#Trade5 (22-Dec-20 to ---------) Update3

Before Trading Thoughts: 4-Legged directionless Monthly Strategy for 28-Jan Expiry. Hedge also considered for Jan expiry. Feb option chain was not liquid. Aim to to gain theta decay.

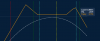

During Trading Thoughts: Trade Started with Range of 14300CE & 12100PE and hedged with 14000CE & 12500PE.

23-Dec-20 - NIFTY gained +100 points leaving almost 50% premium on put side. Collected the premium & rolled up to 12500PE & hedged with 12900PE.

24-Dec-20 - NIFTY gained +130 points causing almost 0.50% loss on CE side, so I rolled up to 14600CE & hedged with 14300CE.

28-Dec-20 - Market opened after 3 days , with gap up of +84 point, got good theta decay in premiums.

No change/update in strategy .If market takes small pause or draw down i will get very good premium erosion.

If not i will roll up by PE side as premiums have already eroded by 40%.

29-Dec-20 - NIFTY opened gap up of 35 Points(13915), my put side premiums have eroded by 50%.

Market seems bullish , also volatility has increased, may be due to year end.

At same level premiums have increased causing me loss on call side.

I have booked profit on put side and shifted by put side to 12900 and hedged by 13300.

04-Dec-20 - My put side premiums have eroded by 50%.

I have booked profit on put side and shifted by put side to 13300 and hedged by 13600.

05-Dec-20 - Market are drawdown below support level of 14065.

I bought additional put of 13600 in case market heads low.

pressure was also due to DOW Jones closing lower. later market recovered and sustained for longer duration. I Closed the put position.

06-Dec-20 - Market crossed 14200 mark and , support from put side made me close 1 Call option of 14600 CE.

Call side was under immense pressure due to market heading high.

This trade took long and initial call side caused major draw down.

My aim is to close this strategy in minor profit or cost to cost.

If market remains sideways in can close it with minor profit.

Now my strategy looks like this, at extreme ends.

Post Trading Thoughts: Still in Trade......

I am novice, and learning Option strategies. My thoughts should not influence anyone to trade like wise.

I am posting trades, to learn, track my progress and get guidance from learned members of this forum.[/QUOTE]