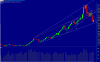

Well time to review, during the bull market, we used to have significant corrections approx every 6 months & now this seems to be a case in the bear market...

Only consolation is we stopped right where the monthly trendline of the bull market is... IMHO somewhere in August 2nd week onwards we should go to test the same, whether it holds or breaks we should review the the further course, yours views if any please...

PS: @CV: you were right it takes sometime to adapt but still the same, thanks.

===================================================================================

For those new to stock markets: some old food for thought:

To end, some interesting quotes:

1)

from a post of Traderji:

The Start of a Bear Market

After mutual funds and retail investors are fully invested, the market is overbought. This means that there is no more cash to fuel the rally. The market can only go in one direction: down. All it takes is just a hint of negative news and the market collapses under its own weight. Investors quickly realize the market is made of smoke and mirrors, as frauds or other scams come to light.

When panic selling starts, a market will always fall quicker than it had risen. Oftentimes, as everyone heads for the exit at the same time, there isnt anyone willing to buy the stock. This can be especially disastrous for margin users as they grow deeply indebted to their brokers. Bankruptcy is the usual result for these foolish gamblers. The majority of retail investors dont sell even as the market is plummeting. This crowd keeps holding on to stocks in hopes that the market will recover. As the market plummets 25%, then 50% the average retail investor foolishly holds on, in complete denial that the bull market is over. Finally retail investors sell every stock they own plummeting the market even further. This mass exodus is called capitulation.

http://www.traderji.com/technical-analysis/trading-psyc...et-cycles.html

2) post by a joe black:

HOT STOCKS

CONFIDENTIAL ESSAY

By George Chelekis

NOTE: I believe this may be one of the most important essays on the financial markets which you will ever read. This essay will be

the lead article in Hot Stocks Review, (Part Two). Up until recently, I knew that I was missing something, but I could not

quite put my finger on it. Now I know what it is. The data which follows is only as good as you can actually use it. These are the cold, savage and ruthless facts of market manipulation. I have not made these up, but have dug them up out of out-dated, generally unavailable books on Canadian market manipulations, and pieced the rest together from observations, personal experiences and conversations with market professionals and insiders. While the books are out of date, the manipulations have been passed down from one generation to another. The only thing missing was someone to supply you with what those tricks were so you can become a more educated speculator. Many thanks to Robert Short and Vern Flannery, of Market News Publishing, for finding and sending me a copy of the book, "The Story Behind Canadian Mining Speculation" by T. H. Mitchell, first published in 1957 by George J. McLeod Limited; also Ivan Shaffer's book, "The Stock Promotion Game." I have been told that many of these tricks are now illegal. If so, would someone please tell that to the market manipulators.

THE DEADLY ART OF STOCK MANIPULATION....

In every profession, there are probably a dozen or two major rules. Knowing them cold is what separates the professional from the

amateur. Not knowing them at all? Well, let's put it this way: How safe would you feel if you suddenly found yourself piloting (solo) a Boeing 747 as it were landing on an airstrip? Unless you are a professional pilot, you would probably be frightened out of your wits and would soil your underwear. Hold that thought as you read this essay because I will explain to you how market manipulation works.

In order to successfully speculate, one should presume the following: THE SMALL CAP STOCK MARKETS PRIMARILY EXIST TO FLEECE YOU! I'm talking about Vancouver, Alberta, the Canadian Dealing Network and the US Over-the Counter markets (Pink Sheets, Bulletin Board, etc.). One could also stretch this, with many stocks, to include the world's senior stock markets, including Toronto, New York, NASDAQ, London, etc. The average investor or speculator is not very likely to have much success in the small cap crapshoots. I guess that is what attracted ME to these markets. I have been trying, for quite some time, to answer this question, "How come?" Now, I know. And you should, too!

By the way, the premise of these books is uniformly: "While these speculative companies do not actually make any money, one can profit by speculating in these companies." THAT is the premise on how these markets are run, by both the stock promoters, insiders, brokers, analysts and others in this industry. That logic is flawed in that it presumes "someone else" is going to end up holding the dirty bag. Follow this premise all the way through and you will realize the insane conclusion: For these markets to continue along that route, new suckers have to continue coming into the marketplace. The conclusion is insane in that such mad activity can only be short-lived. I disagree with this premise and propose another solution (see my earlier essay: A Modest Proposal) at the end of this essay.

What the professionals and the securities regulators know and understand, which the rest of us do not, is this.

"RULE NUMBER ONE: ALL SHARP PRICE MOVEMENTS -- WHETHER UP OR DOWN -- ARE THE RESULT OF ONE OR MORE (USUALLY A GROUP OF) PROFESSIONALS MANIPULATING THE SHARE PRICE."

This should explain why a mining company finds something good and "nothing happens" or the stock goes down. At the same

time, for NO apparent reason, a stock suddenly takes off for the sky! On little volume! Someone is manipulating that stock, often with an unfounded rumor.

In order to make these market manipulations work, the professionals assume: (a) The Public is STUPID and (b) The Public

will mainly buy at the HIGH and (c) The Public will sell at the LOW.

Therefore, as long as the market manipulator can run crowd control, he can be successful.

Let's face it: The reason you speculate in such markets is that you are greedy AND optimistic. You believe in a better tomorrow and NEED to make money quickly. It is this sentiment which is exploited by the market manipulator. He controls YOUR greed and fear about a particular stock. If he wants you to buy, the company's prospects look like the next Microsoft. If the manipulator wants you to desert the sinking ship, he suddenly becomes very guarded in his remarks about the company, isn't around to glowingly answer questions about the company and/or GETS issued very bad news about the company. Which brings us to the next important rule.

"RULE NUMBER TWO: IF THE MARKET MANIPULATOR WANTS TO DISTRIBUTE (DUMP) HIS SHARES, HE WILL START A GOOD NEWS PROMOTIONAL CAMPAIGN."

Ever wonder why a particular company is made to look like the greatest thing since sliced bread? That sentiment is manufactured.

Newsletter writers are hired -- either secretly or not -- to cheerlead a stock. PR firms are hired and let loose upon an unsuspecting public. Contracts to appear on radio talk shows are signed and implemented. Stockbrokers get "cheap" stock to recommend the company to their "book" (that means YOU, the client in his book). An advertising campaign is rolled out (television ads, newspaper ads, card deck mailings). The company signs up to exhibit at "investment conferences" and "gold shows" (mainly so they can get a little "podium time" to hype you on their stock and tell you how "their company is really different" and "not a stock promotion.") Funny little "hype" messages are posted on Internet newsgroups by the same cast of usual suspects. The more, the merrier. And a little "juice" can go a long way toward running up the stock price.

The HYPE is on. The more clever a stock promoter, the better his knowledge of the advertising business. Little gimmicks like

"positioning" are used. Example: Make a completely unknown company look warm and fuzzy and appealing to you by comparing it

to a recent success story, Diamond Fields or Bre-X Minerals. That is the POSITIONING gospel, authored by Ries and Trout (famous for "Avis: We Want To Be #1" and "We Try Harder" and other such slogans). These advertising/PR executives must have stumbled onto this formula after losing their shirts speculating in a few Canadian stock promotions! The only reason you have been invited to this seemingly incredible banquet is that YOU are the main course. After the market manipulator has suckered you into "his investment," exchanging HIS paper for YOUR cash, the walls begin to close in on you. Why is that?

http://www.traderji.com/technical-analysis/trading-psyc...ation-pt1.html