Dear kalyan

He has not written any book.As per his version he has developed a new software programme that only he uses to advise his clients.I am not sure if he will give access of it to his clients.Yes,HE IS THE SAME PERSON WHO HAS BEEN CRYING WOLF FOR A LONG TIME.That is his way.

He has not written any book.As per his version he has developed a new software programme that only he uses to advise his clients.I am not sure if he will give access of it to his clients.Yes,HE IS THE SAME PERSON WHO HAS BEEN CRYING WOLF FOR A LONG TIME.That is his way.

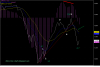

He always gives both sides of the picture - like the current tussle is between a bearish Diammetric & a bullish Breakout from a Running Triangle scenario. Seems logical to me.

I was hoping he had a book from where i could learn the basics of his technique that would enable me to follow his weekly column better.

Thanks & regards,

Kalyan.