If you go into the details of the payoff, you will notice that most of the payoff will come in the later half of the series. Even if the market remains in this range, max payoff is 5000 (not likely though, 2500 considering average payoff). The margin required for this spread is around 80000 (I am holding a single butterfly and the margin requirement is 41000). So, while the profit range is large, the ROC is not great. In my view, it is a safe, but not a great spread to hold at the start of the series.

but still these kind of low risk strategies are my favorites as its got its own pros and cons-

cons-

1. we can not leave our job and trade these kind of setups as trading for living depending on these is not possible

2. needs big funds to achieve the above

3. its conservative and act as capital appreciation method

4. there are similar ROI business are around which one can do

pros-

1. capital is saved most of the times

2. certainty of profits is high

3. capital appreciation method combining with the concept of compound % is killing

4. supporting to above point at stock market your investment can be highly scaled

the list is end less...

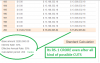

1. as you said let you make 2500 for 80000 - like JUST ONE TRADE a month

2. you have been good only 10 times in a year

3. as you can scale it up in markets you reinvested - lets take the basic as its compounded yearly

you know what you make at the end of 10 years

Rs. 11,02,867

assume you are playing this strategy with 200000 capital and going for job or along with running your own business ( all you can do as it will NOT demand lot of time from you- just one trade!!!!)

your total in trading account would be Rs, 27,57,000

now dont worry about short term capital gain tax as you are reinvesting :thumb:

all these are for 1 trade but during 10 long years dont you rise your number of trades to 200???? then what is your ending capital??????

http://postimg.org/image/w8ltk2j8h/

I believe in these kind of progressive policies & its executions

now you see why i answered "i am profitable on quarterly basis as well as yearly basis"

Attachments

-

20.5 KB Views: 54

Last edited: