VijKris,

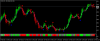

The problem with looking at charts eod is that it looks perfect. And the reason is that MA repaints. So what is looking now like a prefect chart, at that time, would not have had a MA crossover. As the price moved up dramatically, the MA tightened up (as it appears eod) and hence looks like a perfect time to take the trade.

I have been experimenting on RENKO charts with MA's when I noticed this problem. So working on some alternative indicator, which does not not have similar problem.....

My 2C.

The problem with looking at charts eod is that it looks perfect. And the reason is that MA repaints. So what is looking now like a prefect chart, at that time, would not have had a MA crossover. As the price moved up dramatically, the MA tightened up (as it appears eod) and hence looks like a perfect time to take the trade.

I have been experimenting on RENKO charts with MA's when I noticed this problem. So working on some alternative indicator, which does not not have similar problem.....

My 2C.