Got exit on CDSL today at 465.80. It did go further up, but I had hit my target at 10%.

Added TataCoffee, FRetail, Astec, Axis Bank and BDL between yesterday and today. Also entered BSoft, BhartiArtl and Cupid.

I am expecting exit on TataCoffee, TataElxsi and Astec tomorrow.

There is a lot of stock rotation going on in the markets. That is why the indices seem to be neither up nor down.

I am tracking about 508 scrips for this strategy.

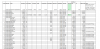

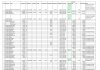

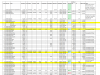

Trade book is attached.

Added TataCoffee, FRetail, Astec, Axis Bank and BDL between yesterday and today. Also entered BSoft, BhartiArtl and Cupid.

I am expecting exit on TataCoffee, TataElxsi and Astec tomorrow.

There is a lot of stock rotation going on in the markets. That is why the indices seem to be neither up nor down.

I am tracking about 508 scrips for this strategy.

Trade book is attached.

Attachments

-

80.9 KB Views: 27

Last edited: