There are many fancy statistics when it comes to analyzing trading performance but the simplest of all is Expectancy.

If you are profitable trader then you should have a positive expectancy else a negative one.

Knowing your Expectancy is very useful. First it says whether you have a edge or not. Second it says how powerful is your edge and how much effort you need to put to make money.

How to calculate

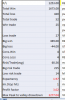

1) Find your list of trades preferably live(than backtest) in last month or last 6 month or year... the more data you have the more reliable numbers you get

2) calculate number of profitable trades and number of losing trades

and then calculate the percentage winner and percentage looser

3) Sum of all winners amt / number of winners = avg winning trade

similarly sum of all losing trades /number of losers = avg loosing trade

Then calculate Risk to Reward ratio as avg loosing trade : avg winning trade

when calculating Risk to reward always make Risk as 1.

4) now to calculate Expectancy = ( percentage winner * Reward ratio - percentage looser * risk ratio ) / 100

My current system which I have been trading for a while has a expectancy of 0.35. Not happy looking to improve my numbers but it is not easy.

If you are profitable trader then you should have a positive expectancy else a negative one.

Knowing your Expectancy is very useful. First it says whether you have a edge or not. Second it says how powerful is your edge and how much effort you need to put to make money.

How to calculate

1) Find your list of trades preferably live(than backtest) in last month or last 6 month or year... the more data you have the more reliable numbers you get

2) calculate number of profitable trades and number of losing trades

and then calculate the percentage winner and percentage looser

3) Sum of all winners amt / number of winners = avg winning trade

similarly sum of all losing trades /number of losers = avg loosing trade

Then calculate Risk to Reward ratio as avg loosing trade : avg winning trade

when calculating Risk to reward always make Risk as 1.

4) now to calculate Expectancy = ( percentage winner * Reward ratio - percentage looser * risk ratio ) / 100

My current system which I have been trading for a while has a expectancy of 0.35. Not happy looking to improve my numbers but it is not easy.