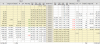

I know what an Open Interest is. I have seen some people making a commentary on it. Like 9000PE has maximum OI and it should provide a good Support. 9200CE has maximum OI, it should provide a good resistance. And generally, those are the support and resistance points figuratively.

My question is, is it really relevant? For Example, there are 4 to 5 calls available let's say CMP is 900 and then we have

920CE with 1000000 OI

940CE with 2000000 OI

960CE with 900000 OI

880 PE with 800000 OI

860 PE with 1300000 OI

840 PE with 400000OI

It interprets that 940 CE has maximum open positions.

1 meaning is that most people have bought CE and they expect the price to move up.

2 meaning is that most people have sold CE and they are the smart money and prices won't go above this point.

As it can be seen from 1 and 2, it is pretty confusing. What does maximum OI at certain strike means?

Without going into delta and theta or IV how can we know whether the calls are being bought or sold?

Can it be deduced from OI that what strike level is going to be respected by the time of expiry? Below what point is it expected for particular stock to close?

Please note that I am asking from 7 days to expiry point of view.

Thanks in advance for help.

My question is, is it really relevant? For Example, there are 4 to 5 calls available let's say CMP is 900 and then we have

920CE with 1000000 OI

940CE with 2000000 OI

960CE with 900000 OI

880 PE with 800000 OI

860 PE with 1300000 OI

840 PE with 400000OI

It interprets that 940 CE has maximum open positions.

1 meaning is that most people have bought CE and they expect the price to move up.

2 meaning is that most people have sold CE and they are the smart money and prices won't go above this point.

As it can be seen from 1 and 2, it is pretty confusing. What does maximum OI at certain strike means?

Without going into delta and theta or IV how can we know whether the calls are being bought or sold?

Can it be deduced from OI that what strike level is going to be respected by the time of expiry? Below what point is it expected for particular stock to close?

Please note that I am asking from 7 days to expiry point of view.

Thanks in advance for help.