Commodities Trading In India

- Thread starter TATrader

- Start date

A

Dear all,

Whether it is equity or commodities, one has to trade carefully in futures. These future's product can make or break your investments. As of now we have only futures available in commodities with out any hedges.

I dont want to comment on number of commodities or liquidity etc as this is a growing market.

But I would suggest... one has adopt TRADE approach while investing in commodities. Trade approach means---- Before you invest your margin (which is otherwise your capital) one has to be clear about the loss that he can bear. For example, If i am invetsing 1 lakh, i should be clear about my loss such as 50000 or 30000 etc. Then, devide your maximum loss with maximum loss that you want to afford per trade. Ex. I am ready to take a maximum loss of 3000 per trade. That means I should take 10 trades. Assuming all 10 trades hit stop loss then I will loose, Rs.30000/-. If 50% trades hits your target of Rs.4000 to 5000/- per trade, then you will be in profits.

Unfortunately, Most of the positional traders ( Those who take one trade and wait for the market to come in his favour) have suffered huge losses. (loosing entire capital and going to debits)

I can write it on paper that this trade call approach will yeild profits.

Do not over expose yourself. What should I call, if anyone is coming to Commodity Markets with a margin of 5000 to 10000 margins and expecting profits of 5000 to 10000/- ... To my human sense it is called as betting or gambling....I dont call it as speculation as speculation is informed trading with sufficient investment margins. Unfortunately, small brokers are allowing investors (?) to over exposures. I see someone writing loosing of 20% in a single day. How can one loose 20% in a day when the average volatility is 2 to 3%. That means he must have taken 10 lots of Crude oil with a margin of 12000 to 15000...Crazy man.....Better these kind of people should buy lottery tickets rather than speculation.

My suggestions>

1. Minimum investable amount is Rs.50000/- ( for Agri Commodities), Rs.100000 ( for metals. - Gold 100g and Silver 5Kg, and Copper) and Rs.200000 (For 1 kg Gold and 30 kg Silver and Zinc)

2. Maximum affordable Loss (Stop Loss) per trade in Agri is- Rs.2500 to 3000/- in Metals Maximum Loss should be Rs.4000 to 5000

3. At any point of time, do not try to have more than one trade. Many people tell to diversify thier portfolio. With the above minimum investment it is not advisable to have more than one position

4. The moment you take position, please enter stop loss. A delay of 5 or 10 min would show you hell... ( We have experienced it during Chana Craashhhh and Silver Crash )

5. Always expect annualized return. If you dont have patience to annulize your returns and expecting weekly or monthly returns, please take out your money....As you are bound to loose your capital

6. If you are systematic enough with above points,... you can expect a return of 5% per month with a risk of your pre-committed loss ( i.e Maximum loss.... assuming 10 trades hitting stop losses thus loosing 30000 to 40000)

7. If you want to be conservative then keep your buy orders at day's low level and Short orders at Day's high levels. This will substantially reduce your stop losses. But only problem, is your trade might or might not get executed. You have to wait for your turn next day.

Final suggestion: MARKETS ARE THERE FOR EVER....BUT YOUR MONEY (INVESTMENT) MIGHT NOT.... ALWAYS TRADE WITH STOP LOSSES

Happy Trading

Nanabala

9986039019

Bangalore

Whether it is equity or commodities, one has to trade carefully in futures. These future's product can make or break your investments. As of now we have only futures available in commodities with out any hedges.

I dont want to comment on number of commodities or liquidity etc as this is a growing market.

But I would suggest... one has adopt TRADE approach while investing in commodities. Trade approach means---- Before you invest your margin (which is otherwise your capital) one has to be clear about the loss that he can bear. For example, If i am invetsing 1 lakh, i should be clear about my loss such as 50000 or 30000 etc. Then, devide your maximum loss with maximum loss that you want to afford per trade. Ex. I am ready to take a maximum loss of 3000 per trade. That means I should take 10 trades. Assuming all 10 trades hit stop loss then I will loose, Rs.30000/-. If 50% trades hits your target of Rs.4000 to 5000/- per trade, then you will be in profits.

Unfortunately, Most of the positional traders ( Those who take one trade and wait for the market to come in his favour) have suffered huge losses. (loosing entire capital and going to debits)

I can write it on paper that this trade call approach will yeild profits.

Do not over expose yourself. What should I call, if anyone is coming to Commodity Markets with a margin of 5000 to 10000 margins and expecting profits of 5000 to 10000/- ... To my human sense it is called as betting or gambling....I dont call it as speculation as speculation is informed trading with sufficient investment margins. Unfortunately, small brokers are allowing investors (?) to over exposures. I see someone writing loosing of 20% in a single day. How can one loose 20% in a day when the average volatility is 2 to 3%. That means he must have taken 10 lots of Crude oil with a margin of 12000 to 15000...Crazy man.....Better these kind of people should buy lottery tickets rather than speculation.

My suggestions>

1. Minimum investable amount is Rs.50000/- ( for Agri Commodities), Rs.100000 ( for metals. - Gold 100g and Silver 5Kg, and Copper) and Rs.200000 (For 1 kg Gold and 30 kg Silver and Zinc)

2. Maximum affordable Loss (Stop Loss) per trade in Agri is- Rs.2500 to 3000/- in Metals Maximum Loss should be Rs.4000 to 5000

3. At any point of time, do not try to have more than one trade. Many people tell to diversify thier portfolio. With the above minimum investment it is not advisable to have more than one position

4. The moment you take position, please enter stop loss. A delay of 5 or 10 min would show you hell... ( We have experienced it during Chana Craashhhh and Silver Crash )

5. Always expect annualized return. If you dont have patience to annulize your returns and expecting weekly or monthly returns, please take out your money....As you are bound to loose your capital

6. If you are systematic enough with above points,... you can expect a return of 5% per month with a risk of your pre-committed loss ( i.e Maximum loss.... assuming 10 trades hitting stop losses thus loosing 30000 to 40000)

7. If you want to be conservative then keep your buy orders at day's low level and Short orders at Day's high levels. This will substantially reduce your stop losses. But only problem, is your trade might or might not get executed. You have to wait for your turn next day.

Final suggestion: MARKETS ARE THERE FOR EVER....BUT YOUR MONEY (INVESTMENT) MIGHT NOT.... ALWAYS TRADE WITH STOP LOSSES

Happy Trading

Nanabala

9986039019

Bangalore

I agree with you to full extent as you outlined money managment principles in layman terms and there is lot of regulation's yet to come to keep this market in control

Hi Gayathri,

Crude is basically driven by following factors.

1. Weekly US Inventory data ( Wednesday). Increase or decrease in inventories will drive higher or lower

2. Monthly Weather forecast of US.

3. OPEC decision of production Cut ( prices increase) or No production Cut ( price decrease)

4. Militatnt activities. On Friday night, some militants attcked on eof the oil refineries in Nigeria. result was an immediate upside of 1$.

So, if you want to trade you need to have supportive fundamental news about Crude.

Visit reuters website regularly or take the help of any good broking firms. To the best of my knowledge all the premier brokers give good calls on Crude.

When compared to Agri & Metals, investments in crude is always safe as the daily average volatility is 1% i.e 2000 to 3000 ( in exceptional cases it moves by 6000). Keep stoplosses and trade. you will get decent returns.

Happy Trading

Nanabala

Bangalore

9986039019

Crude is basically driven by following factors.

1. Weekly US Inventory data ( Wednesday). Increase or decrease in inventories will drive higher or lower

2. Monthly Weather forecast of US.

3. OPEC decision of production Cut ( prices increase) or No production Cut ( price decrease)

4. Militatnt activities. On Friday night, some militants attcked on eof the oil refineries in Nigeria. result was an immediate upside of 1$.

So, if you want to trade you need to have supportive fundamental news about Crude.

Visit reuters website regularly or take the help of any good broking firms. To the best of my knowledge all the premier brokers give good calls on Crude.

When compared to Agri & Metals, investments in crude is always safe as the daily average volatility is 1% i.e 2000 to 3000 ( in exceptional cases it moves by 6000). Keep stoplosses and trade. you will get decent returns.

Happy Trading

Nanabala

Bangalore

9986039019

hi Nanbala,

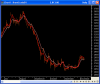

you have given very valuable info on crude. thanks. though I donot track fundamentals but info is very important and precise and your earlier post on trading method very good. I trade crude regularily and agree its low risk high reward commo. One of the method I try and with good success is simple method of MA-lagless MA cross overmethod as shown in the chart.

spiderman

you have given very valuable info on crude. thanks. though I donot track fundamentals but info is very important and precise and your earlier post on trading method very good. I trade crude regularily and agree its low risk high reward commo. One of the method I try and with good success is simple method of MA-lagless MA cross overmethod as shown in the chart.

spiderman

Attachments

-

28.3 KB Views: 266

hi Nanbala,

you have given very valuable info on crude. thanks. though I donot track fundamentals but info is very important and precise and your earlier post on trading method very good. I trade crude regularily and agree its low risk high reward commo. One of the method I try and with good success is simple method of MA-lagless MA cross overmethod as shown in the chart.

spiderman

you have given very valuable info on crude. thanks. though I donot track fundamentals but info is very important and precise and your earlier post on trading method very good. I trade crude regularily and agree its low risk high reward commo. One of the method I try and with good success is simple method of MA-lagless MA cross overmethod as shown in the chart.

spiderman

Hi,

You guys seem to be quite experienced in the field of commodities trading.

I want to learn to trade commodities.

Could you please suggest the trading terminal you think is good (or what you use).

Fast order processing, basic charts and indicators is mainly what i am looking for.

And i would be great if you could tell me the brokerage also.

Thanks...

You guys seem to be quite experienced in the field of commodities trading.

I want to learn to trade commodities.

Could you please suggest the trading terminal you think is good (or what you use).

Fast order processing, basic charts and indicators is mainly what i am looking for.

And i would be great if you could tell me the brokerage also.

Thanks...

hi Nanbala,

you have given very valuable info on crude. thanks. though I donot track fundamentals but info is very important and precise and your earlier post on trading method very good. I trade crude regularily and agree its low risk high reward commo. One of the method I try and with good success is simple method of MA-lagless MA cross overmethod as shown in the chart.

spiderman

you have given very valuable info on crude. thanks. though I donot track fundamentals but info is very important and precise and your earlier post on trading method very good. I trade crude regularily and agree its low risk high reward commo. One of the method I try and with good success is simple method of MA-lagless MA cross overmethod as shown in the chart.

spiderman

thanks

geeta

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| N | NSE Starting Commodities Trading--Your Views? | General Trading & Investing Chat | 5 | |

| H | VSA for daytrading commodities | Energy | 21 | |

| R | Will there be a ban in commodities trading in India? | Commodities | 4 | |

| H | Online Commodities trading in india | Commodities | 11 | |

|

|

Beginners guide to trading commodities in India | Commodities | 9 |

Similar threads

-

NSE Starting Commodities Trading--Your Views?

- Started by newtrader101

- Replies: 5

-

-

-

-