Yesterday's dip was an opportunity to add more to positions.

Added Tata Coffee, Tata Elxsi, MuthootFin and BDL

Also entered AxisBank, FRetail, GodrejProp and Timken.

Added more to this investment fund bringing it above 50K.

Some of these shares may bounce back today. If they fall, as per our original strategy, I will add more.

Our shining star category shares have to be redefined. Q1 results for most companies were bad as expected and hence improved quarterly performance requirement has to be temporarily dropped. Among the above companies AxisBank and FRetail do not belong to shining star category.

Cupid and BDL are falling after bad results. Will keep an eye on this. I may add more to BDL and enter Cupid as well. I expect them to bounceback soon.

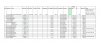

Updated trade book is attached.