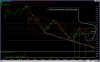

Some of the lines which can be important for next few hours :

" Lay Investors dont sell in LOSS they sell only in PANICs"

" Venturing out in rough weather can be fruitfull in market"

Suddenly one can see a panic and pessimism equivalent to the euphoria which we were seeing in January 2008 . The capitulation and panic may have brought in such unimaginable and dirt prices in many stocks to the extent of 80-90 % of the peak price but such a fall may create a short term or even a very important long term bottom zone after which markets could consolidate. Like in Novemeber to January Sensex dint make very big highs or crossovers but continued to stay at higher levels we may see Sensex and indices continue to stay at lower levels and consolidate before deciding the next move.

All global markets have turned highly oversold in the current state and quite a lot of economic news might have been already discounted in the near term and a decent bounce should be in the offing. There is a lot of blood on the street but thats when the real opportunities come in and also the greed of lower level buying may dissuade investors the same way greed dissuaded investors from selling in January. So even if one is panicky and wants to get out he may get little better chances in coming days!.

" Lay Investors dont sell in LOSS they sell only in PANICs"

" Venturing out in rough weather can be fruitfull in market"

Suddenly one can see a panic and pessimism equivalent to the euphoria which we were seeing in January 2008 . The capitulation and panic may have brought in such unimaginable and dirt prices in many stocks to the extent of 80-90 % of the peak price but such a fall may create a short term or even a very important long term bottom zone after which markets could consolidate. Like in Novemeber to January Sensex dint make very big highs or crossovers but continued to stay at higher levels we may see Sensex and indices continue to stay at lower levels and consolidate before deciding the next move.

All global markets have turned highly oversold in the current state and quite a lot of economic news might have been already discounted in the near term and a decent bounce should be in the offing. There is a lot of blood on the street but thats when the real opportunities come in and also the greed of lower level buying may dissuade investors the same way greed dissuaded investors from selling in January. So even if one is panicky and wants to get out he may get little better chances in coming days!.