calculate PREVIOUS DAY HIGH,PREVIOUS DAY LOW

MOST IMPORTANT ON BUY LOGIC :

----------------------------

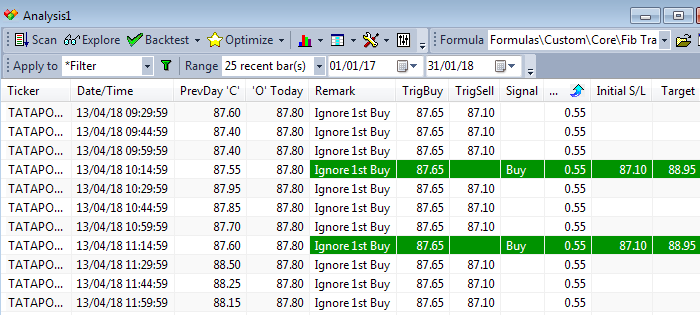

if buy recommended price < previous day's close price....entire day NO BUY..strictly

if day's first candle open price > buy recommended price , then ignore the first buy

BUY trade setup :

---------------

put 2 variables as follows :

CALCULATE " a " = (previous day high - (previous day high-previous day low ) * 0.382

CALCULATE " b " = (previous day high - (previous day high-previous day low ) * 0.618

here, a = buy recommended price , b = stoploss value for the buy entry.

*********a and b values are fixed should not be changed for entire day in buy side ******************

expert advisor must check the important rule :

----------------------------------------------

if a < previous day's close price... entire day no buy

and also

if current day's first candle open price > buy recommended price.. ignore that entry

target price = (previous day's high - previous day's low ) * 0.618 + a

stoploss price = a-b

book at target or exit at stoploss as per logic.

=============================================================================================

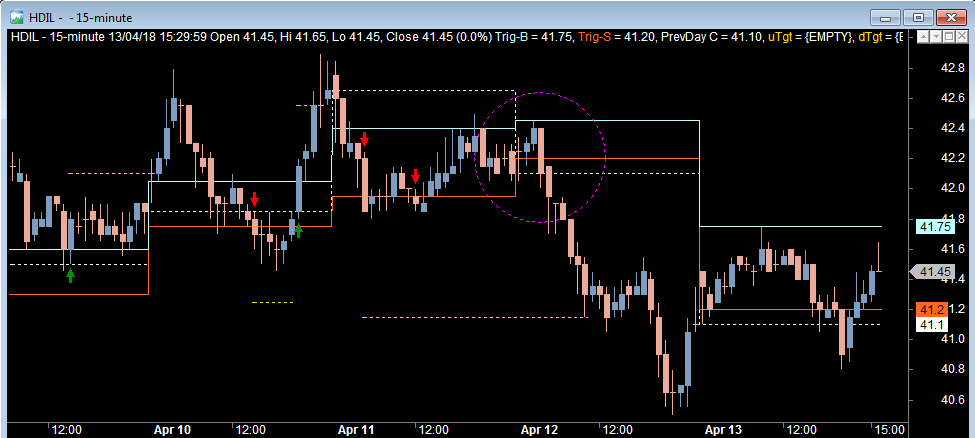

VERY IMPORTANT SELL LOGIC :

-----------------------------

if sell recommended price > previous day's close price....entire day NO SELL..strictly

if day's first candle open price < sell recommended price , then ignore the first sell

SELL trade setup :

---------------

put 2 variables as follows :

CALCULATE " a " = (previous day high - previous day low ) * 0.382 + previous day's low

CALCULATE " b " = (previous day high - previous day low ) * 0.618 + previous day's low

here, a = sell recommended price , b = stoploss value for the sell entry.

*********a and b values are fixed should not be changed for entire day in sell side ******************

expert advisor must check the important rule :

----------------------------------------------

if a > previous day's close price... entire day no sell

and also

if current day's first candle open price < sell recommended price.. ignore that entry

target price = (previous day's low - previous day's high ) * 0.618 + a

stoploss price = a-b

book at target or exit at stoploss as per logic.

=============================================================================================

MOST IMPORTANT ON BUY LOGIC :

----------------------------

if buy recommended price < previous day's close price....entire day NO BUY..strictly

if day's first candle open price > buy recommended price , then ignore the first buy

BUY trade setup :

---------------

put 2 variables as follows :

CALCULATE " a " = (previous day high - (previous day high-previous day low ) * 0.382

CALCULATE " b " = (previous day high - (previous day high-previous day low ) * 0.618

here, a = buy recommended price , b = stoploss value for the buy entry.

*********a and b values are fixed should not be changed for entire day in buy side ******************

expert advisor must check the important rule :

----------------------------------------------

if a < previous day's close price... entire day no buy

and also

if current day's first candle open price > buy recommended price.. ignore that entry

target price = (previous day's high - previous day's low ) * 0.618 + a

stoploss price = a-b

book at target or exit at stoploss as per logic.

=============================================================================================

VERY IMPORTANT SELL LOGIC :

-----------------------------

if sell recommended price > previous day's close price....entire day NO SELL..strictly

if day's first candle open price < sell recommended price , then ignore the first sell

SELL trade setup :

---------------

put 2 variables as follows :

CALCULATE " a " = (previous day high - previous day low ) * 0.382 + previous day's low

CALCULATE " b " = (previous day high - previous day low ) * 0.618 + previous day's low

here, a = sell recommended price , b = stoploss value for the sell entry.

*********a and b values are fixed should not be changed for entire day in sell side ******************

expert advisor must check the important rule :

----------------------------------------------

if a > previous day's close price... entire day no sell

and also

if current day's first candle open price < sell recommended price.. ignore that entry

target price = (previous day's low - previous day's high ) * 0.618 + a

stoploss price = a-b

book at target or exit at stoploss as per logic.

=============================================================================================