( ParamToggle("Plot Normal Candle", "No,Yes", 0 ) )

PlotOHLC( HaOpen, HaHigh, HaLow, HaClose, " " , barcolor, styleCandle | styleThick );

else

PlotOHLC( Open, High, Low, Close, " " , barcolor2, styleCandle | styleThick );

_SECTION_BEGIN("Volume");

Plot( Volume, _DEFAULT_NAME(), IIf( C > O,colorGreen, colorRed), ParamStyle( "Style", styleHistogram | styleOwnScale | styleThick | styleNoLabel, maskHistogram ), 2 );

Plot( OBV(), _DEFAULT_NAME(), ParamColor("OBV Color", colorCycle ), styleDashed| styleOwnScale | styleThick | styleNoLabel );

_SECTION_END();

_SECTION_BEGIN("Chaikin Volatility");

periods= Param("Periods", 10, 2, 100 );

function ChaikinVolatility( periods )

{

return ROC( EMA( High - Low, periods ), periods );

}

Plot( ChaikinVolatility(periods ),_DEFAULT_NAME(), colorYellow,styleLine| styleOwnScale | styleThick | styleNoLabel );

_SECTION_END();

TimeFrameSet(in5Minute);

//TimeFrameSet(in5Minute);

since5=(TimeNum() >= 090000 AND TimeNum()<= 153000) AND (DateNum()==LastValue(DateNum()));

Candles5=(since5 & (C<O | C>O | C==O));

Candles51=Cum(Candles5);

HaClose0 =EMA((O+H+L+C)/4,3);

HaOpen0 = AMA( Ref( HaClose0, -1 ), 0.5 );

HaHigh0 = Max( H, Max( HaClose0, HaOpen0 ) );

HaLow0 = Min( L, Min( HaClose0, HaOpen0 ) );

CondB=Haopen0<Haclose0;CONDS=Haopen0 >Haclose0;

TimeFrameRestore();

_SECTION_BEGIN("2");

//Compress= Param("Compression",3,0.20,100,0.10);

TimeFrameSet(in15Minute);

since15=(TimeNum() >= 090000 AND TimeNum()<= 153000) AND (DateNum()==LastValue(DateNum()));

Candles15=(since15 & (C<O | C>O | C==O));

Candles115=Cum(Candles15);

HaClose1 =EMA((O+H+L+C)/4,3);

HaOpen1 = AMA( Ref( HaClose1, -1 ), 0.5 );

HaHigh1 = Max( H, Max( HaClose1, HaOpen1 ) );

HaLow1 = Min( L, Min( HaClose1, HaOpen1 ) );

CondB1=Haopen1 < Haclose1;CONDS1=Haopen1 >Haclose1;

TimeFrameRestore();

_SECTION_BEGIN("3");

//Compress= Param("Compression",6,0.20,100,0.10);

TimeFrameSet(in15Minute*2);

since2=(TimeNum() >= 090000 AND TimeNum()<= 153000) AND (DateNum()==LastValue(DateNum()));

Candles2=(since2 & (C<O | C>O | C==O));

Candles12=Cum(Candles2);

HaClose2 =EMA((O+H+L+C)/4,3);

HaOpen2 = AMA( Ref( HaClose2, -1 ), 0.5 );

HaHigh2 = Max( H, Max( HaClose2, HaOpen2 ) );

HaLow2 = Min( L, Min( HaClose2, HaOpen2 ) );

CondB2=Haopen2 < Haclose2;CONDS2=Haopen2 > Haclose2;

TimeFrameRestore();

_SECTION_BEGIN("4");

//Compress= Param("Compression",12,0.20,100,0.10);

TimeFrameSet(inHourly);

since3=(TimeNum() >= 090000 AND TimeNum()<= 153000) AND (DateNum()==LastValue(DateNum()));

Candles3=(since3 & (C<O | C>O | C==O));

Candles13=Cum(Candles3);

HaClose3 =EMA((O+H+L+C)/4,3);

HaOpen3 = AMA( Ref( HaClose3, -1 ), 0.5 );

HaHigh3 = Max( H, Max( HaClose3, HaOpen3) );

HaLow3 = Min( L, Min( HaClose3, HaOpen3 ) );

CondB3=Haopen3 < Haclose3;CONDS3=Haopen3 > Haclose3;

TimeFrameRestore();

//patterns

_SECTION_BEGIN("Pattern Alerts");

SRbS = ParamToggle("S/R broken","Off,On",1);

SRcS = ParamToggle("S/R confirmed","Off,On",1);

PjabS = ParamToggle("Price just above/below","Off,On",1);

_SECTION_END();

_SECTION_BEGIN("Pattern Parameters");

PlotP1P2 = ParamToggle("Plot P1/P2 Shapes","Off,On",0);

P1Shape = Param("P1 Shape Typ",35,0,50,1);//default 35

P2Shape = Param("P2 Shape Typ",37,0,50,1);//default 37

Parallellinesswitch = ParamToggle("Plot Parallel Lines","Off,On",0);

DisRange = Param("Plot Parallel Lines Trigger",300,0,1000,20);

_SECTION_BEGIN("Pattern Styles");

Style_SL= ParamStyle("Support",styleLine+styleThick,maskDefault)+styleNoRescale;

Style_RL= ParamStyle("Resistance",styleLine+styleThick,maskDefault)+styleNoRescale;

Style_PHL= ParamStyle("Parallel Support",styleLine+styleDashed,maskDefault)+styleNoRescale;

Style_PLL= ParamStyle("Parallel Resistance",styleLine+styleDashed,maskDefault)+styleNoRescale;

_SECTION_END();

_SECTION_BEGIN("Pattern Selection");

AscTs = ParamToggle("Ascending Triangle","Off,On",1);

DscTs = ParamToggle("Descending Triangle","Off,On",1);

STs = ParamToggle("Symmetrically Triangle","Off,On",1);

ETs = ParamToggle("Expanding Triangle","Off,On",1);

RWs = ParamToggle("Rising Wedge","Off,On",1);

FWs = ParamToggle("Falling Wedge","Off,On",1);

UTs = ParamToggle("Up Trend","Off,On",1);

DTs = ParamToggle("Down Trend","Off,On",1);

Ranges = ParamToggle("Range","Off,On",1);

NonDefinedPatterns = ParamToggle("Not defined Patterns","Off,On",1);

_SECTION_END();

//calcs

HH = HHV(H,20);

LL = LLV(L,20);

Mid = LL+((HH-LL)/2);

Div = 100-(HH/(0.01*Mid));

Per = LastValue(abs(Div));

Hp1 = Ref(H,-1);Hp2 = Ref(H,-2);Hp3 = Ref(H,-3);Hp4 = Ref(H,-4);Hp5 = Ref(H,-5);Hp6 = Ref(H,-6);

Lp1 = Ref(L,-1);Lp2 = Ref(L,-2);Lp3 = Ref(L,-3);Lp4 = Ref(L,-4);Lp5 = Ref(L,-5);Lp6 = Ref(L,-6);

Hf1 = Ref(H,1);Hf2 = Ref(H,2);Hf3 = Ref(H,3);Hf4 = Ref(H,4);Hf5 = Ref(H,5);Hf6 = Ref(H,6);

Lf1 = Ref(L,1);Lf2 = Ref(L,2);Lf3 = Ref(L,3);Lf4 = Ref(L,4);Lf5 = Ref(L,5);Lf6 = Ref(L,6);

x = Cum(1);

divx = LastValue(x)-x;

//Tops

A = H;

Top1 = A > Hf2 & A > Hf1 & A > Hp1 & A > Hp2 & divx>2;

Top2 = A > Hf3 & A > Hf2 & A ==Hf1 & A > Hp1 & A > Hp2 & divx>3 ;

Top3 = A > Hf4 & A > Hf3 & A ==Hf2 & A >=Hf1 & A > Hp1 & A > Hp2 & divx>4;

Top4 = A > Hf5 & A > Hf4 & A ==Hf3 & A >=Hf2 & A >=Hf1 & A > Hp1 & A > Hp2 & divx>5;

Top5 = A > Hf6 & A > Hf5 & A ==Hf4 & A >=Hf3 & A ==Hf2 & A >=Hf1 & A > Hp1 & A >Hp2 & divx>6;

Top = Top1 OR Top2 OR Top3 OR Top4 OR Top5;

TopHigh = ValueWhen(Top,H);

TopX = ValueWhen(Top,X);

//Valleys

A = L;

Valley1 = A < Lf2 & A <= Lf1 & A <= Lp1 & A < Lp2 & divx>2;

Valley2 = A < Lf3 & A < Lf2 & A == Lf1 & A < Lp1 & A < Lp2 & divx>3;

Valley3 = A < Lf4 & A < Lf3 & A == Lf2 & A <= Lf1 & A < Lp1 & A < Lp2 & divx>4;

Valley4 = A < Lf5 & A < Lf4 & A == Lf3 & A <= Lf2 & A <= Lf1 & A < Lp1 & A < Lp2 & divx>5;

Valley5 = A < Lf6 & A < Lf5 & A == Lf4 & A <= Lf3 & A == Lf2 & A <= Lf1 & A < Lp1 & A < Lp2 & divx>6;

Valley = Valley1 OR Valley2 OR Valley3 OR Valley4 OR Valley4 OR Valley5;

ValleyLow = ValueWhen(Valley,L);

ValleyX = ValueWhen(Valley,X);

x = Cum(1);

xb = LastValue(ValueWhen(Valley,x,1));

xa = LastValue(ValueWhen(Valley,x,2));

yb = LastValue(ValueWhen(Valley,L,1));

Ya = LastValue(ValueWhen(Valley,L,2));

xab_log = log(yb/yA)/(xb-xa);

SL = exp((x-xb)*xab_log)*yb;

RocSL = ROC(SL,1);

xd = LastValue(ValueWhen(top,x,1));

xc = LastValue(ValueWhen(top,x,2));

yd = LastValue(ValueWhen(top,H,1));

Yc = LastValue(ValueWhen(top,H,2));

xcd_log = log(yd/yc)/(xd-xc);

RL = exp((x-xd)*xcd_log)*yd;

RocRL = ROC(RL,1);

//LPL

Low_Value = LastValue(Ref(LLV(L,xd-xc),-(x-xd)));

x2 = LastValue(ValueWhen(L==Low_Value & x>xc & x<xd,x));

PLL = IIf(LastValue(x)-x2>5,exp((x-x2)*xcd_log)*Low_Value,-1e10);

//HPL

Hi_Value = LastValue(Ref(HHV(H,xb-xa),-(x-xb)));

x3 = LastValue(ValueWhen(H==Hi_Value & x>xa & x<xb,x));

PHL = IIf(LastValue(x)-x3>5,exp((x-x3)*xab_log)*Hi_Value,-1e10);

//Channels

AvgRoc = abs(MA(ROC(C,1),100));

Threshold_parallel = 15;

Threshold_Trend = 0.001*per;

SLabs = SL-Ref(SL,-1); RLabs = RL-Ref(RL,-1);

ROC2SL = (SLabs/C)*100; ROC2RL = (RLabs/C)*100;

RSL = ROC2SL > Threshold_Trend; FlatSL = abs(ROC2SL) < Threshold_Trend; FSL = ROC2SL < -Threshold_Trend;

RRL = ROC2RL > Threshold_Trend; FlatRL = abs(ROC2RL) < Threshold_Trend; FRL = ROC2RL < -Threshold_Trend;

parallel= abs(((RocSL/RocRL)-1)*100)<Threshold_parallel;

UT= RSL AND RRL AND parallel;

DT= FSL AND FRL AND parallel;

DT_UT = IIf (DT,-1,IIf(UT,1,0));

Rangeee = parallel AND FlatSL AND FlatRL;

Xm = xb-xa >4 & xd-xc >4; //x-min.distance - optional

AscT= FlatRL & RSL;// & xa<xd & xc<xb;// & Xm;

DscT= FlatSL & FRL;// & xa<xd & xc<xb;// & Xm;

AT_DT= IIf(AscT,1,IIf(DscT,-1,0));

ST = RSL & FRL & RL>SL;//& xa<xd & xc<xb;// & Xm;

ET = RRL & FSL & RL>SL;//& xa<xd & xc<xb;// & Xm;//abs(ROCSL/ROCRL)<3 - optional

ST_ET = IIf(ST,1,IIf(ET,-1,0));

RW = RRL & RSL & RocSL>RocRL & SL>RL AND NOT parallel;// & Xm;

FW = FSL & FRL & RocRL<RocSL & SL<RL AND NOT parallel;// & Xm;

RW_FW = IIf (RW,1,IIf(FW,-1,0));

Distance = 0.5*ATR(14);

//Support line signals

Sup_break = Cross(SL,C) & X>XB;

Sup_pricejustabove = L<SL+Distance & L>SL & X>XB;

Sup_confirmed = L<=SL & C>SL & X>XB;

//Resistance line signals

Res_break = Cross(C,RL) & X>XD;

Res_pricejustbelow = H>RL-Distance & H<RL & X>XD;

Res_confirmed = H>=RL & C<RL & X>XD;

//Parallel lower line signals

PLL_break = Cross(PLL,C);

PLL_pricejustabove = L<PLL+Distance & L>PLL;

PLL_confirmed = L<=PLL & C>PLL;

//Parallel higher line signals

PHL_break = Cross(C,PHL);

PHL_pricejustbelow = H>PHL-Distance & H<PHL;

PHL_confirmed = H>=PHL & C<PHL;

SupSignals = Sup_break | Sup_pricejustabove | Sup_confirmed;

ResSignals = Res_break | Res_pricejustbelow | Res_confirmed;

PLLSignals = PLL_break | PLL_pricejustabove | PLL_confirmed;

PHLSignals = PHL_break | PHL_pricejustbelow | PHL_confirmed;

//BS = Sup_confirmed OR Res_break;

//SS = Res_confirmed OR Sup_break;

BS = Sup_confirmed OR Sup_pricejustabove OR Res_break;

SS = Res_confirmed OR Res_pricejustbelow OR Sup_break;

NS = Sup_pricejustabove OR Res_pricejustbelow;

PatternDirection =

IIf(AscT|FW|UT,1,

IIf(DscT|RW|DT,-1,

IIf(ST|ET|Rangeee,0,0)));

//Display Cond. fix when Chart is compl.zoomed out

PLLd = abs((LastValue(C)/LastValue(PLL))-1)<0.01*DisRange;

PHLd = abs((LastValue(C)/LastValue(PHL))-1)<0.01*DisRange;

barvisible = Status("barvisible");

firstvisiblebar = barvisible & NOT

Ref(barvisible,-1);

HHvisible = LastValue(HighestSince(firstvisiblebar,High));

LLvisible = LastValue(LowestSince(firstvisiblebar,Low));

RaH = HHvisible *1.05; //Range High

RaL = LLVisible *0.95; //Range Low

//Anyline_zero

AnZ= ya==0 OR yb==0 OR yc==0 OR yd==0;

SL_plot = IIf(x>=xa & SL>RaL & SL<RaH & NOT AnZ,SL,IIf(x>=xa & RaL==0 & NOT AnZ,SL,-1e10));

RL_plot = IIf(x>=xc & RL>RaL & RL<RaH & NOT AnZ,RL,IIf(x>=xc & RaL==0 & NOT AnZ,RL,-1e10));

PLL_plot = IIf(x-x2>=0 & abs(LastValue(L/PLL)-1) <abs(LastValue((DisRange/1000)*ATR(14))) & PLL>RaL & PLL<RaH & NOT AnZ,PLL,IIf(x-x2>=0 & RaL==0 & PLLd & abs(LastValue(L/PLL)-1) <abs(LastValue((DisRange/1000)*ATR(14)))& NOT AnZ,PLL,-1e10));

PHL_plot = IIf(x-x3>=0 & abs(LastValue(H/PHL)-1) <abs(LastValue((DisRange/1000)*ATR(14))) & PHL>RaL & PHL<RaH & NOT AnZ,PHL,IIf(x-x3>=0 & RaL==0 & PHLd & abs(LastValue(H/PHL)-1) <abs(LastValue((DisRange/1000)*ATR(14)))& NOT AnZ,PHL,-1e10));

///////////Begin Ploting Part////////////

LastBar = Cum(1) == LastValue(Cum(1));

Plot(SL_plot ," SL" ,colorCustom13,Style_SL+styleNoTitle);

Plot(RL_plot ," RL" ,colorCustom12,Style_RL+styleNoTitle);

Plot(IIf(Parallellinesswitch,PLL_plot,-1e10)," PLL",colorCustom13,Style_PLL+styleNoTitle);

Plot(IIf(Parallellinesswitch,PHL_plot,-1e10)," PHL",colorCustom12,Style_PHL+styleNoTitle);

// Shading

BEGIN=Min(xa,xc);

TRS = IIf(x>BEGIN-1,SL,-1e10);

TRR = IIf(x>BEGIN-1,RL,-1e10);

trr = IIf(trr>0,trr,Null);

yVal=IIf(trs > trr,trr,trs);

yval = IIf(yval>0,yval,Null);

GraphZOrder = 0;

if(Version()>4.75){

//PlotOHLC(0,trr,yval,0,"",Shadowcolor,styleCloud+styleNoLabel);

}

///////////End Ploting Part////////////

DefinedPatterns = AscT | DscT | ST | ET | RW | FW | UT | DT;

Filter = BarIndex()==LastValue(BarIndex()) AND NOT GroupID()==253;

Filter = Filter AND

(AscT AND AscTs)| (DscT AND DscTs)| (ST AND STs)|

(ET AND ETs)| (RW AND RWs)| (FW AND FWs)|

(UT AND UTs)| (DT AND DTs)|(Rangeee AND Ranges)|

(SupSignals AND NonDefinedPatterns AND NOT DefinedPatterns)|

(ResSignals AND NonDefinedPatterns AND NOT DefinedPatterns);

// | PLLSignals | PHLSignals | Trade Variables

//Shapes

if(PlotP1P2){

PlotShapes(IIf(x==xa & NOT AnZ,P1Shape,shapeNone),Color_SL,0,SL,-13 );

PlotShapes(IIf(x==xc & NOT AnZ,P1Shape,shapeNone),Color_RL,0,H,13 );

}

//end pattern

//////////////////////////////////////////////////////////////////

_SECTION_BEGIN("Fib Retracements");

fibs = ParamToggle("Plot Fibs","Off|On",1);

pctH = Param ("Pivot Hi %", 0.325,0.001,2.0,0.002);

HiLB = Param ("Hi LookBack",1,1,BarCount-1,1);

pctL = Param ("Pivot Lo %", 0.325,0.001,2.0,0.002);

LoLB = Param ("Lo LookBack",1,1,BarCount-1,1);

Back = Param ("Extend Left = 2",1,1,500,1);

Fwd = Param("Plot Forward", 0, 0, 500, 1);

text = ParamToggle("Plot Text","Off|On",1);

hts = Param ("Text Shift", -33.5,-50,50,0.10);

style =ParamStyle("Line Style",styleLine,styleNoLabel);

x = BarIndex();

pRp = PeakBars( H, pctH, 1) == 0;

yRp0 = SelectedValue(ValueWhen( pRp, H, HiLB));

xRp0 = SelectedValue(ValueWhen( pRp, x, HiLB));

pSp = TroughBars( L, pctL, 1) == 0;

ySp0 = SelectedValue(ValueWhen( pSp, L, LoLB));

xSp0 = SelectedValue(ValueWhen( pSp, x, LoLB));

Delta = yRp0 - ySp0;

function fib(ret)

{

retval = (Delta * ret);

Fibval = IIf(ret < 1.0

AND xSp0 < xRp0, yRp0 - retval, IIf(ret < 1.0

AND xSp0 > xRp0, ySp0 + retval,IIf(ret > 1.0

AND xSp0 < xRp0, yRp0 - retval, IIf(ret > 1.0

AND xSp0 > xRp0, ySp0 + retval, Null))));

return FibVal;

}

x0 = Min(xSp0,xRp0)-Back;

x1 = (BarCount -1);

//////////////////////////////////////////////////////////////////

r236 = fib(0.236); r236I = LastValue (r236,1);

r382 = fib(0.382); r382I = LastValue (r382,1);

r050 = fib(0.50); r050I = LastValue (r050,1);

r618 = fib(0.618); r618I = LastValue (r618,1);

r786 = fib(0.786); r786I = LastValue (r786,1);

e127 = fib(1.27); e127I = LastValue (e127,1);

e162 = fib(1.62); e162I = LastValue (e162,1);

e200 = fib(2.00); e200I = LastValue (e200,1);

e262 = fib(2.62); e262I = LastValue (e262,1);

e424 = fib(4.24); e424I = LastValue (e424,1);

//////////////////////////////////////////////////////////////////

p00 = IIf(xSp0 > xRp0,ySp0,yRp0); p00I = LastValue (p00,1);

p100 = IIf(xSp0 < xRp0,ySp0,yRp0); p100I = LastValue (p100,1);

color00 =IIf(xSp0 > xRp0,colorLime,colorRed);

color100 =IIf(xSp0 < xRp0,colorLime,colorRed);

//////////////////////////////////////////////////////////////////

numbars = LastValue(Cum(Status("barvisible")));

fraction= IIf(StrRight(Name(),3) == "", 3.2, 3.2);

//////////////////////////////////////////////////////////////////

Col=IIf(p00<p100,43,32);

if(fibs==1)

{

Plot(LineArray(xRp0-Fwd,yRp0,x1,yRp0,Back),"PR",Col,8|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(xSp0-Fwd,ySp0,x1,ySp0,Back),"PS",Col,8|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,r236,x1,r236,Back),"",Col,styleDashed|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,r382,x1,r382,Back),"",Col,styleDashed|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,r050,x1,r050,Back),"",41,styleDots|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,r618,x1,r618,Back),"",Col,styleDashed|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,r786,x1,r786,Back),"",Col,styleDashed|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,e127,x1,e127,Back),"e127",Col,styleDashed|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,e162,x1,e162,Back),"e162",Col,styleDashed|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,e200,x1,e200,Back),"p200",Col,styleDashed|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,e262,x1,e262,Back),"p262",Col,styleDashed|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,e424,x1,e424,Back),"p424",Col,styleDashed|styleNoRescale,Null, Null,Fwd);

}

//////////////////////////////////////////////////////////////////

if(text==1)

{

PlotText(" 0% = " + WriteVal(p00,fraction), LastValue(BarIndex())-(numbars/hts), p00I + 0.05, col);

PlotText("23% = " + WriteVal(r236,fraction), LastValue(BarIndex())-(numbars/hts), r236I + 0.05, Col);

PlotText("38% = " + WriteVal(r382,fraction), LastValue(BarIndex())-(numbars/hts), r382I + 0.05, Col);

PlotText("50% = " + WriteVal(r050,fraction), LastValue(BarIndex())-(numbars/hts), r050I + 0.05, Col);

PlotText("62% = " + WriteVal(r618,fraction), LastValue(BarIndex())-(numbars/hts), r618I + 0.05, Col);

PlotText("78% = " + WriteVal(r786,fraction), LastValue(BarIndex())-(numbars/hts), r786I + 0.05, Col);

PlotText("100% = " + WriteVal(p100,fraction), LastValue(BarIndex())-(numbars/hts),p100I + 0.05, col);

PlotText("127% = " + WriteVal(e127,fraction), LastValue(BarIndex())-(numbars/hts),e127I + 0.05, Col);

PlotText("162% = " + WriteVal(e162,fraction), LastValue(BarIndex())-(numbars/hts),e162I + 0.05, Col);

PlotText("200% = " + WriteVal(e200,fraction), LastValue(BarIndex())-(numbars/hts),e200I + 0.05, Col);

PlotText("262% = " + WriteVal(e262,fraction), LastValue(BarIndex())-(numbars/hts),e262I + 0.05, Col);

PlotText("424% = " + WriteVal(e424,fraction), LastValue(BarIndex())-(numbars/hts),e424I + 0.05, Col);

}

_SECTION_END();

//////////////////////////////////////////////////////////////////

_SECTION_BEGIN("Volume Price Analysis");

//=======================================================================================

DTL=Param("Linear regression period",60,10,100,10);

wbf=Param("WRB factor",1.5,1.3,2.5,.1);

nbf=Param("NRB factor",0.7,0.3,0.9,0.1);

TL=LinRegSlope(MA(C, DTL),2);

Vlp=Param("Volume lookback period",30,20,300,10);

Vrg=MA(V,Vlp);

St = StDev(Vrg,Vlp);

Vp3 = Vrg + 3*st;

Vp2 = Vrg + 2*st;;

Vp1 = Vrg + 1*st;;

Vn1 = Vrg -1*st;

Vn2 = Vrg -2*st;

_SECTION_END();

//nr7 setup

TimeFrameSet(TT);

High1=IIf(O>H,O,H);

Low1=IIf(O<L,O,L);

rang=High1-Low1;

nr7=(rang==LLV(rang,7));

nr8=(Ref(nr7,-1) AND rang==LLV(rang,8));

InsideBar = Inside() ;

nri=(nr7 AND InsideBar);

G=C>O;

R=C<O;

TGN7=nr7 & G;

TRN7=nr7 & R;

TGN8=nr8 & G;

TRN8=nr8 & R;

TGN7i=nri & G;

TRN7i=nri & R;

YGN7=Ref(TGN7,-1);

YRN7=Ref(TRN7,-1);

YGN8=Ref(TGN8,-1);

YRN8=Ref(TRN8,-1);

YGN7i=Ref(TGN7i,-1);

YRN7i=Ref(TRN7i,-1);

zGN7=Ref(TGN7,-2);

zRN7=Ref(TRN7,-2);

zGN8=Ref(TGN8,-2);

zRN8=Ref(TRN8,-2);

zGN7i=Ref(TGN7i,-2);

zRN7i=Ref(TRN7i,-2);

aGN7=Ref(TGN7,-3);

aRN7=Ref(TRN7,-3);

aGN8=Ref(TGN8,-3);

aRN8=Ref(TRN8,-3);

aGN7i=Ref(TGN7i,-3);

aRN7i=Ref(TRN7i,-3);

bGN7=Ref(TGN7,-4);

bRN7=Ref(TRN7,-4);

bGN8=Ref(TGN8,-4);

bRN8=Ref(TRN8,-4);

bGN7i=Ref(TGN7i,-4);

bRN7i=Ref(TRN7i,-4);

Cgn7=IIf(dy & no==0,tgn7,0);

Crn7=IIf(dy & no==0,trn7,0);

Cgn8=IIf(dy & no==0,tgn8,0);

Crn8=IIf(dy & no==0,trn8,0);

Cgn7i=IIf(dy & no==0,tgn7i,0);

Crn7i=IIf(dy & no==0,trn7i,0);

dgn7=IIf(dy & no==1,tgn7 & ygn7,0);

drn7=IIf(dy & no==1,trn7 & yrn7,0);

dgn8=IIf(dy & no==1,tgn8 & ygn8,0);

drn8=IIf(dy & no==1,trn8 & yrn8,0);

dgn7i=IIf(dy & no==1,tgn7i & ygn7i,0);

drn7i=IIf(dy & no==1,trn7i & yrn7i,0);

egn7=IIf(dy & no==2,tgn7 & ygn7 & zgn7,0);

ern7=IIf(dy & no==2,trn7 & yrn7 & zrn7,0);

egn8=IIf(dy & no==2,tgn8 & ygn8 & zgn8,0);

ern8=IIf(dy & no==2,trn8 & yrn8 & zrn8,0);

egn7i=IIf(dy & no==2,tgn7i & ygn7i & zgn7i,0);

ern7i=IIf(dy & no==2,trn7i & yrn7i & zrn7i,0);

fgn7=IIf(dy & no==3,tgn7 & ygn7 & zgn7 & agn7,0);

frn7=IIf(dy & no==3,trn7 & yrn7 & zrn7 & arn7,0);

fgn8=IIf(dy & no==3,tgn8 & ygn8 & zgn8 & agn8,0);

frn8=IIf(dy & no==3,trn8 & yrn8 & zrn8 & arn8,0);

fgn7i=IIf(dy & no==3,tgn7i & ygn7i & zgn7i & agn7i,0);

frn7i=IIf(dy & no==3,trn7i & yrn7i & zrn7i & arn7i,0);

ggn7=IIf(dy & no==4,tgn7 & ygn7 & zgn7 & agn7 & bgn7,0);

grn7=IIf(dy & no==4,trn7 & yrn7 & zrn7 & arn7 & brn7,0);

ggn8=IIf(dy & no==4,tgn8 & ygn8 & zgn8 & agn8 & bgn8,0);

grn8=IIf(dy & no==4,trn8 & yrn8 & zrn8 & arn8 & brn8,0);

ggn7i=IIf(dy & no==4,tgn7i & ygn7i & zgn7i & agn7i & bgn7i,0);

grn7i=IIf(dy & no==4,trn7i & yrn7i & zrn7i & arn7i & brn7i,0);

TimeFrameRestore();

red=(since & (C<O | C==O));

green=(since & (C>O | C==O));

Reds=Cum(Red);

Greens=Cum(Green);

redr=IIf(red,O-C,0);

greenr=IIf(green,C-O,0);

Candles=Cum(red + green);

Os=Sum(redr,Candles);

ws=Sum(greenr,Candles);

Lotsize=round((inv*5.5)/r236);

//////////////////////////////////////////////////////////////////

Chg=Ref(C,-1);

if (tchoice==1 )

{

_N(Title = EncodeColor(colorWhite)+StrFormat(" {{NAME}} - {{INTERVAL}} {{DATE}} Open: %g, High: %g, Low: %g, Close: %g {{VALUES}}",O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

}

//////////////////////////////////////////////////////////////////

if (tchoice==2 )

{

Title = EncodeColor(colorWhite)+ Date() + " Tick = " + EncodeColor(5) + Interval()+

EncodeColor(55)+ " Open: "+ EncodeColor(colorWhite)+ WriteVal(O,format=1.2) +

EncodeColor(55)+ " High: "+ EncodeColor(colorWhite) + WriteVal(H,format=1.2) +

EncodeColor(55)+ " Low: "+ EncodeColor(colorWhite)+ WriteVal(L,format=1.2) +

EncodeColor(55)+ " Close: "+ WriteIf(C> Chg,EncodeColor(colorBrightGreen),EncodeColor(colorRed))+ WriteVal(C,format=1.2)+

EncodeColor(55)+ " Change: "+ WriteIf(C> Chg,EncodeColor(colorBrightGreen),EncodeColor(colorRed))+ WriteVal(ROC(C,1),format=1.2)+ "%"+

EncodeColor(55)+ " Volume: "+ EncodeColor(colorWhite)+ WriteVal(V,1)+EncodeColor(colorYellow) + " Lotsize: "+WriteVal(Lotsize,1)+" Lotsize/2: "+WriteVal(Lotsize/2,1)+"\n"+

WriteIf(LastValue(AscT),"Ascending Triangle - bullish formation that usually forms during an uptrend as a continuation pattern"+"","")+

WriteIf(LastValue(DscT),"Decending Triangle - bearish formation that usually forms during a downtrend as a continuation pattern."+"","")+

//WriteIf(LastValue(ST),"Symmetrical Triangle - mark important trend reversals, they more often mark a continuation of the current trend - direction of the next major move can only be determined after a valid breakout."+"","")+

WriteIf(LastValue(ET),"Expanding Triangle - The expanding triangle is said to be a good indicator of a reversal pattern"+"","")+

WriteIf(LastValue(RW),"Rising Wedge - rising wedges definitely slope up and have a bearish bias"+"","")+

WriteIf(LastValue(FW),"Falling Wedge - falling wedges definitely slope down and have a bullish bias."+" ","")+

WriteIf(LastValue(UT),"Up Channel - Bullish Trend"+"","")+

WriteIf(LastValue(DT),"Down Channel - Bearish Trend"+"","")+"\n"+

EncodeColor(colorYellow)+

Comm2=("heikin 5m : ")+

WriteIf(LastValue(Condb),EncodeColor(colorBrightGreen)+"+Up",

WriteIf(LastValue(Conds),EncodeColor(colorRed)+"-Down",EncodeColor(colorLightYellow)+"< Flat >"))+"\n"+

EncodeColor(colorYellow)+

Comm2=("heikin 15m : ")+

WriteIf(LastValue(Condb1),EncodeColor(colorBrightGreen)+"+Up",

WriteIf(LastValue(Conds1),EncodeColor(colorRed)+"-Down",EncodeColor(colorLightYellow)+"< Flat >"))+"\n"+

EncodeColor(colorYellow)+

Comm2=("heikin 30m : ")+

WriteIf(LastValue(Condb2),EncodeColor(colorBrightGreen)+"+Up",

WriteIf(LastValue(Conds2),EncodeColor(colorRed)+"-Down",EncodeColor(colorLightYellow)+"< Flat >"))+"\n"+

EncodeColor(colorYellow)+

Comm2=("heikin 1Hr : ")+

WriteIf(LastValue(Condb3),EncodeColor(colorBrightGreen)+"+Up",

WriteIf(LastValue(Conds3),EncodeColor(colorRed)+"-Down",EncodeColor(colorLightYellow)+"< Flat >"))+"\n"+

"\n"+EncodeColor(07)+"Volume: "+WriteIf(V>Vp2,EncodeColor(colorLime)+"Very High",WriteIf(V>Vp1,EncodeColor(colorLime)+" High",WriteIf(V>Vrg,EncodeColor(colorLime)+"Above Average",

WriteIf(V<Vrg AND V>Vn1,EncodeColor(colorRed)+"Less than Average",WriteIf(V<Vn1,EncodeColor(colorRed)+"Low","")))))+ "\n" +

EncodeColor(colorYellow)+

Comm2=("Trend: ")+

WriteIf(Greens>Reds,EncodeColor(colorBrightGreen)+"+Up",

WriteIf(Reds>Greens,EncodeColor(colorRed)+"-Down",EncodeColor(colorLightYellow)+"< Flat >"))+"\n"+

EncodeColor(colorRed) +

WriteIf(Reds, "Reds: "+(reds)+" ","")+"\n"+

EncodeColor(colorBrightGreen) +

WriteIf(Greens, "Greens: "+(greens)+" ","")+"\n"+

EncodeColor(colorRed) +

Comm2=("Red Range: ")+

WriteVal(Os, 1.2)+"\n"+

EncodeColor(colorBrightGreen) +

Comm2=("Green Range: ")+

WriteVal(Ws, 1.2)+"\n"+

EncodeColor(colorRed) +

WriteIf(ChaikinVolatility( periods )<0, "Chaikin: "+(ChaikinVolatility( periods )

)+" ","")+"\n"+

EncodeColor(colorBrightGreen) +

WriteIf(ChaikinVolatility( periods )>0

, "Chaikin: "+(ChaikinVolatility( periods )

)+" ","")+

"\n"+

WriteIf(Sup_pricejustabove,EncodeColor(colorBrightGreen)+"Price just above Support",

WriteIf(Sup_confirmed,EncodeColor(colorBrightGreen)+"Support Confirmed",EncodeColor(colorWhite)+""))+

WriteIf(Sup_break,EncodeColor(colorRed)+"Support Break"+"","")+"\n"+

WriteIf(Res_pricejustbelow,EncodeColor(colorRed)+"Price just below Resistance",

WriteIf(Res_confirmed,EncodeColor(colorRed)+"Resistance Confirmed",EncodeColor(colorWhite)+""))+

WriteIf(Res_break,EncodeColor(colorBrightGreen)+"Resistance Break"+"","");

}

GraphXSpace=5;

dy1=IIf(dy==1,(tgn7 | trn7 | tgn8|trn8|tgn7i|trn7i|ygn7 | yrn7 | ygn8|yrn8|ygn7i|yrn7i|zgn7 | zrn7 |zgn8|zrn8|zgn7i|zrn7i|agn7 | arn7 |agn8|arn8|agn7i|arn7i|bgn7 | brn7 | bgn8|brn8|bgn7i|brn7i),0);

dy2=IIf(dy==1,(cgn7 | crn7 | cgn8|crn8|cgn7i|crn7i|dgn7 | drn7 | dgn8|drn8|dgn7i|drn7i|egn7 | ern7 |egn8|ern8|egn7i|ern7i|fgn7 |frn7 |fgn8|frn8|fgn7i|frn7i|ggn7 | grn7 | ggn8|grn8|ggn7i|grn7i),0);

// Angle variables

PI = atan(1.00) * 4;

periods = periods;

HighHigh = HHV(H, periods);

LowLow = LLV(L, periods);

range = 25 / (HighHigh - LowLow) * LowLow;

// LSMA25 Angle

LSMA25 = OBV();

x1_LSMA25 = 0;

x2_LSMA25 = 1;

y1_LSMA25 = 0;

y2_LSMA25 = (Ref(LSMA25, -1) - LSMA25) / Avg * range;

c_LSMA25 = sqrt((x2_LSMA25 - x1_LSMA25)*(x2_LSMA25 - x1_LSMA25) + (y2_LSMA25 - y1_LSMA25)*(y2_LSMA25 - y1_LSMA25));

angle_LSMA25 = round(180 * acos((x2_LSMA25 - x1_LSMA25)/c_LSMA25) / PI);

angle_LSMA25 = IIf(y2_LSMA25 > 0, - angle_LSMA25, angle_LSMA25);

Buy=IIf((p00<p100 & ChaikinVolatility( periods )>0 & angle_LSMA25>30 & Ws>=(Os+(Os*perc/100)) & (Cross(H,r236) | Cross(C,r236))),1,0);

Buystop=ValueWhen(Buy,p00);

btgt1=ValueWhen(Buy,r618);

btgt2=ValueWhen(Buy,r786);

Short=IIf((p00>p100 & ChaikinVolatility( periods )>0 & angle_LSMA25<(-30) & Os>=(Ws+(Ws*perc/100)) & (Cross(r236,L) | Cross(r236,C))),1,0);

shortstop=ValueWhen(Short,p00);

stgt1=ValueWhen(Short,r618);

stgt2=ValueWhen(Short,r786);

//Buy=ExRem(Buy,Short);

//Short=ExRem(Short,Buy);

//shapes

PlotShapes(IIf(Buy,shapeUpArrow,shapeNone),colorWhite,0,L,-25 );

PlotShapes(IIf(Short,shapeDownArrow,shapeNone),colorOrange,0,H,-25 );

AddColumn( IIf(Buy & dy==0, r236, IIf(Short & dy==0, r236,01 )), "ENTRY@", 1.2, colorWhite, bkcolor= IIf(Short & dy==0,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(Buy & dy==0, Buystop, IIf(Short & dy==0, Shortstop,01 )), "STOP@", 1.2, colorWhite, bkcolor= IIf(Short & dy==0,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(Buy & dy==0, btgt1, IIf(Short & dy==0, stgt1,01 )), "TARGT-1", 1.2, colorWhite, bkcolor= IIf(Short & dy==0,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(Buy & dy==0, btgt2, IIf(Short & dy==0, stgt2,01 )), "TARGT-2", 1.2, colorWhite, bkcolor= IIf(Short & dy==0,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(Buy & dy==0, Lotsize, IIf(Short & dy==0, Lotsize,01 )), "QNTY", 1, colorWhite, bkcolor= IIf(Short & dy==0,colorDarkRed,colorDarkGreen) );

//AddColumn(dy==1 & no,"NR days",1);

AddColumn( IIf(( dy==1 & tgn7), 55, IIf(( dy==1 & trn7), 55,01 )), "NR7-0", formatChar, colorWhite, bkcolor= IIf((dy==1 & trn7),colorDarkRed,colorDarkGreen) );

AddColumn( IIf((dy==1 & tgn8), 56, IIf(dy==1 & trn8, 56,01 )), "NR8-0", formatChar, colorWhite, bkcolor= IIf(dy==1 & trn8,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & tgn7i, 73, IIf(dy==1 & trn7i, 73,01 )), "NR7i-0", formatChar, colorWhite, bkcolor= IIf(dy==1 & trn7i,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & ygn7, 55, IIf(dy==1 & yrn7, 55,01 )), "NR7-1", formatChar, colorWhite, bkcolor= IIf(dy==1 & yrn7,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & ygn8, 56, IIf(dy==1 & yrn8, 56,01 )), "NR8-1", formatChar, colorWhite, bkcolor= IIf(dy==1 & yrn8,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & ygn7i, 73, IIf(dy==1 & yrn7i, 73,01 )), "NR7i-1", formatChar, colorWhite, bkcolor= IIf(dy==1 & yrn7i,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & zgn7, 55, IIf(dy==1 & zrn7, 55,01 )), "NR7-2", formatChar, colorWhite, bkcolor= IIf(dy==1 & zrn7,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & zgn8, 56, IIf(dy==1 & zrn8, 56,01 )), "NR8-2", formatChar, colorWhite, bkcolor= IIf(dy==1 & zrn8,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & zgn7i, 73, IIf(dy==1 & zrn7i, 73,01 )), "NR7i-2", formatChar, colorWhite, bkcolor= IIf(dy==1 & zrn7i,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & agn7, 55, IIf(dy==1 & arn7, 55,01 )), "NR7-3", formatChar, colorWhite, bkcolor= IIf(dy==1 & arn7,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & agn8, 56, IIf(dy==1 & arn8, 56,01 )), "NR8-3", formatChar, colorWhite, bkcolor= IIf(dy==1 & arn8,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & agn7i, 73, IIf(dy==1 & arn7i, 73,01 )), "NR7i-3", formatChar, colorWhite, bkcolor= IIf(dy==1 & arn7i,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & bgn7, 55, IIf(dy==1 & brn7, 55,01 )), "NR7-4", formatChar, colorWhite, bkcolor= IIf(dy==1 & brn7,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & bgn8, 56, IIf(dy==1 & brn8, 56,01 )), "NR7-4", formatChar, colorWhite, bkcolor= IIf(dy==1 & brn8,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & bgn7i, 66, IIf(dy==1 & brn7i, 83,01 )), "NR7i-4", formatChar, colorWhite, bkcolor= IIf(dy==1 & brn7i,colorDarkRed,colorDarkGreen) );

//daily sup/res

_SECTION_BEGIN("Daily Sup/Res Plot lines");

//Set parameter default to YES for displaying the final

//results of the break out calculations.

PlotBreak = ParamToggle("Plot Breakout", "YES|NO", 0);

//set parameter default to YES for displaying PP, S1 and R1

PPSR1 = ParamToggle("PP,S1/R1", "YES|NO", 0);

//set paramter default to NO for displaying S2 and R2

S2R2 = ParamToggle("S2,R2", "YES|NO", 0);

//set parameter default to NO for dsiplaying S3 and R3

S3R3 = ParamToggle("S3,R3", "YES|NO", 1);

//set paramter default to NO for diplaying S4 and R4

S4R4 = ParamToggle("S4,R4", "YES|NO", 1);

_SECTION_END();

_SECTION_BEGIN("Realtime Hours ");

//Determine the value of the market close. Initial setting is for

//4:00 PM to match US Market Open. Adjust as need for your market

UserOpen = ParamTime("Market Open", "09:00");

UserClose = ParamTime("Market Close", "15:30");

UseIndia = "YES";//ParamList("Indian Market?", "YES|NO",0);

if(UseIndia == "YES")

{

TimeOpen = ValueWhen(DateNum() != Ref(DateNum(),-1), TimeNum());

}

CalcClose = UserClose;

TimeClose = IIf(StrMid(NumToStr(CalcClose ,1,False),2,2)=="00",

6000-((Interval()/60)*100)+(CalcClose-10000),

CalcClose-(100*(Interval()/60)));

CurBarTime = TimeNum();

DlyHigh = HighestSince(CurBarTime == TimeOpen , High);

DlyHighest = ValueWhen(CurBarTime == TimeClose , DlyHigh);

DlyLow = LowestSince(CurBarTime == TimeOpen , Low);

DlyLowest = ValueWhen(CurBarTime == TimeClose , DlyLow);

MrktClose = ValueWhen(CurBarTime == TimeClose , Close);

Rangeeee = DlyHighest - DlyLowest;

PP = (DlyHighest + DlyLowest + MrktClose)/3;

PP = round(PP * 4) / 4;

R1 = (2 * PP) - DlyLowest;

S1 = (2 * PP) - DlyHighest;

R2 = PP + Rangeeee;

S2 = PP - Rangeeee;

R3 = R2 + Rangeeee;

S3 = S2 - Rangeeee;

R4 = R3 + Rangeeee;

S4 = S3 - Rangeeee;

TitlePivots = "\n"+

EncodeColor(colorYellow) +"Today's Daily Pivots" +"\n"

+"R1: " +R1 +"\n" +"PP: " +PP +"\n" +"S1: " +S1

//+WriteVal((fhh))+WriteVal((FHL))+WriteVal(((TOP)))+ WriteVal((bi1[0]))

+"\n";

if(PPSR1 == 0)

{

Plot(R1, "Dly R1", colorPink, styleDashed | styleThick | styleNoRescale);

Plot(PP, "Dly Pivot", colorGrey40, styleDots | styleThick | styleNoRescale);

Plot(S1, "Dly S1", colorAqua, styleDashed | styleThick | styleNoRescale);

}

if(S2R2 == 0)

{

Plot(R2, "Dly R2", colorPink, styleDashed | styleThick | styleNoRescale);

Plot(S2, "Dly S2", colorAqua, styleDashed | styleThick | styleNoRescale);

}

if(S3R3 == 0)

{

Plot(R3, "Dly R3", colorPink, styleDashed | styleThick | styleNoRescale);

Plot(S3, "Dly S3", colorAqua, styleDashed | styleThick | styleNoRescale);

}

if(S4R4 == 0)

{

Plot(R4, "Dly R4", colorPink, styleDashed | styleThick | styleNoRescale);

Plot(S4, "Dly S4", colorAqua, styleDashed | styleThick | styleNoRescale);

}

_SECTION_END();

Filter=Buy | Short | dy1;

SetChartOptions(0,chartShowArrows|chartShowDates|chartWrapTitle|chartHideQuoteMarker);

dy=ParamToggle("NR calc for", "RT SCAN|EOD SCAN", 0);

TT=IIf(dy==0,in15Minute,inDaily);

no=Param("NR days filter",0,0,4,1);

Limit=Param(" Trade Till (Hour)(Min)(Sec)",153000,103000,153000,100);

since=(TimeNum() >= 084500 AND TimeNum()<= Limit) AND (DateNum()==LastValue(DateNum()));

perc= Param("Red-Green ratio % Set", 35, 0, 100, 1 );

inv=Param("INVEST CAPITAL", 23000,1000, 1000000, 500 );

SetChartBkColor(ParamColor("Outer panel",colorBlack)); // color of outer border

SetChartBkGradientFill( ParamColor("Inner panel upper",colorBlack),ParamColor("Inner panel lower",colorBlack));

tchoice=Param("Title Selection ",2,1,2,1);

_SECTION_BEGIN("Haiken");

Show_color = ParamToggle("Display CandleColor", "No|Yes", 0);

r1 = Param( "ColorFast avg", 5, 2, 200, 1 );

r2 = Param( "ColorSlow avg", 10, 2, 200, 1 );

r3 = Param( "ColorSignal avg", 5, 2, 200, 1 );

Prd1=Param("ATR Period",4,1,20,1);

Prd2=Param("Look Back",7,1,20,1);

greenD = HHV(LLV(L,Prd1)+ATR(Prd1),Prd2);

redD = LLV(HHV(H,Prd1)-ATR(Prd1),Prd2);

HaClose =EMA((O+H+L+C)/4,3); // Woodie

HaOpen = AMA( Ref( HaClose, -1 ), 0.5 );

HaHigh = Max( H, Max( HaClose, HaOpen ) );

HaLow = Min( L, Min( HaClose, HaOpen ) );

Temp = Max(High, HaOpen);

Temp = Min(Low,HaOpen);

m1=MACD(r1,r2);

s1=Signal(r1,r2,r3);

mycolor=IIf(m1<0 AND m1>s1, ColorRGB(230,230,0),IIf(m1>0 AND m1>s1,colorLime,IIf(m1>0 AND m1<s1,colorOrange,colorDarkRed)));

if(Show_color)

{

ColorHighliter = myColor;

SetBarFillColor( ColorHighliter );

}

//////////

barColor=IIf(C>GreenD ,colorBrightGreen,IIf(C < REDD,colorRed,colorYellow));

barColor2=IIf(CCI(14) > ((Ref(CCI(14),-1)+Ref(CCI(14),-2))/2),colorAqua,colorBrown);

if( ParamToggle("Plot Normal Candle", "No,Yes", 0 ) )

PlotOHLC( HaOpen, HaHigh, HaLow, HaClose, " " , barcolor, styleCandle | styleThick );

else

PlotOHLC( Open, High, Low, Close, " " , barcolor2, styleCandle | styleThick );

_SECTION_BEGIN("Volume");

Plot( Volume, _DEFAULT_NAME(), IIf( C > O,colorGreen, colorRed), ParamStyle( "Style", styleHistogram | styleOwnScale | styleThick | styleNoLabel, maskHistogram ), 2 );

Plot( OBV(), _DEFAULT_NAME(), ParamColor("OBV Color", colorCycle ), styleDashed| styleOwnScale | styleThick | styleNoLabel );

_SECTION_END();

_SECTION_BEGIN("Chaikin Volatility");

periods= Param("Periods", 10, 2, 100 );

function ChaikinVolatility( periods )

{

return ROC( EMA( High - Low, periods ), periods );

}

Plot( ChaikinVolatility(periods ),_DEFAULT_NAME(), colorYellow,styleLine| styleOwnScale | styleThick | styleNoLabel );

_SECTION_END();

TimeFrameSet(in5Minute);

//TimeFrameSet(in5Minute);

since5=(TimeNum() >= 090000 AND TimeNum()<= 153000) AND (DateNum()==LastValue(DateNum()));

Candles5=(since5 & (C<O | C>O | C==O));

Candles51=Cum(Candles5);

HaClose0 =EMA((O+H+L+C)/4,3);

HaOpen0 = AMA( Ref( HaClose0, -1 ), 0.5 );

HaHigh0 = Max( H, Max( HaClose0, HaOpen0 ) );

HaLow0 = Min( L, Min( HaClose0, HaOpen0 ) );

CondB=Haopen0<Haclose0;CONDS=Haopen0 >Haclose0;

TimeFrameRestore();

_SECTION_BEGIN("2");

//Compress= Param("Compression",3,0.20,100,0.10);

TimeFrameSet(in15Minute);

since15=(TimeNum() >= 090000 AND TimeNum()<= 153000) AND (DateNum()==LastValue(DateNum()));

Candles15=(since15 & (C<O | C>O | C==O));

Candles115=Cum(Candles15);

HaClose1 =EMA((O+H+L+C)/4,3);

HaOpen1 = AMA( Ref( HaClose1, -1 ), 0.5 );

HaHigh1 = Max( H, Max( HaClose1, HaOpen1 ) );

HaLow1 = Min( L, Min( HaClose1, HaOpen1 ) );

CondB1=Haopen1 < Haclose1;CONDS1=Haopen1 >Haclose1;

TimeFrameRestore();

_SECTION_BEGIN("3");

//Compress= Param("Compression",6,0.20,100,0.10);

TimeFrameSet(in15Minute*2);

since2=(TimeNum() >= 090000 AND TimeNum()<= 153000) AND (DateNum()==LastValue(DateNum()));

Candles2=(since2 & (C<O | C>O | C==O));

Candles12=Cum(Candles2);

HaClose2 =EMA((O+H+L+C)/4,3);

HaOpen2 = AMA( Ref( HaClose2, -1 ), 0.5 );

HaHigh2 = Max( H, Max( HaClose2, HaOpen2 ) );

HaLow2 = Min( L, Min( HaClose2, HaOpen2 ) );

CondB2=Haopen2 < Haclose2;CONDS2=Haopen2 > Haclose2;

TimeFrameRestore();

_SECTION_BEGIN("4");

//Compress= Param("Compression",12,0.20,100,0.10);

TimeFrameSet(inHourly);

since3=(TimeNum() >= 090000 AND TimeNum()<= 153000) AND (DateNum()==LastValue(DateNum()));

Candles3=(since3 & (C<O | C>O | C==O));

Candles13=Cum(Candles3);

HaClose3 =EMA((O+H+L+C)/4,3);

HaOpen3 = AMA( Ref( HaClose3, -1 ), 0.5 );

HaHigh3 = Max( H, Max( HaClose3, HaOpen3) );

HaLow3 = Min( L, Min( HaClose3, HaOpen3 ) );

CondB3=Haopen3 < Haclose3;CONDS3=Haopen3 > Haclose3;

TimeFrameRestore();

//patterns

_SECTION_BEGIN("Pattern Alerts");

SRbS = ParamToggle("S/R broken","Off,On",1);

SRcS = ParamToggle("S/R confirmed","Off,On",1);

PjabS = ParamToggle("Price just above/below","Off,On",1);

_SECTION_END();

_SECTION_BEGIN("Pattern Parameters");

PlotP1P2 = ParamToggle("Plot P1/P2 Shapes","Off,On",0);

P1Shape = Param("P1 Shape Typ",35,0,50,1);//default 35

P2Shape = Param("P2 Shape Typ",37,0,50,1);//default 37

Parallellinesswitch = ParamToggle("Plot Parallel Lines","Off,On",0);

DisRange = Param("Plot Parallel Lines Trigger",300,0,1000,20);

_SECTION_BEGIN("Pattern Styles");

Style_SL= ParamStyle("Support",styleLine+styleThick,maskDefault)+styleNoRescale;

Style_RL= ParamStyle("Resistance",styleLine+styleThick,maskDefault)+styleNoRescale;

Style_PHL= ParamStyle("Parallel Support",styleLine+styleDashed,maskDefault)+styleNoRescale;

Style_PLL= ParamStyle("Parallel Resistance",styleLine+styleDashed,maskDefault)+styleNoRescale;

_SECTION_END();

_SECTION_BEGIN("Pattern Selection");

AscTs = ParamToggle("Ascending Triangle","Off,On",1);

DscTs = ParamToggle("Descending Triangle","Off,On",1);

STs = ParamToggle("Symmetrically Triangle","Off,On",1);

ETs = ParamToggle("Expanding Triangle","Off,On",1);

RWs = ParamToggle("Rising Wedge","Off,On",1);

FWs = ParamToggle("Falling Wedge","Off,On",1);

UTs = ParamToggle("Up Trend","Off,On",1);

DTs = ParamToggle("Down Trend","Off,On",1);

Ranges = ParamToggle("Range","Off,On",1);

NonDefinedPatterns = ParamToggle("Not defined Patterns","Off,On",1);

_SECTION_END();

//calcs

HH = HHV(H,20);

LL = LLV(L,20);

Mid = LL+((HH-LL)/2);

Div = 100-(HH/(0.01*Mid));

Per = LastValue(abs(Div));

Hp1 = Ref(H,-1);Hp2 = Ref(H,-2);Hp3 = Ref(H,-3);Hp4 = Ref(H,-4);Hp5 = Ref(H,-5);Hp6 = Ref(H,-6);

Lp1 = Ref(L,-1);Lp2 = Ref(L,-2);Lp3 = Ref(L,-3);Lp4 = Ref(L,-4);Lp5 = Ref(L,-5);Lp6 = Ref(L,-6);

Hf1 = Ref(H,1);Hf2 = Ref(H,2);Hf3 = Ref(H,3);Hf4 = Ref(H,4);Hf5 = Ref(H,5);Hf6 = Ref(H,6);

Lf1 = Ref(L,1);Lf2 = Ref(L,2);Lf3 = Ref(L,3);Lf4 = Ref(L,4);Lf5 = Ref(L,5);Lf6 = Ref(L,6);

x = Cum(1);

divx = LastValue(x)-x;

//Tops

A = H;

Top1 = A > Hf2 & A > Hf1 & A > Hp1 & A > Hp2 & divx>2;

Top2 = A > Hf3 & A > Hf2 & A ==Hf1 & A > Hp1 & A > Hp2 & divx>3 ;

Top3 = A > Hf4 & A > Hf3 & A ==Hf2 & A >=Hf1 & A > Hp1 & A > Hp2 & divx>4;

Top4 = A > Hf5 & A > Hf4 & A ==Hf3 & A >=Hf2 & A >=Hf1 & A > Hp1 & A > Hp2 & divx>5;

Top5 = A > Hf6 & A > Hf5 & A ==Hf4 & A >=Hf3 & A ==Hf2 & A >=Hf1 & A > Hp1 & A >Hp2 & divx>6;

Top = Top1 OR Top2 OR Top3 OR Top4 OR Top5;

TopHigh = ValueWhen(Top,H);

TopX = ValueWhen(Top,X);

//Valleys

A = L;

Valley1 = A < Lf2 & A <= Lf1 & A <= Lp1 & A < Lp2 & divx>2;

Valley2 = A < Lf3 & A < Lf2 & A == Lf1 & A < Lp1 & A < Lp2 & divx>3;

Valley3 = A < Lf4 & A < Lf3 & A == Lf2 & A <= Lf1 & A < Lp1 & A < Lp2 & divx>4;

Valley4 = A < Lf5 & A < Lf4 & A == Lf3 & A <= Lf2 & A <= Lf1 & A < Lp1 & A < Lp2 & divx>5;

Valley5 = A < Lf6 & A < Lf5 & A == Lf4 & A <= Lf3 & A == Lf2 & A <= Lf1 & A < Lp1 & A < Lp2 & divx>6;

Valley = Valley1 OR Valley2 OR Valley3 OR Valley4 OR Valley4 OR Valley5;

ValleyLow = ValueWhen(Valley,L);

ValleyX = ValueWhen(Valley,X);

x = Cum(1);

xb = LastValue(ValueWhen(Valley,x,1));

xa = LastValue(ValueWhen(Valley,x,2));

yb = LastValue(ValueWhen(Valley,L,1));

Ya = LastValue(ValueWhen(Valley,L,2));

xab_log = log(yb/yA)/(xb-xa);

SL = exp((x-xb)*xab_log)*yb;

RocSL = ROC(SL,1);

xd = LastValue(ValueWhen(top,x,1));

xc = LastValue(ValueWhen(top,x,2));

yd = LastValue(ValueWhen(top,H,1));

Yc = LastValue(ValueWhen(top,H,2));

xcd_log = log(yd/yc)/(xd-xc);

RL = exp((x-xd)*xcd_log)*yd;

RocRL = ROC(RL,1);

//LPL

Low_Value = LastValue(Ref(LLV(L,xd-xc),-(x-xd)));

x2 = LastValue(ValueWhen(L==Low_Value & x>xc & x<xd,x));

PLL = IIf(LastValue(x)-x2>5,exp((x-x2)*xcd_log)*Low_Value,-1e10);

//HPL

Hi_Value = LastValue(Ref(HHV(H,xb-xa),-(x-xb)));

x3 = LastValue(ValueWhen(H==Hi_Value & x>xa & x<xb,x));

PHL = IIf(LastValue(x)-x3>5,exp((x-x3)*xab_log)*Hi_Value,-1e10);

//Channels

AvgRoc = abs(MA(ROC(C,1),100));

Threshold_parallel = 15;

Threshold_Trend = 0.001*per;

SLabs = SL-Ref(SL,-1); RLabs = RL-Ref(RL,-1);

ROC2SL = (SLabs/C)*100; ROC2RL = (RLabs/C)*100;

RSL = ROC2SL > Threshold_Trend; FlatSL = abs(ROC2SL) < Threshold_Trend; FSL = ROC2SL < -Threshold_Trend;

RRL = ROC2RL > Threshold_Trend; FlatRL = abs(ROC2RL) < Threshold_Trend; FRL = ROC2RL < -Threshold_Trend;

parallel= abs(((RocSL/RocRL)-1)*100)<Threshold_parallel;

UT= RSL AND RRL AND parallel;

DT= FSL AND FRL AND parallel;

DT_UT = IIf (DT,-1,IIf(UT,1,0));

Rangeee = parallel AND FlatSL AND FlatRL;

Xm = xb-xa >4 & xd-xc >4; //x-min.distance - optional

AscT= FlatRL & RSL;// & xa<xd & xc<xb;// & Xm;

DscT= FlatSL & FRL;// & xa<xd & xc<xb;// & Xm;

AT_DT= IIf(AscT,1,IIf(DscT,-1,0));

ST = RSL & FRL & RL>SL;//& xa<xd & xc<xb;// & Xm;

ET = RRL & FSL & RL>SL;//& xa<xd & xc<xb;// & Xm;//abs(ROCSL/ROCRL)<3 - optional

ST_ET = IIf(ST,1,IIf(ET,-1,0));

RW = RRL & RSL & RocSL>RocRL & SL>RL AND NOT parallel;// & Xm;

FW = FSL & FRL & RocRL<RocSL & SL<RL AND NOT parallel;// & Xm;

RW_FW = IIf (RW,1,IIf(FW,-1,0));

Distance = 0.5*ATR(14);

//Support line signals

Sup_break = Cross(SL,C) & X>XB;

Sup_pricejustabove = L<SL+Distance & L>SL & X>XB;

Sup_confirmed = L<=SL & C>SL & X>XB;

//Resistance line signals

Res_break = Cross(C,RL) & X>XD;

Res_pricejustbelow = H>RL-Distance & H<RL & X>XD;

Res_confirmed = H>=RL & C<RL & X>XD;

//Parallel lower line signals

PLL_break = Cross(PLL,C);

PLL_pricejustabove = L<PLL+Distance & L>PLL;

PLL_confirmed = L<=PLL & C>PLL;

//Parallel higher line signals

PHL_break = Cross(C,PHL);

PHL_pricejustbelow = H>PHL-Distance & H<PHL;

PHL_confirmed = H>=PHL & C<PHL;

SupSignals = Sup_break | Sup_pricejustabove | Sup_confirmed;

ResSignals = Res_break | Res_pricejustbelow | Res_confirmed;

PLLSignals = PLL_break | PLL_pricejustabove | PLL_confirmed;

PHLSignals = PHL_break | PHL_pricejustbelow | PHL_confirmed;

//BS = Sup_confirmed OR Res_break;

//SS = Res_confirmed OR Sup_break;

BS = Sup_confirmed OR Sup_pricejustabove OR Res_break;

SS = Res_confirmed OR Res_pricejustbelow OR Sup_break;

NS = Sup_pricejustabove OR Res_pricejustbelow;

PatternDirection =

IIf(AscT|FW|UT,1,

IIf(DscT|RW|DT,-1,

IIf(ST|ET|Rangeee,0,0)));

//Display Cond. fix when Chart is compl.zoomed out

PLLd = abs((LastValue(C)/LastValue(PLL))-1)<0.01*DisRange;

PHLd = abs((LastValue(C)/LastValue(PHL))-1)<0.01*DisRange;

barvisible = Status("barvisible");

firstvisiblebar = barvisible & NOT

Ref(barvisible,-1);

HHvisible = LastValue(HighestSince(firstvisiblebar,High));

LLvisible = LastValue(LowestSince(firstvisiblebar,Low));

RaH = HHvisible *1.05; //Range High

RaL = LLVisible *0.95; //Range Low

//Anyline_zero

AnZ= ya==0 OR yb==0 OR yc==0 OR yd==0;

SL_plot = IIf(x>=xa & SL>RaL & SL<RaH & NOT AnZ,SL,IIf(x>=xa & RaL==0 & NOT AnZ,SL,-1e10));

RL_plot = IIf(x>=xc & RL>RaL & RL<RaH & NOT AnZ,RL,IIf(x>=xc & RaL==0 & NOT AnZ,RL,-1e10));

PLL_plot = IIf(x-x2>=0 & abs(LastValue(L/PLL)-1) <abs(LastValue((DisRange/1000)*ATR(14))) & PLL>RaL & PLL<RaH & NOT AnZ,PLL,IIf(x-x2>=0 & RaL==0 & PLLd & abs(LastValue(L/PLL)-1) <abs(LastValue((DisRange/1000)*ATR(14)))& NOT AnZ,PLL,-1e10));

PHL_plot = IIf(x-x3>=0 & abs(LastValue(H/PHL)-1) <abs(LastValue((DisRange/1000)*ATR(14))) & PHL>RaL & PHL<RaH & NOT AnZ,PHL,IIf(x-x3>=0 & RaL==0 & PHLd & abs(LastValue(H/PHL)-1) <abs(LastValue((DisRange/1000)*ATR(14)))& NOT AnZ,PHL,-1e10));

///////////Begin Ploting Part////////////

LastBar = Cum(1) == LastValue(Cum(1));

Plot(SL_plot ," SL" ,colorCustom13,Style_SL+styleNoTitle);

Plot(RL_plot ," RL" ,colorCustom12,Style_RL+styleNoTitle);

Plot(IIf(Parallellinesswitch,PLL_plot,-1e10)," PLL",colorCustom13,Style_PLL+styleNoTitle);

Plot(IIf(Parallellinesswitch,PHL_plot,-1e10)," PHL",colorCustom12,Style_PHL+styleNoTitle);

// Shading

BEGIN=Min(xa,xc);

TRS = IIf(x>BEGIN-1,SL,-1e10);

TRR = IIf(x>BEGIN-1,RL,-1e10);

trr = IIf(trr>0,trr,Null);

yVal=IIf(trs > trr,trr,trs);

yval = IIf(yval>0,yval,Null);

GraphZOrder = 0;

if(Version()>4.75){

//PlotOHLC(0,trr,yval,0,"",Shadowcolor,styleCloud+styleNoLabel);

}

///////////End Ploting Part////////////

DefinedPatterns = AscT | DscT | ST | ET | RW | FW | UT | DT;

Filter = BarIndex()==LastValue(BarIndex()) AND NOT GroupID()==253;

Filter = Filter AND

(AscT AND AscTs)| (DscT AND DscTs)| (ST AND STs)|

(ET AND ETs)| (RW AND RWs)| (FW AND FWs)|

(UT AND UTs)| (DT AND DTs)|(Rangeee AND Ranges)|

(SupSignals AND NonDefinedPatterns AND NOT DefinedPatterns)|

(ResSignals AND NonDefinedPatterns AND NOT DefinedPatterns);

// | PLLSignals | PHLSignals | Trade Variables

//Shapes

if(PlotP1P2){

PlotShapes(IIf(x==xa & NOT AnZ,P1Shape,shapeNone),Color_SL,0,SL,-13 );

PlotShapes(IIf(x==xc & NOT AnZ,P1Shape,shapeNone),Color_RL,0,H,13 );

}

//end pattern

//////////////////////////////////////////////////////////////////

_SECTION_BEGIN("Fib Retracements");

fibs = ParamToggle("Plot Fibs","Off|On",1);

pctH = Param ("Pivot Hi %", 0.325,0.001,2.0,0.002);

HiLB = Param ("Hi LookBack",1,1,BarCount-1,1);

pctL = Param ("Pivot Lo %", 0.325,0.001,2.0,0.002);

LoLB = Param ("Lo LookBack",1,1,BarCount-1,1);

Back = Param ("Extend Left = 2",1,1,500,1);

Fwd = Param("Plot Forward", 0, 0, 500, 1);

text = ParamToggle("Plot Text","Off|On",1);

hts = Param ("Text Shift", -33.5,-50,50,0.10);

style =ParamStyle("Line Style",styleLine,styleNoLabel);

x = BarIndex();

pRp = PeakBars( H, pctH, 1) == 0;

yRp0 = SelectedValue(ValueWhen( pRp, H, HiLB));

xRp0 = SelectedValue(ValueWhen( pRp, x, HiLB));

pSp = TroughBars( L, pctL, 1) == 0;

ySp0 = SelectedValue(ValueWhen( pSp, L, LoLB));

xSp0 = SelectedValue(ValueWhen( pSp, x, LoLB));

Delta = yRp0 - ySp0;

function fib(ret)

{

retval = (Delta * ret);

Fibval = IIf(ret < 1.0

AND xSp0 < xRp0, yRp0 - retval, IIf(ret < 1.0

AND xSp0 > xRp0, ySp0 + retval,IIf(ret > 1.0

AND xSp0 < xRp0, yRp0 - retval, IIf(ret > 1.0

AND xSp0 > xRp0, ySp0 + retval, Null))));

return FibVal;

}

x0 = Min(xSp0,xRp0)-Back;

x1 = (BarCount -1);

//////////////////////////////////////////////////////////////////

r236 = fib(0.236); r236I = LastValue (r236,1);

r382 = fib(0.382); r382I = LastValue (r382,1);

r050 = fib(0.50); r050I = LastValue (r050,1);

r618 = fib(0.618); r618I = LastValue (r618,1);

r786 = fib(0.786); r786I = LastValue (r786,1);

e127 = fib(1.27); e127I = LastValue (e127,1);

e162 = fib(1.62); e162I = LastValue (e162,1);

e200 = fib(2.00); e200I = LastValue (e200,1);

e262 = fib(2.62); e262I = LastValue (e262,1);

e424 = fib(4.24); e424I = LastValue (e424,1);

//////////////////////////////////////////////////////////////////

p00 = IIf(xSp0 > xRp0,ySp0,yRp0); p00I = LastValue (p00,1);

p100 = IIf(xSp0 < xRp0,ySp0,yRp0); p100I = LastValue (p100,1);

color00 =IIf(xSp0 > xRp0,colorLime,colorRed);

color100 =IIf(xSp0 < xRp0,colorLime,colorRed);

//////////////////////////////////////////////////////////////////

numbars = LastValue(Cum(Status("barvisible")));

fraction= IIf(StrRight(Name(),3) == "", 3.2, 3.2);

//////////////////////////////////////////////////////////////////

Col=IIf(p00<p100,43,32);

if(fibs==1)

{

Plot(LineArray(xRp0-Fwd,yRp0,x1,yRp0,Back),"PR",Col,8|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(xSp0-Fwd,ySp0,x1,ySp0,Back),"PS",Col,8|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,r236,x1,r236,Back),"",Col,styleDashed|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,r382,x1,r382,Back),"",Col,styleDashed|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,r050,x1,r050,Back),"",41,styleDots|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,r618,x1,r618,Back),"",Col,styleDashed|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,r786,x1,r786,Back),"",Col,styleDashed|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,e127,x1,e127,Back),"e127",Col,styleDashed|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,e162,x1,e162,Back),"e162",Col,styleDashed|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,e200,x1,e200,Back),"p200",Col,styleDashed|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,e262,x1,e262,Back),"p262",Col,styleDashed|styleNoRescale,Null, Null,Fwd);

Plot(LineArray(x0-Fwd,e424,x1,e424,Back),"p424",Col,styleDashed|styleNoRescale,Null, Null,Fwd);

}

//////////////////////////////////////////////////////////////////

if(text==1)

{

PlotText(" 0% = " + WriteVal(p00,fraction), LastValue(BarIndex())-(numbars/hts), p00I + 0.05, col);

PlotText("23% = " + WriteVal(r236,fraction), LastValue(BarIndex())-(numbars/hts), r236I + 0.05, Col);

PlotText("38% = " + WriteVal(r382,fraction), LastValue(BarIndex())-(numbars/hts), r382I + 0.05, Col);

PlotText("50% = " + WriteVal(r050,fraction), LastValue(BarIndex())-(numbars/hts), r050I + 0.05, Col);

PlotText("62% = " + WriteVal(r618,fraction), LastValue(BarIndex())-(numbars/hts), r618I + 0.05, Col);

PlotText("78% = " + WriteVal(r786,fraction), LastValue(BarIndex())-(numbars/hts), r786I + 0.05, Col);

PlotText("100% = " + WriteVal(p100,fraction), LastValue(BarIndex())-(numbars/hts),p100I + 0.05, col);

PlotText("127% = " + WriteVal(e127,fraction), LastValue(BarIndex())-(numbars/hts),e127I + 0.05, Col);

PlotText("162% = " + WriteVal(e162,fraction), LastValue(BarIndex())-(numbars/hts),e162I + 0.05, Col);

PlotText("200% = " + WriteVal(e200,fraction), LastValue(BarIndex())-(numbars/hts),e200I + 0.05, Col);

PlotText("262% = " + WriteVal(e262,fraction), LastValue(BarIndex())-(numbars/hts),e262I + 0.05, Col);

PlotText("424% = " + WriteVal(e424,fraction), LastValue(BarIndex())-(numbars/hts),e424I + 0.05, Col);

}

_SECTION_END();

//////////////////////////////////////////////////////////////////

_SECTION_BEGIN("Volume Price Analysis");

//=======================================================================================

DTL=Param("Linear regression period",60,10,100,10);

wbf=Param("WRB factor",1.5,1.3,2.5,.1);

nbf=Param("NRB factor",0.7,0.3,0.9,0.1);

TL=LinRegSlope(MA(C, DTL),2);

Vlp=Param("Volume lookback period",30,20,300,10);

Vrg=MA(V,Vlp);

St = StDev(Vrg,Vlp);

Vp3 = Vrg + 3*st;

Vp2 = Vrg + 2*st;;

Vp1 = Vrg + 1*st;;

Vn1 = Vrg -1*st;

Vn2 = Vrg -2*st;

_SECTION_END();

//nr7 setup

TimeFrameSet(TT);

High1=IIf(O>H,O,H);

Low1=IIf(O<L,O,L);

rang=High1-Low1;

nr7=(rang==LLV(rang,7));

nr8=(Ref(nr7,-1) AND rang==LLV(rang,8));

InsideBar = Inside() ;

nri=(nr7 AND InsideBar);

G=C>O;

R=C<O;

TGN7=nr7 & G;

TRN7=nr7 & R;

TGN8=nr8 & G;

TRN8=nr8 & R;

TGN7i=nri & G;

TRN7i=nri & R;

YGN7=Ref(TGN7,-1);

YRN7=Ref(TRN7,-1);

YGN8=Ref(TGN8,-1);

YRN8=Ref(TRN8,-1);

YGN7i=Ref(TGN7i,-1);

YRN7i=Ref(TRN7i,-1);

zGN7=Ref(TGN7,-2);

zRN7=Ref(TRN7,-2);

zGN8=Ref(TGN8,-2);

zRN8=Ref(TRN8,-2);

zGN7i=Ref(TGN7i,-2);

zRN7i=Ref(TRN7i,-2);

aGN7=Ref(TGN7,-3);

aRN7=Ref(TRN7,-3);

aGN8=Ref(TGN8,-3);

aRN8=Ref(TRN8,-3);

aGN7i=Ref(TGN7i,-3);

aRN7i=Ref(TRN7i,-3);

bGN7=Ref(TGN7,-4);

bRN7=Ref(TRN7,-4);

bGN8=Ref(TGN8,-4);

bRN8=Ref(TRN8,-4);

bGN7i=Ref(TGN7i,-4);

bRN7i=Ref(TRN7i,-4);

Cgn7=IIf(dy & no==0,tgn7,0);

Crn7=IIf(dy & no==0,trn7,0);

Cgn8=IIf(dy & no==0,tgn8,0);

Crn8=IIf(dy & no==0,trn8,0);

Cgn7i=IIf(dy & no==0,tgn7i,0);

Crn7i=IIf(dy & no==0,trn7i,0);

dgn7=IIf(dy & no==1,tgn7 & ygn7,0);

drn7=IIf(dy & no==1,trn7 & yrn7,0);

dgn8=IIf(dy & no==1,tgn8 & ygn8,0);

drn8=IIf(dy & no==1,trn8 & yrn8,0);

dgn7i=IIf(dy & no==1,tgn7i & ygn7i,0);

drn7i=IIf(dy & no==1,trn7i & yrn7i,0);

egn7=IIf(dy & no==2,tgn7 & ygn7 & zgn7,0);

ern7=IIf(dy & no==2,trn7 & yrn7 & zrn7,0);

egn8=IIf(dy & no==2,tgn8 & ygn8 & zgn8,0);

ern8=IIf(dy & no==2,trn8 & yrn8 & zrn8,0);

egn7i=IIf(dy & no==2,tgn7i & ygn7i & zgn7i,0);

ern7i=IIf(dy & no==2,trn7i & yrn7i & zrn7i,0);

fgn7=IIf(dy & no==3,tgn7 & ygn7 & zgn7 & agn7,0);

frn7=IIf(dy & no==3,trn7 & yrn7 & zrn7 & arn7,0);

fgn8=IIf(dy & no==3,tgn8 & ygn8 & zgn8 & agn8,0);

frn8=IIf(dy & no==3,trn8 & yrn8 & zrn8 & arn8,0);

fgn7i=IIf(dy & no==3,tgn7i & ygn7i & zgn7i & agn7i,0);

frn7i=IIf(dy & no==3,trn7i & yrn7i & zrn7i & arn7i,0);

ggn7=IIf(dy & no==4,tgn7 & ygn7 & zgn7 & agn7 & bgn7,0);

grn7=IIf(dy & no==4,trn7 & yrn7 & zrn7 & arn7 & brn7,0);

ggn8=IIf(dy & no==4,tgn8 & ygn8 & zgn8 & agn8 & bgn8,0);

grn8=IIf(dy & no==4,trn8 & yrn8 & zrn8 & arn8 & brn8,0);

ggn7i=IIf(dy & no==4,tgn7i & ygn7i & zgn7i & agn7i & bgn7i,0);

grn7i=IIf(dy & no==4,trn7i & yrn7i & zrn7i & arn7i & brn7i,0);

TimeFrameRestore();

red=(since & (C<O | C==O));

green=(since & (C>O | C==O));

Reds=Cum(Red);

Greens=Cum(Green);

redr=IIf(red,O-C,0);

greenr=IIf(green,C-O,0);

Candles=Cum(red + green);

Os=Sum(redr,Candles);

ws=Sum(greenr,Candles);

Lotsize=round((inv*5.5)/r236);

//////////////////////////////////////////////////////////////////

Chg=Ref(C,-1);

if (tchoice==1 )

{

_N(Title = EncodeColor(colorWhite)+StrFormat(" {{NAME}} - {{INTERVAL}} {{DATE}} Open: %g, High: %g, Low: %g, Close: %g {{VALUES}}",O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

}

//////////////////////////////////////////////////////////////////

if (tchoice==2 )

{

Title = EncodeColor(colorWhite)+ Date() + " Tick = " + EncodeColor(5) + Interval()+

EncodeColor(55)+ " Open: "+ EncodeColor(colorWhite)+ WriteVal(O,format=1.2) +

EncodeColor(55)+ " High: "+ EncodeColor(colorWhite) + WriteVal(H,format=1.2) +

EncodeColor(55)+ " Low: "+ EncodeColor(colorWhite)+ WriteVal(L,format=1.2) +

EncodeColor(55)+ " Close: "+ WriteIf(C> Chg,EncodeColor(colorBrightGreen),EncodeColor(colorRed))+ WriteVal(C,format=1.2)+

EncodeColor(55)+ " Change: "+ WriteIf(C> Chg,EncodeColor(colorBrightGreen),EncodeColor(colorRed))+ WriteVal(ROC(C,1),format=1.2)+ "%"+

EncodeColor(55)+ " Volume: "+ EncodeColor(colorWhite)+ WriteVal(V,1)+EncodeColor(colorYellow) + " Lotsize: "+WriteVal(Lotsize,1)+" Lotsize/2: "+WriteVal(Lotsize/2,1)+"\n"+

WriteIf(LastValue(AscT),"Ascending Triangle - bullish formation that usually forms during an uptrend as a continuation pattern"+"","")+

WriteIf(LastValue(DscT),"Decending Triangle - bearish formation that usually forms during a downtrend as a continuation pattern."+"","")+

//WriteIf(LastValue(ST),"Symmetrical Triangle - mark important trend reversals, they more often mark a continuation of the current trend - direction of the next major move can only be determined after a valid breakout."+"","")+

WriteIf(LastValue(ET),"Expanding Triangle - The expanding triangle is said to be a good indicator of a reversal pattern"+"","")+

WriteIf(LastValue(RW),"Rising Wedge - rising wedges definitely slope up and have a bearish bias"+"","")+

WriteIf(LastValue(FW),"Falling Wedge - falling wedges definitely slope down and have a bullish bias."+" ","")+

WriteIf(LastValue(UT),"Up Channel - Bullish Trend"+"","")+

WriteIf(LastValue(DT),"Down Channel - Bearish Trend"+"","")+"\n"+

EncodeColor(colorYellow)+

Comm2=("heikin 5m : ")+

WriteIf(LastValue(Condb),EncodeColor(colorBrightGreen)+"+Up",

WriteIf(LastValue(Conds),EncodeColor(colorRed)+"-Down",EncodeColor(colorLightYellow)+"< Flat >"))+"\n"+

EncodeColor(colorYellow)+

Comm2=("heikin 15m : ")+

WriteIf(LastValue(Condb1),EncodeColor(colorBrightGreen)+"+Up",

WriteIf(LastValue(Conds1),EncodeColor(colorRed)+"-Down",EncodeColor(colorLightYellow)+"< Flat >"))+"\n"+

EncodeColor(colorYellow)+

Comm2=("heikin 30m : ")+

WriteIf(LastValue(Condb2),EncodeColor(colorBrightGreen)+"+Up",

WriteIf(LastValue(Conds2),EncodeColor(colorRed)+"-Down",EncodeColor(colorLightYellow)+"< Flat >"))+"\n"+

EncodeColor(colorYellow)+

Comm2=("heikin 1Hr : ")+

WriteIf(LastValue(Condb3),EncodeColor(colorBrightGreen)+"+Up",

WriteIf(LastValue(Conds3),EncodeColor(colorRed)+"-Down",EncodeColor(colorLightYellow)+"< Flat >"))+"\n"+

"\n"+EncodeColor(07)+"Volume: "+WriteIf(V>Vp2,EncodeColor(colorLime)+"Very High",WriteIf(V>Vp1,EncodeColor(colorLime)+" High",WriteIf(V>Vrg,EncodeColor(colorLime)+"Above Average",

WriteIf(V<Vrg AND V>Vn1,EncodeColor(colorRed)+"Less than Average",WriteIf(V<Vn1,EncodeColor(colorRed)+"Low","")))))+ "\n" +

EncodeColor(colorYellow)+

Comm2=("Trend: ")+

WriteIf(Greens>Reds,EncodeColor(colorBrightGreen)+"+Up",

WriteIf(Reds>Greens,EncodeColor(colorRed)+"-Down",EncodeColor(colorLightYellow)+"< Flat >"))+"\n"+

EncodeColor(colorRed) +

WriteIf(Reds, "Reds: "+(reds)+" ","")+"\n"+

EncodeColor(colorBrightGreen) +

WriteIf(Greens, "Greens: "+(greens)+" ","")+"\n"+

EncodeColor(colorRed) +

Comm2=("Red Range: ")+

WriteVal(Os, 1.2)+"\n"+

EncodeColor(colorBrightGreen) +

Comm2=("Green Range: ")+

WriteVal(Ws, 1.2)+"\n"+

EncodeColor(colorRed) +

WriteIf(ChaikinVolatility( periods )<0, "Chaikin: "+(ChaikinVolatility( periods )

)+" ","")+"\n"+

EncodeColor(colorBrightGreen) +

WriteIf(ChaikinVolatility( periods )>0

, "Chaikin: "+(ChaikinVolatility( periods )

)+" ","")+

"\n"+

WriteIf(Sup_pricejustabove,EncodeColor(colorBrightGreen)+"Price just above Support",

WriteIf(Sup_confirmed,EncodeColor(colorBrightGreen)+"Support Confirmed",EncodeColor(colorWhite)+""))+

WriteIf(Sup_break,EncodeColor(colorRed)+"Support Break"+"","")+"\n"+

WriteIf(Res_pricejustbelow,EncodeColor(colorRed)+"Price just below Resistance",

WriteIf(Res_confirmed,EncodeColor(colorRed)+"Resistance Confirmed",EncodeColor(colorWhite)+""))+

WriteIf(Res_break,EncodeColor(colorBrightGreen)+"Resistance Break"+"","");

}

GraphXSpace=5;

dy1=IIf(dy==1,(tgn7 | trn7 | tgn8|trn8|tgn7i|trn7i|ygn7 | yrn7 | ygn8|yrn8|ygn7i|yrn7i|zgn7 | zrn7 |zgn8|zrn8|zgn7i|zrn7i|agn7 | arn7 |agn8|arn8|agn7i|arn7i|bgn7 | brn7 | bgn8|brn8|bgn7i|brn7i),0);

dy2=IIf(dy==1,(cgn7 | crn7 | cgn8|crn8|cgn7i|crn7i|dgn7 | drn7 | dgn8|drn8|dgn7i|drn7i|egn7 | ern7 |egn8|ern8|egn7i|ern7i|fgn7 |frn7 |fgn8|frn8|fgn7i|frn7i|ggn7 | grn7 | ggn8|grn8|ggn7i|grn7i),0);

// Angle variables

PI = atan(1.00) * 4;

periods = periods;

HighHigh = HHV(H, periods);

LowLow = LLV(L, periods);

range = 25 / (HighHigh - LowLow) * LowLow;

// LSMA25 Angle

LSMA25 = OBV();

x1_LSMA25 = 0;

x2_LSMA25 = 1;

y1_LSMA25 = 0;

y2_LSMA25 = (Ref(LSMA25, -1) - LSMA25) / Avg * range;

c_LSMA25 = sqrt((x2_LSMA25 - x1_LSMA25)*(x2_LSMA25 - x1_LSMA25) + (y2_LSMA25 - y1_LSMA25)*(y2_LSMA25 - y1_LSMA25));

angle_LSMA25 = round(180 * acos((x2_LSMA25 - x1_LSMA25)/c_LSMA25) / PI);

angle_LSMA25 = IIf(y2_LSMA25 > 0, - angle_LSMA25, angle_LSMA25);

Buy=IIf((p00<p100 & ChaikinVolatility( periods )>0 & angle_LSMA25>30 & Ws>=(Os+(Os*perc/100)) & (Cross(H,r236) | Cross(C,r236))),1,0);

Buystop=ValueWhen(Buy,p00);

btgt1=ValueWhen(Buy,r618);

btgt2=ValueWhen(Buy,r786);

Short=IIf((p00>p100 & ChaikinVolatility( periods )>0 & angle_LSMA25<(-30) & Os>=(Ws+(Ws*perc/100)) & (Cross(r236,L) | Cross(r236,C))),1,0);

shortstop=ValueWhen(Short,p00);

stgt1=ValueWhen(Short,r618);

stgt2=ValueWhen(Short,r786);

//Buy=ExRem(Buy,Short);

//Short=ExRem(Short,Buy);

//shapes

PlotShapes(IIf(Buy,shapeUpArrow,shapeNone),colorWhite,0,L,-25 );

PlotShapes(IIf(Short,shapeDownArrow,shapeNone),colorOrange,0,H,-25 );

AddColumn( IIf(Buy & dy==0, r236, IIf(Short & dy==0, r236,01 )), "ENTRY@", 1.2, colorWhite, bkcolor= IIf(Short & dy==0,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(Buy & dy==0, Buystop, IIf(Short & dy==0, Shortstop,01 )), "STOP@", 1.2, colorWhite, bkcolor= IIf(Short & dy==0,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(Buy & dy==0, btgt1, IIf(Short & dy==0, stgt1,01 )), "TARGT-1", 1.2, colorWhite, bkcolor= IIf(Short & dy==0,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(Buy & dy==0, btgt2, IIf(Short & dy==0, stgt2,01 )), "TARGT-2", 1.2, colorWhite, bkcolor= IIf(Short & dy==0,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(Buy & dy==0, Lotsize, IIf(Short & dy==0, Lotsize,01 )), "QNTY", 1, colorWhite, bkcolor= IIf(Short & dy==0,colorDarkRed,colorDarkGreen) );

//AddColumn(dy==1 & no,"NR days",1);

AddColumn( IIf(( dy==1 & tgn7), 55, IIf(( dy==1 & trn7), 55,01 )), "NR7-0", formatChar, colorWhite, bkcolor= IIf((dy==1 & trn7),colorDarkRed,colorDarkGreen) );

AddColumn( IIf((dy==1 & tgn8), 56, IIf(dy==1 & trn8, 56,01 )), "NR8-0", formatChar, colorWhite, bkcolor= IIf(dy==1 & trn8,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & tgn7i, 73, IIf(dy==1 & trn7i, 73,01 )), "NR7i-0", formatChar, colorWhite, bkcolor= IIf(dy==1 & trn7i,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & ygn7, 55, IIf(dy==1 & yrn7, 55,01 )), "NR7-1", formatChar, colorWhite, bkcolor= IIf(dy==1 & yrn7,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & ygn8, 56, IIf(dy==1 & yrn8, 56,01 )), "NR8-1", formatChar, colorWhite, bkcolor= IIf(dy==1 & yrn8,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & ygn7i, 73, IIf(dy==1 & yrn7i, 73,01 )), "NR7i-1", formatChar, colorWhite, bkcolor= IIf(dy==1 & yrn7i,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & zgn7, 55, IIf(dy==1 & zrn7, 55,01 )), "NR7-2", formatChar, colorWhite, bkcolor= IIf(dy==1 & zrn7,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & zgn8, 56, IIf(dy==1 & zrn8, 56,01 )), "NR8-2", formatChar, colorWhite, bkcolor= IIf(dy==1 & zrn8,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & zgn7i, 73, IIf(dy==1 & zrn7i, 73,01 )), "NR7i-2", formatChar, colorWhite, bkcolor= IIf(dy==1 & zrn7i,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & agn7, 55, IIf(dy==1 & arn7, 55,01 )), "NR7-3", formatChar, colorWhite, bkcolor= IIf(dy==1 & arn7,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & agn8, 56, IIf(dy==1 & arn8, 56,01 )), "NR8-3", formatChar, colorWhite, bkcolor= IIf(dy==1 & arn8,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & agn7i, 73, IIf(dy==1 & arn7i, 73,01 )), "NR7i-3", formatChar, colorWhite, bkcolor= IIf(dy==1 & arn7i,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & bgn7, 55, IIf(dy==1 & brn7, 55,01 )), "NR7-4", formatChar, colorWhite, bkcolor= IIf(dy==1 & brn7,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & bgn8, 56, IIf(dy==1 & brn8, 56,01 )), "NR7-4", formatChar, colorWhite, bkcolor= IIf(dy==1 & brn8,colorDarkRed,colorDarkGreen) );

AddColumn( IIf(dy==1 & bgn7i, 66, IIf(dy==1 & brn7i, 83,01 )), "NR7i-4", formatChar, colorWhite, bkcolor= IIf(dy==1 & brn7i,colorDarkRed,colorDarkGreen) );

//daily sup/res

_SECTION_BEGIN("Daily Sup/Res Plot lines");

//Set parameter default to YES for displaying the final

//results of the break out calculations.

PlotBreak = ParamToggle("Plot Breakout", "YES|NO", 0);

//set parameter default to YES for displaying PP, S1 and R1

PPSR1 = ParamToggle("PP,S1/R1", "YES|NO", 0);

//set paramter default to NO for displaying S2 and R2

S2R2 = ParamToggle("S2,R2", "YES|NO", 0);

//set parameter default to NO for dsiplaying S3 and R3

S3R3 = ParamToggle("S3,R3", "YES|NO", 1);

//set paramter default to NO for diplaying S4 and R4

S4R4 = ParamToggle("S4,R4", "YES|NO", 1);

_SECTION_END();

_SECTION_BEGIN("Realtime Hours ");

//Determine the value of the market close. Initial setting is for

//4:00 PM to match US Market Open. Adjust as need for your market

UserOpen = ParamTime("Market Open", "09:00");

UserClose = ParamTime("Market Close", "15:30");

UseIndia = "YES";//ParamList("Indian Market?", "YES|NO",0);

if(UseIndia == "YES")

{

TimeOpen = ValueWhen(DateNum() != Ref(DateNum(),-1), TimeNum());

}

CalcClose = UserClose;

TimeClose = IIf(StrMid(NumToStr(CalcClose ,1,False),2,2)=="00",

6000-((Interval()/60)*100)+(CalcClose-10000),

CalcClose-(100*(Interval()/60)));

CurBarTime = TimeNum();

DlyHigh = HighestSince(CurBarTime == TimeOpen , High);

DlyHighest = ValueWhen(CurBarTime == TimeClose , DlyHigh);

DlyLow = LowestSince(CurBarTime == TimeOpen , Low);

DlyLowest = ValueWhen(CurBarTime == TimeClose , DlyLow);

MrktClose = ValueWhen(CurBarTime == TimeClose , Close);

Rangeeee = DlyHighest - DlyLowest;

PP = (DlyHighest + DlyLowest + MrktClose)/3;

PP = round(PP * 4) / 4;

R1 = (2 * PP) - DlyLowest;

S1 = (2 * PP) - DlyHighest;

R2 = PP + Rangeeee;

S2 = PP - Rangeeee;

R3 = R2 + Rangeeee;

S3 = S2 - Rangeeee;

R4 = R3 + Rangeeee;

S4 = S3 - Rangeeee;

TitlePivots = "\n"+

EncodeColor(colorYellow) +"Today's Daily Pivots" +"\n"

+"R1: " +R1 +"\n" +"PP: " +PP +"\n" +"S1: " +S1

//+WriteVal((fhh))+WriteVal((FHL))+WriteVal(((TOP)))+ WriteVal((bi1[0]))

+"\n";

if(PPSR1 == 0)

{

Plot(R1, "Dly R1", colorPink, styleDashed | styleThick | styleNoRescale);

Plot(PP, "Dly Pivot", colorGrey40, styleDots | styleThick | styleNoRescale);

Plot(S1, "Dly S1", colorAqua, styleDashed | styleThick | styleNoRescale);

}

if(S2R2 == 0)

{

Plot(R2, "Dly R2", colorPink, styleDashed | styleThick | styleNoRescale);

Plot(S2, "Dly S2", colorAqua, styleDashed | styleThick | styleNoRescale);

}

if(S3R3 == 0)

{

Plot(R3, "Dly R3", colorPink, styleDashed | styleThick | styleNoRescale);

Plot(S3, "Dly S3", colorAqua, styleDashed | styleThick | styleNoRescale);

}

if(S4R4 == 0)

{

Plot(R4, "Dly R4", colorPink, styleDashed | styleThick | styleNoRescale);

Plot(S4, "Dly S4", colorAqua, styleDashed | styleThick | styleNoRescale);

}

_SECTION_END();

Filter=Buy | Short | dy1;

Just Posting Today Chart OF Silver For Info Normal Chart

After Last Short Signal Silver Just Crashed To 54000 And Covered And Posting Chart :thumb:

After Last Short Signal Silver Just Crashed To 54000 And Covered And Posting Chart :thumb:

Hi

What is the below given indicator (2nd one in the chart)

Thanks

Sudha

What is the below given indicator (2nd one in the chart)

Thanks

Sudha

Dear Arrow Is Paint Tool

But Indi Is Rsi CCI And ADx Mix

But Indi Is Rsi CCI And ADx Mix

Can u please share it?

Thanks

Sudha

Thanks

Sudha

Sorry Dear It's Not For Sharing Or Selling

Can't Help Your It's For My Private Use

Can't Help Your It's For My Private Use

Ok No problem, Can u give me an idea on how to create the indicator by my own

Thanks

Sudha

Thanks

Sudha

u can try this...

// Accumulation or Bought/Distribution or Sold=====\\

//===========Matrix Series==========\\

//============\\

_SECTION_BEGIN("Flower");//=============\\

//Plot (Close,"", IIf( C > O, ParamColor("Up Color", colorWhite ), ParamColor("Down Color", colorRed )),ParamStyle( "Style", styleCandle | styleThick, maskAll));//

Title = StrFormat("\\c02 {{NAME}} | {{DATE}} | Open : %g | High : %g | Low : %g | Close : %g | Change = %.1f%% | Volume = " +WriteVal( V, 1.0 ) +" {{VALUES}}",O, H, L, C, SelectedValue( ROC( C, 1 )) );

_SECTION_END();//=================\\

_SECTION_BEGIN("Sup/Res Detail");//====================================\\

SupResPeriod = Param("LookBack Period", 50, 0, 200,1);

SupResPercentage = Param("Percentage", 100, 0, 200,1);

PricePeriod = Param("Price Period", 16, 0, 200,1);

SupportLinecolor = ParamColor( "Support Color", colorGreen );

SupportLinestyle = ParamStyle("Support Style", styleThick|8|styleNoLabel);

ResistanceLinecolor = ParamColor( "Resistance Color", colorRed );

Resistancestyle = ParamStyle("Resistance Style", styleThick|8|styleNoLabel);

_SECTION_END();//============================\\

_SECTION_BEGIN("Line Detail");//==============\\

OverBought = Param("OverBought Above", 200, 0, 400,1);

OverSold = Param("OverSold Bellow", -200, -400, 0,1);

_SECTION_END();//==================================\\

_SECTION_BEGIN("Trend Bought/Sold Detail");//=======================================\\

Smoother = Param("Trend Smoother", 5, 5, 20);

upcolor = ParamColor( "UpTrend Color", colorGreen );

Downcolor = ParamColor( "DownTrend Color", colorRed );

_SECTION_END();//===================================\\

_SECTION_BEGIN("Circle Detail");//=========================================\\

Warningcolor = ParamColor( "Warning/Watch Signal", colorBlue );

WatchColor = ParamColor( "Accumulation Zone", colorWhite );

EntryColor = ParamColor( "Entry Signal", colorAqua );

ProfitTakeColor = ParamColor( "Distribution Zone", colorYellow );

ExitColor = ParamColor( "Exit Signal", colorRed );

_SECTION_END();//=================================================\\

_SECTION_BEGIN("Swing Sup/Res");//=========================================\\

Lookback=SupResPeriod;

PerCent=SupResPercentage;

Pds =PricePeriod;

Var=MACD();

Up=IIf(Var>Ref(Var,-1),abs(Var-Ref(Var,-1)),0);

Dn=IIf(Var<Ref(Var,-1),abs(Var-Ref(Var,-1)),0);

Ut=Wilders(Up,Pds);

Dt=Wilders(Dn,Pds);

RSIt=100*(Ut/(Ut+Dt));

A1=RSIt; B2=RSI(pds); C3=CCI(pds); D4=StochK(pds); E5=StochD(pds);

F6=MFI(pds); G7=Ultimate(pds); H8=ROC(C,pds);

Osc=C3;

Value1 = Osc;

Value2 = HHV(Value1,Lookback);

Value3 = LLV(Value1,Lookback);

Value4 = Value2 - Value3;

Value5 = Value4 * (PerCent / 100);

ResistanceLine = Value3 + Value5;

SupportLine = Value2 - Value5;

baseline=IIf( Osc < 100 AND Osc > 10 ,50 ,IIf( Osc < 0 ,0,0));

Plot(ResistanceLine,"",SupportLinecolor,SupportLinestyle);

Plot(SupportLine,"",ResistanceLinecolor,Resistancestyle);

_SECTION_END();//================================================\\

_SECTION_BEGIN("Entry/Exit Detail");//=========================================\\

n=Smoother;

ys1=(High+Low+Close*2)/4;

rk3=EMA(ys1,n);

rk4=StDev(ys1,n);

rk5=(ys1-rk3)*200/rk4;

rk6=EMA(rk5,n);

UP=EMA(rk6,n);

DOWN=EMA(up,n);

Oo=IIf(up<down,up,down);

Hh=Oo;

Ll=IIf(up<down,down,up);

Cc=Ll;

barcolor2=IIf(Ref(oo,-1)<Oo AND Cc<Ref(Cc,-1),upcolor,IIf(up>down,upcolor,downcolor));

PlotOHLC( Oo,hh,ll,Cc, "Matrix - Accumulation or Bought/Distribution or Sold", barcolor2, styleCandle);

Buy=Cross(up,OverSold);

Sell=Cross(OverBought,up);

PlotShapes (IIf(Buy, shapeSmallCircle, shapeNone) ,EntryColor, layer = 0, yposition = -220, offset = 1 );

PlotShapes (IIf(Sell, shapeSmallCircle, shapeNone) ,ExitColor, layer = 0, yposition = 220, offset = 1 );

_SECTION_END();//===================================\\

_SECTION_BEGIN("Overbought/Oversold/Warning Detail");//========================================\\

n=Smoother;

ys1=(High+Low+Close*2)/4;

rk3=EMA(ys1,n);

rk4=StDev(ys1,n);

rk5=(ys1-rk3)*210/rk4;

rk6=EMA(rk5,n);

UP=EMA(rk6,n);

DOWN=EMA(up,n);

Oo=IIf(up<down,up,down);

Hh=Oo;

Ll=IIf(up<down,down,up);

Cc=Ll;

barcolor2=IIf(Ref(oo,-1)<Oo AND Cc<Ref(Cc,-1),colorGreen,IIf(up>down,colorGreen,colorRed));

PlotOHLC( Oo,hh,ll,Cc, "", barcolor2, styleCandle|stylehidden );

UP=EMA(rk6,n);

UPshape = IIf(UP >= OverBought OR UP<=OverSold, shapeHollowSmallCircle, shapeNone);

UPColor = IIf(UP>=210, ProfitTakeColor, IIf(UP<=-210, WatchColor, Warningcolor));