Dear swagat,

So you totally switched your earlier method which you made from since last 3-4 years knowlege in one go ....

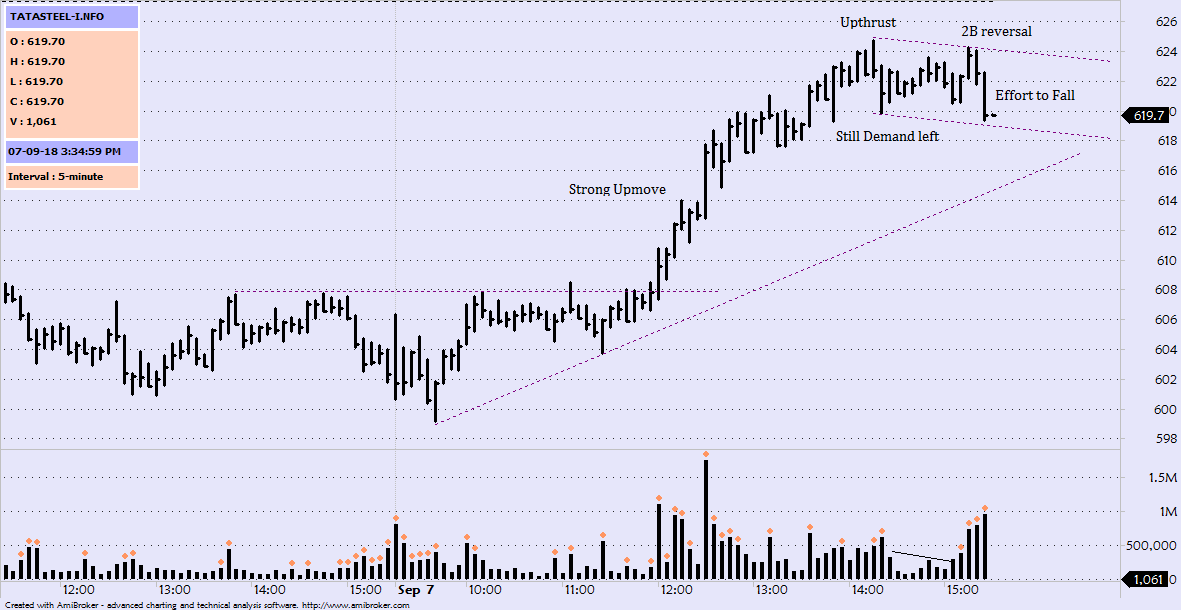

Am again telling you method is need ...buf important is how you apply in our trades....if you look yesterdays tatasteel imo every method catched that move...some method could catched even from bottom...only thing some dif in entry values only....no method is there as holygrail

So you totally switched your earlier method which you made from since last 3-4 years knowlege in one go ....

Am again telling you method is need ...buf important is how you apply in our trades....if you look yesterdays tatasteel imo every method catched that move...some method could catched even from bottom...only thing some dif in entry values only....no method is there as holygrail

Last edited: