oops....

lost!!! all the profit and 5% of capital in a single trade!!!

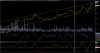

Hmmm... ONGC stoploss hit and everything sold at 1290!!!

And the same moment a bounce in market!!!

But Costly lesson learned!!!

Dont PANIC... Just wait for you ship to come!!! Could have minimized loss and made profit if had a small wait! Ha... remorse!!!

lost!!! all the profit and 5% of capital in a single trade!!!

Hmmm... ONGC stoploss hit and everything sold at 1290!!!

And the same moment a bounce in market!!!

But Costly lesson learned!!!

Dont PANIC... Just wait for you ship to come!!! Could have minimized loss and made profit if had a small wait! Ha... remorse!!!

Costly yes, but not a good lesson to learn. May be it turned this time, and maybe it would just not do so next time ...

Stops are to be honoured, not streched ...

I read/heard some place

A good teacher uses pleasure/pain (Reward/Punishment) to teach, you get praise when right and scolding when wrong,

Markets are anything but Good Teacher, in the markets we might keep geting stopped, (pain, lots of it) inspite of trading the signals from our system correctly.

And yes to top it all the -ve reinforcements about would have, could have, should have ...

Markets are anything but Good Teacher, in the markets we might keep geting stopped, (pain, lots of it) inspite of trading the signals from our system correctly.

And yes to top it all the -ve reinforcements about would have, could have, should have ...

Thanks

nb

!

!