Hello,

Should we do one time investment (NFO) in lets say HDFC Gold ETF or should we invest as SIP???

Because SIP fundas say that its not very useful when the proces go up OR down continuously?

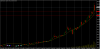

Also, does anyone know if the price of gold has ever gone down, is there always appreciation???

Regards,

Kunal.

Should we do one time investment (NFO) in lets say HDFC Gold ETF or should we invest as SIP???

Because SIP fundas say that its not very useful when the proces go up OR down continuously?

Also, does anyone know if the price of gold has ever gone down, is there always appreciation???

Regards,

Kunal.

Attachments

-

29.2 KB Views: 93