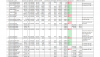

On 1st Nov. sold NovartisInd, BalrampurChin and bought Bata, AsianPaints, ALBK(Allahabad Bank), SMSLife and more of BankIndia. Now another risk is emerging. my exposure to PSU Banks is rising, while SEBI has given out a circular to listed banks on new NPA recognition rule. This is impacting one bank that I hold (IndianB)

https://www.business-standard.com/a...-day-after-sebi-directive-119110101483_1.html

The PSU bank upward march may have stopped after this circular.

In the progress report attached below, Bata purchases made are expected to continue. I expect Bata to fall further. So stoploss rules do not apply because, I postponed further purchase in anticipation of further fall.

https://www.business-standard.com/a...-day-after-sebi-directive-119110101483_1.html

The PSU bank upward march may have stopped after this circular.

In the progress report attached below, Bata purchases made are expected to continue. I expect Bata to fall further. So stoploss rules do not apply because, I postponed further purchase in anticipation of further fall.

Attachments

-

87 KB Views: 46

Last edited: