Shining Stars:

After observing what makes the cut and what succeeds, I identified some parameters for getting scrips that work in our model. Let us call them Shining Star scrips. Why? They are relatively doing well and carry less risks.

Technical criteria required for Shining Star scrips:

1. LTP should be higher than 70% of 52 week low

2. LTP should be within a range of 15% of 52 week high.

Fundamental criteria required for Shining Star scrips:

3. It should have delivered good/improved results in the last quarter. By results, I mean improved Profit and Sales at a consolidated level both YOY and QOQ and improvement on industry specific metrics like NPAs for banks etc.

Shining Star trade strategy:

4. Wait for a correction or dip. Then Invest only 15% of total amount that you wanted to invest on this trade.

5. If it falls further, invest 30% more. If it is moving up and started performing leave it to hit the targets and exit.

6. If it falls even further than in step 5, invest the balance.

7. This is only for cash segment. I am not interested in futures or options.

8. Total money on this trade should not exceed 20% or 10% of trading capital (will discuss further)

9. Target is 2% or more based on candle stick charts. Exit on long green bar or on the following day of such green bar in the first minute. Or exit on any candlestick sell signals.

10. If the share has dropped to the level of being farther than 30% of 52 week high, then exit it as it is a stop loss.

It is not a Shining Star anymore.

Money Management rules:

11. Never be under capitalised. Do not trade futures or options as that is a sign of under capitalisation. If the trading capital is Rs. 1 lakh, then the maximum capital allocated for this exercise is Rs. 20,000. If the Shining Star scrip is priced around Rs. 100, then the first tranche is about Rs. 3000 involving 30 shares, etc. Sometimes we exit in a profit without investing the complete 20,000.

Calculation from Risk Management perspective:

Example with hitting stop loss at maximum loss level.

If say total capital is Rs. 1 lakh and Rs. 20,000 is fully invested and then the price drops to farther than 30% of 52 week high,

- 52 week high Rs. 100

- 52 week low 10.

- Invested at 99 ie 30 shares

- Now price falls to 95

- Buy 6000/95 = 63 shares.

- Now price falls to 90.

- Buy 11000/90 = 122 shares

- Now share price falls to 69 ie below 70 which is farther than 30% of 52 week high

- Sell at 69

The loss can be slightly more or less based on the price gap between the tranches.

Okay we have calculated the highest possible stop loss. This is about 5% of our capital. This should be kept in mind. If we are entering the trade, we are willing to give up 5% of the trading capital. So entry decision should be well thought out.

The risk can be reduced two ways:

One way is to reduce the capital allocated to individual scrip to 10% of total trading capital instead of 20%.

In that case, the risk looks like this on a share capital of Rs. 1 lakh.

- 52 week high Rs. 100

- 52 week low 10.

- Invested at 99 ie 15 shares

- Now price falls to 95

- Buy 3000/95 = 31 shares.

- Now price falls to 90.

- Buy 5500/90 = 61 shares

- Now share price falls to 69 ie below 70 which is farther than 30% of 52 week high

- Sell at 69

Another way to reduce risk is to redefine stop loss as a percentage of your purchase price. I am not in favour of this method.

Now in this strategy, to buy a share costing Rs. 4,500 then one should have a trading capital of Rs. 3 lakhs.(This is under the lower risk profile of allocating 10% maximum capital to individual trades)

So, if you notice, we are going opposite to leverage. I would call it negative leverage. We are putting more money for the trade. Putting cash aside for further deployment. This reduces returns.

I am already implementing some of these strategies in here without explicitly defining the rules till now. I believe that it may reduce the returns but will be profitable in the long run. I am likely to integrate more and more of these principles in my trades. My equity curve and profitability statement would eventually show if this approach is correct.

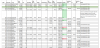

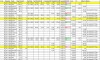

Not all the shares that I am trading here qualify for Shining Stars. RNAM, Bata, Affle, Cupid, Berger Paints and Polycab qualify as shining stars.

Why am I looking for Shining Star scrips?

I am looking for safety of capital and minimal impact of stop losses on my account.

Next time, I enter a trade, I will specifically identify it as shining star in my notes (if that trade is based on the above criteria). Let us track to see how this pans out.