Hi,

Sorry for 1 year++ late to join this group, here is the translate of the metastock code:

//-- Begin of Script -----

/*

====================

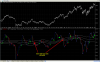

MACD - composite EMA

====================

-----------------------------------------------

{ MACD OR Histogram based on multiple EMA's }

{ Incorporating automatic overbought/oversold

levels }

{ Copyright 2005 Jose Silva }

{

http://www.metastocktools.com }

*/

function IsDefined(arry)

{

return NOT IsEmpty(arry);

}

//{ User inputs }

plot1=ParamToggle("Choose MACD OR Histogram", "MACD|Histogram");

plot2=ParamToggle("Choose MACD/Hist OR Normalized","MACD/Hist|Normalized");

pds=Param("Signal/Histogram EMA periods",21, 2, 260);

//{ Composite-EMA MACD/Histogram }

ema1= EMA(C,3)+ EMA(C,5)+EMA(C,8)+EMA(C,11)+EMA(C,14)+EMA(C,17);

ema2= EMA(C,30)+EMA(C,35)+EMA(C,40)+EMA(C,45)+EMA(C,50)+EMA(C,56);

emaComp=ema1-ema2;

sig=EMA(emaComp,pds);

hist=emaComp-sig;

//{ Choose MACD OR Histogram }

MacdH=IIf(plot1==0,emaComp,hist);

//{ Normalized MACD/Histogram }

normMod=Highest(MacdH)-Lowest(MacdH);

normMod=IIf(normMod==0, 0.000001,normMod);

MacdHnorm=

((MacdH-Lowest(MacdH))/normMod-.5)*200;

//{ Choose standard/normalized }

MacdComp=IIf(plot2==0,MacdH,MacdHnorm);

sig=EMA(MacdComp,pds);

//{ MACD/Hist average }

Avgs=Cum(MacdComp)/Cum(IsDefined(MacdComp));

//{ MACD/Hist auto boundaries }

pk=Ref(MacdComp,-1)>MacdComp

AND Ref(MacdComp,-1)>Ref(MacdComp,-2)

AND Ref(MacdComp,-1)>Avgs;

pkVal=ValueWhen(pk,Ref(MacdComp,-1));

tr=Ref(MacdComp,-1)<MacdComp

AND Ref(MacdComp,-1)<Ref(MacdComp,-2)

AND Ref(MacdComp,-1)<Avgs;

trVal=ValueWhen(tr,Ref(MacdComp,-1));

Obought=Cum(pkVal)/Cum(IsDefined(pkVal));

Osold=Cum(trVal)/Cum(IsDefined(trVal));

//{ Plot in own window }

Plot(Obought, "OB", colorRed); //{ Red }

Plot(Avgs, "Avg", colorDarkGrey); //{ Grey }

Plot(Osold, "OS", colorBlue); //{ Blue }

Plot( IIf(plot1==0,Sig,Avgs), "Plot1", colorGreen); //{ Green }

Plot(MacdComp, "MACDComp", colorBlack);// { Black }

//-- End of Script -------

Hope it meet your need.