TD Sequential

What is it for?

Applying Tom DeMark’s TD Sequential serves the purpose of identifying a price point where an uptrend or a downtrend exhausts itself and reverses.

.

What are the main components of TD Sequential?

TD Sequential has two parts – TD Setup and TD Countdown. The first phase of TD Sequential starts with a TD Setup and is completed with a 9 count. When the 9 count is completed, it is at that point, a price pause, price pullback, or reversal is likely. It is also at that point where TD Sequential starts the second phase with TD Countdown and is completed with a 13 count. When the 13 count is recorded, it is at that point, a price pause, price pullback, or a reversal is likely.

.

Just 9 and 13. Is it really that simple?

Absolutely not. Other DeMark indicators and other technical analysis indicators should align with TD Sequential’s ability to pinpoint potential reversals. For example, if a leading indicator identifies a condition for a market reversal is likely in the near future, the job of TD Sequential is to provide the “when” for the reversal is likely to take place.

.

What is TD Buy Setup, TD Sell Setup, TD Buy Countdown, and TD Sell Countdown?

TD Buy Setup is the name for a TD Setup when the DeMark counts are recorded as prices are trending lower. Conversely, TD Sell Setup is the name for a TD Setup when the DeMark counts are recorded as prices are trending higher. The same goes for TD Countdown. A TD Buy Countdown is the name for TD Countdown when the DeMark counts are recorded as prices are trending lower and a TD Sell Countdown is the name of TD Countdown when the DeMark counts are trending higher.

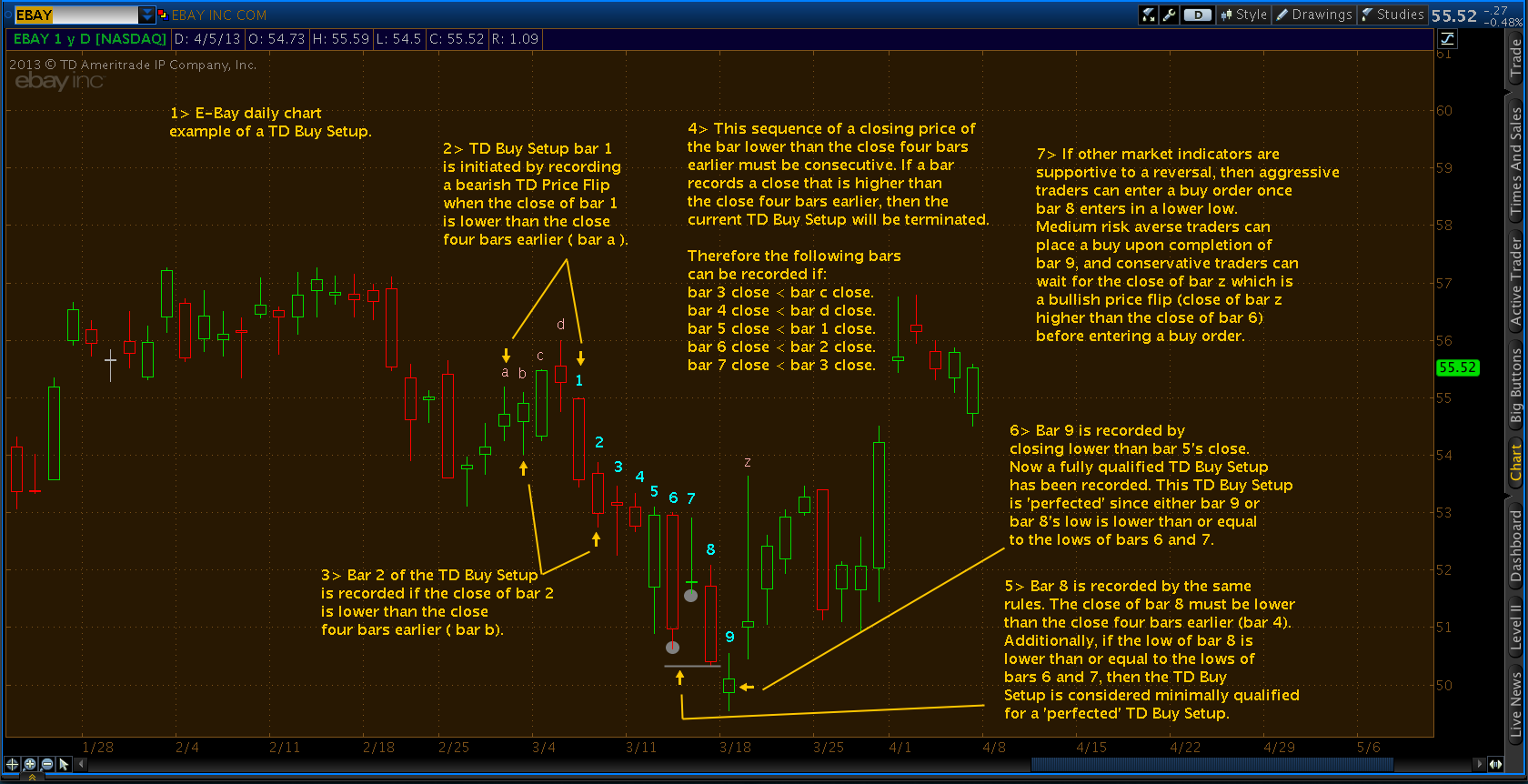

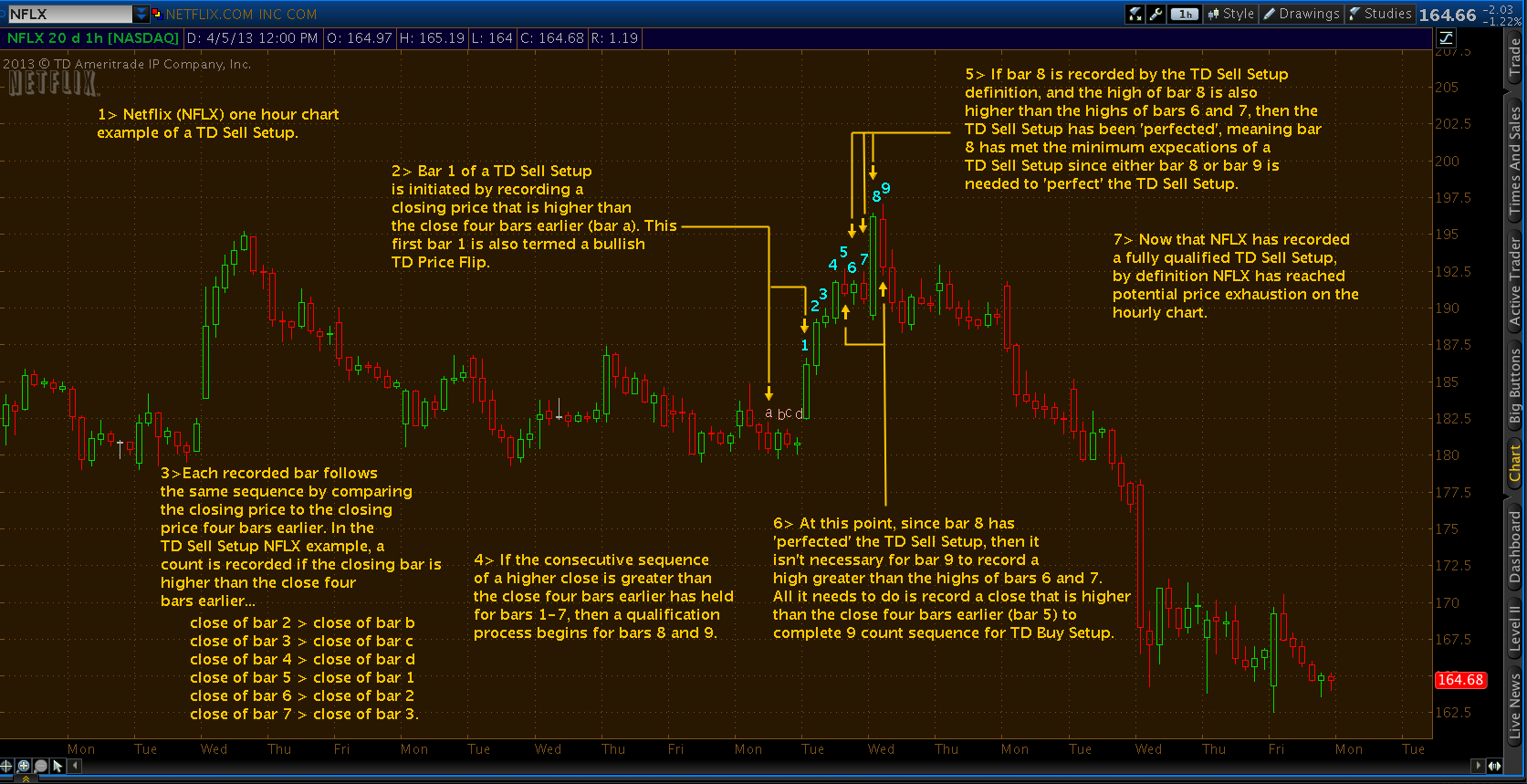

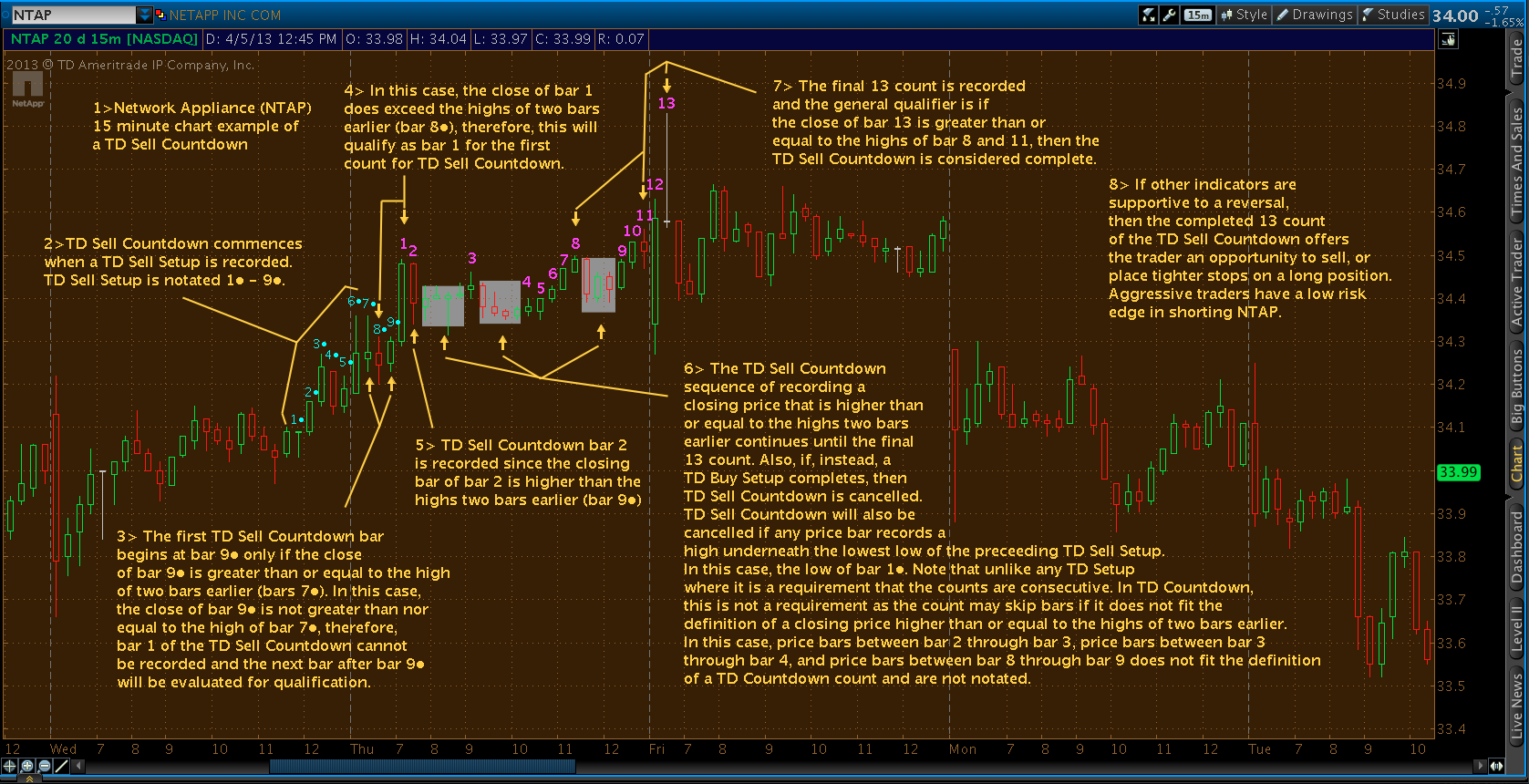

Below are four visual examples in describing the components of TD Sequential.

TD Buy Setup for Ebay (EBAY)

The written explanation of each example is numbered in order.

TD Buy Countdown for Zynga (ZNGA)

TD Sell Setup for Netflix (NFLX)

TD Sell Countdown for Network Appliance (NTAP)