Metals ALERTS BY "santhosh2010"

- Thread starter santhosh2010

- Start date

Silver long term view [vimalraj]

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

1. What is National Spot Exchange?

National Spot Exchange Limited (NSEL) is the national level, institutionalized, demutualised and

transparent Electronic Spot Exchange set up by Financial Technologies India Limited (FTIL) and

National Agricultural Co-operative Marketing Federation of India Limited (NAFED) to create a

delivery based pan India spot market for commodities. It is commodities exchange in India just

like Multi Commodity Exchange (MCX)& National Commodity and Derivatives Exchange (NCDEX).

2.What commodities are traded on NSEL e-Series Platform?

e-SERIES is an innovative commodities investment product from NSEL. It enables investors to

invest their funds into commodities in smaller denomination and hold it in Demat form for

sale/delivery in future. Presently under e-Series product NSEL has launched e-Gold, e-Silver, e-

Copper, e-Zinc ,e-Lead , e-Nickel& e-Platinum. You can deal in all non perishable commodities

through NSEL.

3.What is dematerialization or dematting of commodities?

Dematerialization of commodity implies storage of commodities in NSEL Exchange designated

vaults/ warehouses and keeping record of its ownership in electronic form. The legal and

beneficial owner of the goods gets a credit in his account electronically, which is similar to holding

a pass book in the bank. Similarly, transfer of ownership against buy and sale is done from one

account to the other, just like money transfer through a cheque. Customer can view the holding

and transfers in their commodity accounts.

4.How to buy commodities in Demat form? What is the process?

The process is similar to opening Demat account for equity. The investor is required to fill-up

Demat account opening form and provide his KYC (know your client) documents to any of the

ICICI Bank Branch offering Demat services.

Customers will not be able to buy through ICICI Direct Trading account. Customers will have to

open a trading account with any other broker to purchase and sell commodities in NSEL platform.

It would be a standalone Demat account.

5.What are the timings for trading in Demat commodities on NSEL platform?

Trading in E-Gold as well as other e-Series products is available from Monday to Friday from

10:00 am to 11:30 pm. Trading in E-Series products are not allowed on Saturdays and other

holidays notified by the Exchange.

6. I am an investor holding a Demat account for equities. Am I required to open separate Demat

account for NSEL?

Yes. You have to open a separate Demat account with NSEL. For holding equities and

commodities, separate Demat accounts are required. However, if you have a Demat account

opened for trading in Multi Commodity Exchange (MCX)& National Commodity and Derivatives

Exchange (NCDEX) , the same account can be used for NSEL.

7.Are E-Series products launched by NSEL compulsory Demat units or I can get physical

warehouse receipts too?

E-Series product launched by NSEL are compulsory Demat units. For taking delivery of such units,

you must have a Demat account. Similarly, for selling in E-Series contract, you must hold Demat

units in your commodity account.

8.If I have sold E-Gold units, how will I deliver the same?

On the trading day or T+1 day, you have to issue a delivery instruction for sale (DIS) to ICICI Bank

offering Demat Services. Please ensure to write correct settlement number, market type, ICIN

number and quantity. Your member (broker) will provide you the market type and settlement

number. The instructions should be received latest by 4 p.m on business day prior to the

execution date. Instructions received after 4 p.m. will be accepted on BEST EFFORT BASIS.

9.Am I required to pay some custody charges?

No, there is no custody charges applicable for holding the e-series (e-gold/e-silver/e-copper etc)

units in Demat form.

10.Can I take physical delivery of goods against surrender of Demat units?

Yes. The process is very simple. Customers needs to submit the Surrender Request Form (SRF)

along with the copy of Delivery Instruction Slip (DIS) and PAN card copy of the account

holder,who will collect the delivery from the NSEL designated delivery centres . You can take

physical delivery of goods against surrender of Demat units at any point of time.

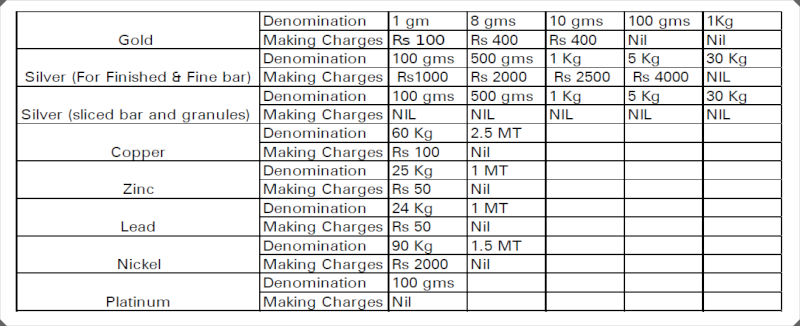

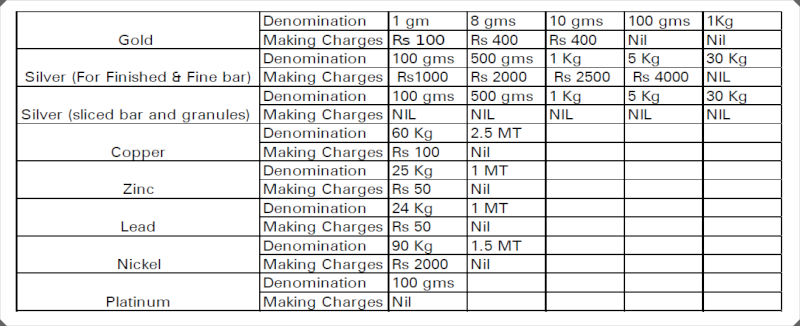

11.Is conversion into physical units available and in what denomination ?

The physical delivery for 1gm, 8gm, 10gm will be in the form of Gold coins and 100gms and 1 Kg

in the form of gold bars. The Making Charges are given below for physical conversion. The clients

opting for conversion of electronic units to physical units will be required to pay VAT/Octroi or any

other local taxes as applicable at the place of the delivery and service will be applicable on

making/packing charges. There will be also delivery charges for e-Zinc, e-Nickel,e-Copper,e-Lead.

Customer will have to pay the charges directly to the exchange (NSEL).

12. What will be the purity of the physical e-Series Units?

E-Gold – Per 1 gram Gold of 99.5% purity

E-Silver- Per 100 gram Silver of 99.9% purity

E- Copper- GRADE 1 COPPER CATHODE: Copper Cathode conforming to standards as defined

under ASTM B 115-00 (Reapproved 2004)/BS EN1978:1998(Cu Cath-1)/IS 191, Confirming to LME

Grade A

E- Zinc- Zinc Ingots of 99.995% purity conforming to BS EN 1179:2003

E-Lead- Lead Ingots of 99.99% purity

E- Nickel-NSEL Standard Nickel (Cathodes) of 99.80% purity

E-Platinum- Platinum of 99.5% purity

13.What is the TAT for getting the physical delivery of commodities?

The exchange makes necessary arrangement of physical commodity at the requested delivery

centre within 7 working days from the date of receipt of SRF & E-series units. However the same

can be extended up to 15 days in case of non availability of the commodity at specific

denominations at the particular delivery centre.

14. Can I pledge the commodities for availing overdraft?

Yes, commodities can be pledged for availing overdraft facility.

THANKS TO : ICICI DIRECT

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

1. What is National Spot Exchange?

National Spot Exchange Limited (NSEL) is the national level, institutionalized, demutualised and

transparent Electronic Spot Exchange set up by Financial Technologies India Limited (FTIL) and

National Agricultural Co-operative Marketing Federation of India Limited (NAFED) to create a

delivery based pan India spot market for commodities. It is commodities exchange in India just

like Multi Commodity Exchange (MCX)& National Commodity and Derivatives Exchange (NCDEX).

2.What commodities are traded on NSEL e-Series Platform?

e-SERIES is an innovative commodities investment product from NSEL. It enables investors to

invest their funds into commodities in smaller denomination and hold it in Demat form for

sale/delivery in future. Presently under e-Series product NSEL has launched e-Gold, e-Silver, e-

Copper, e-Zinc ,e-Lead , e-Nickel& e-Platinum. You can deal in all non perishable commodities

through NSEL.

3.What is dematerialization or dematting of commodities?

Dematerialization of commodity implies storage of commodities in NSEL Exchange designated

vaults/ warehouses and keeping record of its ownership in electronic form. The legal and

beneficial owner of the goods gets a credit in his account electronically, which is similar to holding

a pass book in the bank. Similarly, transfer of ownership against buy and sale is done from one

account to the other, just like money transfer through a cheque. Customer can view the holding

and transfers in their commodity accounts.

4.How to buy commodities in Demat form? What is the process?

The process is similar to opening Demat account for equity. The investor is required to fill-up

Demat account opening form and provide his KYC (know your client) documents to any of the

ICICI Bank Branch offering Demat services.

Customers will not be able to buy through ICICI Direct Trading account. Customers will have to

open a trading account with any other broker to purchase and sell commodities in NSEL platform.

It would be a standalone Demat account.

5.What are the timings for trading in Demat commodities on NSEL platform?

Trading in E-Gold as well as other e-Series products is available from Monday to Friday from

10:00 am to 11:30 pm. Trading in E-Series products are not allowed on Saturdays and other

holidays notified by the Exchange.

6. I am an investor holding a Demat account for equities. Am I required to open separate Demat

account for NSEL?

Yes. You have to open a separate Demat account with NSEL. For holding equities and

commodities, separate Demat accounts are required. However, if you have a Demat account

opened for trading in Multi Commodity Exchange (MCX)& National Commodity and Derivatives

Exchange (NCDEX) , the same account can be used for NSEL.

7.Are E-Series products launched by NSEL compulsory Demat units or I can get physical

warehouse receipts too?

E-Series product launched by NSEL are compulsory Demat units. For taking delivery of such units,

you must have a Demat account. Similarly, for selling in E-Series contract, you must hold Demat

units in your commodity account.

8.If I have sold E-Gold units, how will I deliver the same?

On the trading day or T+1 day, you have to issue a delivery instruction for sale (DIS) to ICICI Bank

offering Demat Services. Please ensure to write correct settlement number, market type, ICIN

number and quantity. Your member (broker) will provide you the market type and settlement

number. The instructions should be received latest by 4 p.m on business day prior to the

execution date. Instructions received after 4 p.m. will be accepted on BEST EFFORT BASIS.

9.Am I required to pay some custody charges?

No, there is no custody charges applicable for holding the e-series (e-gold/e-silver/e-copper etc)

units in Demat form.

10.Can I take physical delivery of goods against surrender of Demat units?

Yes. The process is very simple. Customers needs to submit the Surrender Request Form (SRF)

along with the copy of Delivery Instruction Slip (DIS) and PAN card copy of the account

holder,who will collect the delivery from the NSEL designated delivery centres . You can take

physical delivery of goods against surrender of Demat units at any point of time.

11.Is conversion into physical units available and in what denomination ?

The physical delivery for 1gm, 8gm, 10gm will be in the form of Gold coins and 100gms and 1 Kg

in the form of gold bars. The Making Charges are given below for physical conversion. The clients

opting for conversion of electronic units to physical units will be required to pay VAT/Octroi or any

other local taxes as applicable at the place of the delivery and service will be applicable on

making/packing charges. There will be also delivery charges for e-Zinc, e-Nickel,e-Copper,e-Lead.

Customer will have to pay the charges directly to the exchange (NSEL).

12. What will be the purity of the physical e-Series Units?

E-Gold – Per 1 gram Gold of 99.5% purity

E-Silver- Per 100 gram Silver of 99.9% purity

E- Copper- GRADE 1 COPPER CATHODE: Copper Cathode conforming to standards as defined

under ASTM B 115-00 (Reapproved 2004)/BS EN1978:1998(Cu Cath-1)/IS 191, Confirming to LME

Grade A

E- Zinc- Zinc Ingots of 99.995% purity conforming to BS EN 1179:2003

E-Lead- Lead Ingots of 99.99% purity

E- Nickel-NSEL Standard Nickel (Cathodes) of 99.80% purity

E-Platinum- Platinum of 99.5% purity

13.What is the TAT for getting the physical delivery of commodities?

The exchange makes necessary arrangement of physical commodity at the requested delivery

centre within 7 working days from the date of receipt of SRF & E-series units. However the same

can be extended up to 15 days in case of non availability of the commodity at specific

denominations at the particular delivery centre.

14. Can I pledge the commodities for availing overdraft?

Yes, commodities can be pledged for availing overdraft facility.

THANKS TO : ICICI DIRECT

Mcx Nickel ~ Positional view in Technical analysis

According to previous events the price has still been trapped between 828 -812,thus it is reasonable to be careful at this area.

Nickel now facing strong resistance at 828 -831 levels,then it will indicate considerable bullish strength.

Nickel if trade and hold above the strong resistance (828 -831) then fresh break-out target : 871.00,one who take the fresh positions here keep stop loss : 811.00.

Chart and views updates for learning purpose only,Therefore should take any trading positions with your own analysis….

According to previous events the price has still been trapped between 828 -812,thus it is reasonable to be careful at this area.

Nickel now facing strong resistance at 828 -831 levels,then it will indicate considerable bullish strength.

Nickel if trade and hold above the strong resistance (828 -831) then fresh break-out target : 871.00,one who take the fresh positions here keep stop loss : 811.00.

Chart and views updates for learning purpose only,Therefore should take any trading positions with your own analysis….

Re: Mcx Nickel ~ Positional view in Technical analysis

Thanks Santhosh, Your post are very informative.

Thanks Santhosh, Your post are very informative.

According to previous events the price has still been trapped between 828 -812,thus it is reasonable to be careful at this area.

Nickel now facing strong resistance at 828 -831 levels,then it will indicate considerable bullish strength.

Nickel if trade and hold above the strong resistance (828 -831) then fresh break-out target : 871.00,one who take the fresh positions here keep stop loss : 811.00.

Chart and views updates for learning purpose only,Therefore should take any trading positions with your own analysis….

Nickel now facing strong resistance at 828 -831 levels,then it will indicate considerable bullish strength.

Nickel if trade and hold above the strong resistance (828 -831) then fresh break-out target : 871.00,one who take the fresh positions here keep stop loss : 811.00.

Chart and views updates for learning purpose only,Therefore should take any trading positions with your own analysis….

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Commodities Forecasting Views ! Crude,Ngas,Base Metals ETC. | Commodities | 8 | |

|

|

Metallica - Rocking the Metals (Trending with MA) | Metals | 3 | |

| U | RTD from Nest Trader for Metals and Crude | Intraday | 1 | |

|

|

Trading In Base Metals | Metals | 13 | |

| G | Trading Diary for metals and energy | Metals | 16 |