Hi

Can Anyone help me on FUTURES AND OPTIONS in simple way with an example.

Im new to trading and i dont understand explanations given on the web

someone please help me

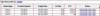

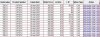

I have attached some sample

can any please explain

how much money do i need to invest in futures & options

Thanks

Arun

Can Anyone help me on FUTURES AND OPTIONS in simple way with an example.

Im new to trading and i dont understand explanations given on the web

someone please help me

I have attached some sample

can any please explain

how much money do i need to invest in futures & options

Thanks

Arun

Attachments

-

13 KB Views: 92

-

44 KB Views: 51

-

58.4 KB Views: 48