Can anybody know about how to code a intraday strategy in algo and also run a backrest like any professional who can help traders like me who know about the market have some knowledge and we want to improve the trading latency and want to use algo as a helper tool for quick trading but also not having any knowledge about algo or python coding but I do trade on amibroker and know about technical analysis. If anyone can suggest me to the right way because algo coding is very much difficult to learn.

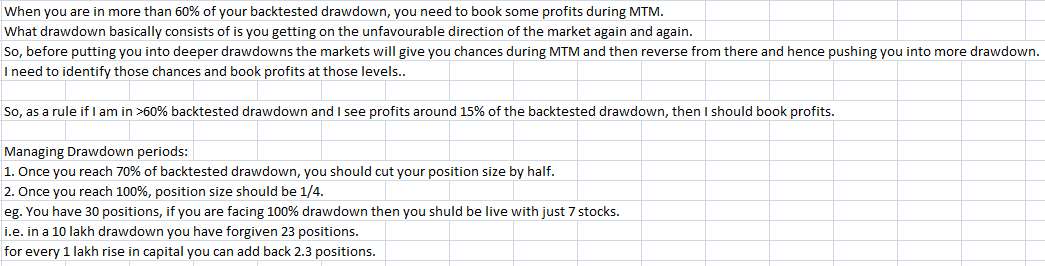

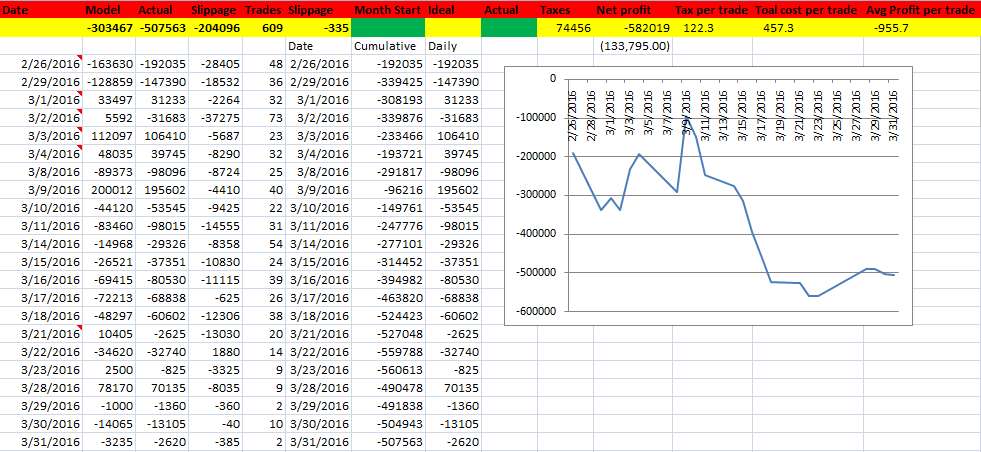

My algo trading daily performance

- Thread starter mechtrader

- Start date

Similar threads

-

-

Software engineer from Hyderabad - Freelancer for algo trading systems and Strategy development

- Started by vamsi_stockdeveloper

- Replies: 10

-

hi how to start algo trading from broker api?

- Started by hrchandran

- Replies: 4

-

Started Algo Trading - Daily Paper Trade updates

- Started by Cubt

- Replies: 228