GOOD PROFIT: Hedged nifty positions with straddle...

- Thread starter linkon7

- Start date

Hello Linkon7 sir,

Visited ur thread and found ur strategy good.....:thumb:

there are lot of things i use to try with options while paper trading and real trading.....averaging, hedging etc....

one point which i saw in some last trading is that.....averaging my risks by buying lots at low rates is helping out.:clapping:

but it is suggested not to rely over averaging in options......

plz give some suggestions

Visited ur thread and found ur strategy good.....:thumb:

there are lot of things i use to try with options while paper trading and real trading.....averaging, hedging etc....

one point which i saw in some last trading is that.....averaging my risks by buying lots at low rates is helping out.:clapping:

but it is suggested not to rely over averaging in options......

plz give some suggestions

options are wasted assets... If your value is diminishing... that normally means trend is against you or we are in a sideways market. Accept that.

Averaging it is very risky. As incase market trend doesnt reverse in your direction, you will only end up averaging a losing trade. A good portion of your option's value is just probability. With every passing day, that probability takes a hit.

Intraday, averaging makes sense... but as a rule, never carry a bad position for the next day. 80% of the rime, bad turns worse.... There is no room for "hope" in the market.

Averaging it is very risky. As incase market trend doesnt reverse in your direction, you will only end up averaging a losing trade. A good portion of your option's value is just probability. With every passing day, that probability takes a hit.

Intraday, averaging makes sense... but as a rule, never carry a bad position for the next day. 80% of the rime, bad turns worse.... There is no room for "hope" in the market.

Guys, I have shorted 4400 straddle for a net premium of 400 points. since we are close to 4400, i didnt take any position in NF. Expect to do so on Monday.

The lower break even point 4000 and the upper breakeven point is 4800. I think its a very safe range. I should be able to gain 400 points by mid August.

Lets hope... this strategy pays off....

The lower break even point 4000 and the upper breakeven point is 4800. I think its a very safe range. I should be able to gain 400 points by mid August.

Lets hope... this strategy pays off....

Code:

scrip cost present diff profit/loss

4400 CE 200.00 203.00 (3.00) (300.00)

4400 PE 200.00 203.00 (3.00) (300.00)

Nifty Fut 4,397.00 4,397.00 - -

Total = (600.00)Script

4400 CE bought at 200 has a current price of Rs. 203 is at a loss of Rs. -300

4400 PE bought at 200 has a current price of Rs. 203 is at a loss of Rs.-300

Nifty Futures long / short not initiated as we were too close to the mean.

Total = loss of Rs. -600

Statistics

Cost of the straddle = 400.00

present price of the straddle = 406.00

Actual value of the straddle = 3.00

profit on straddle = (6.00)

Profit on nifty = -

total profit = (6.00)

Weekly market performance....

After a ranged week, which saw some volatility marked by bounce-backs, the market ended on a very positive note. It was a spectacular end to a reasonably good week, it being the biggest weekly gain since week ended May 24, 2009. This week's performance was good and the numbers are: Sensex up 9.5% and Nifty up 9.6%. BSE Midcap index was up 9%, BSE Smallcap index up 6.6% over the week. BSE Realty index was up 18.6%, BSE Oil & Gas index up 8%, BSE IT index up 10% and BSE Auto index up 11.6%.

After a ranged week, which saw some volatility marked by bounce-backs, the market ended on a very positive note. It was a spectacular end to a reasonably good week, it being the biggest weekly gain since week ended May 24, 2009. This week's performance was good and the numbers are: Sensex up 9.5% and Nifty up 9.6%. BSE Midcap index was up 9%, BSE Smallcap index up 6.6% over the week. BSE Realty index was up 18.6%, BSE Oil & Gas index up 8%, BSE IT index up 10% and BSE Auto index up 11.6%.

Last edited:

Today's performance:

It was a strong day of trade today with realty, technology, FMCG and IT sectors leading the gains. Global cues were also positive with US and Asia closing on a strong note. Sensex shut shop at 14744, up 494 points and Nifty at 4374, up 143 points from the previous close. CNX Midcap index was up 2.3% and BSE Smallcap index was up 2.4%. The market breadth was positive with advances at 988 against declines of 262 on the NSE. Top Nifty gainers included HCL Technologies, Reliance Infrastructure and Mahindra & Mahindra while losers included Gail, Sterlite Industries and Reliance Power.

It was a strong day of trade today with realty, technology, FMCG and IT sectors leading the gains. Global cues were also positive with US and Asia closing on a strong note. Sensex shut shop at 14744, up 494 points and Nifty at 4374, up 143 points from the previous close. CNX Midcap index was up 2.3% and BSE Smallcap index was up 2.4%. The market breadth was positive with advances at 988 against declines of 262 on the NSE. Top Nifty gainers included HCL Technologies, Reliance Infrastructure and Mahindra & Mahindra while losers included Gail, Sterlite Industries and Reliance Power.

Code:

scrip cost present diff profit/loss

4400 CE 200.00 203.00 (3.00) (300.00)

4400 PE 200.00 203.00 (3.00) (300.00)

Nifty Fut 4,397.00 4,397.00 - -

Total = (600.00)Script

4400 CE bought at 200 has a current price of Rs. 203 is at a loss of Rs. -300

4400 PE bought at 200 has a current price of Rs. 203 is at a loss of Rs.-300

Nifty Futures long / short not initiated as we were too close to the mean.

Total = loss of Rs. -600

Statistics

Cost of the straddle = 400.00

present price of the straddle = 406.00

Actual value of the straddle = 3.00

profit on straddle = (6.00)

Profit on nifty = -

total profit = (6.00)

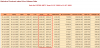

I was going through the option chain (trying to figure out a bit about options!)

I am a newbie with options. What I know is what ITM,OTM,ATM options are and that BE for calls is strike+prem and put it is strike-prem.

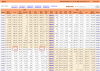

While going through the option chain I noticed that the difference between LTP and Offer is large and also in the next image I wanted to know why there is difference between the close on LTP for index futures.

One other thing, when buying call how do you choose the strike price? rather why do you choose a particular strike price?

I am a newbie with options. What I know is what ITM,OTM,ATM options are and that BE for calls is strike+prem and put it is strike-prem.

While going through the option chain I noticed that the difference between LTP and Offer is large and also in the next image I wanted to know why there is difference between the close on LTP for index futures.

One other thing, when buying call how do you choose the strike price? rather why do you choose a particular strike price?

Attachments

-

38.1 KB Views: 269

-

86.2 KB Views: 268

This is the modified version of a strategy I played and the progress is documented in this thread...

http://www.traderji.com/options/27603-nifty-straddle-target-whole-premium.html

Now, the strategy has become a bit complex and the old rules no longer apply. There were certain design flaws and the rules have been modified so that I can add to my profit without having to add extra risk. I find this is to be the safest and most profitable way to play nifty positions.

The process might sound a bit complicated, but making money in this market is never simple and easy. there is no short cut.

last month i was able to gain 34 thousand by using this strategy but a good amount of it was luck. I acheved my targeted profit early and i exited.

I have initiated the following positions yesterday, on 21st April09

-- Nifty long on 2 lots at 3402

-- Nifty 3400 PE may 2 lot sold at 215

-- Nifty 3400 CE may 2 lots sold at 230

Total investment about 1,25,000 /-

Profit target : 40,000 plus

How I want to play these positions

shorting straddles (i.e. selling both calls and puts of the same strike price) is a neutral strategy where the expectation is that market will remain range bound and at the end of the series, you get to keep a portion of the premium that u receive.

for example,

I shorted 3400 call May at 222

and shorted 3400 put May at 203

total premium received = 445

my lower break even is 3400 - 445 = 2955

and upper break even is 3400 + 445 = 3845

If nifty closes between 2955 and 3845 when the series closes on 28th May09, I stand to make a profit.

Now my target is to use this 445 points as my hedge, so every time bad luck happens, I end up loosing some of the targeted profit. Itll take a lot of misfortune for me to loose 445 points playing nifty. And if I am lucky, I can add to that 445 points. Let me explain how

Below 3400, I will short nifty and above 3400 I will go long.

Below 3400, the nifty shorts and short 3400 put act like a covered put and the amount of points I gain by shorting nifty will be marginally nullified by the loss on shorting 3400 put. But the other leg, 3400 call will loose value more rapidly and ultimately bring the straddle to a profit.

And likewise, above 3400, it becomes a covered call and the amount of points I gain by going long on nifty will be marginally nullified by the loss on shorting 3400 call.

So eventually, I get to keep the whole premium i.e.445 points. This strategy looked fine on paper but when I put it to trade, gap ups and gap downs were tearing this strategy to shreds. Plus I had to rely a lot on luck and thats not good for any strategys success rate. Plus I noticed that every time nifty comes back to the strike price, I was gaining on the straddle but I was giving up profits from nifty.

What I mean is I shorted nifty at 3397 and it went down to 3360 levels, the 3400 put gained in value, 3400 call lost some value and nifty short was in good profit. But when nifty started going back to 3400 levels, why should I let the profit I made in shorting nifty go away by riding it back. I closed the short at 3365 and put a sell nifty trigger at 3367 and hence I can safely wait it out, for nifty to break 3400 on the upside and 3367 on the down side. And when nifty started falling, I can short it again and ride it down for some more profit. but the main golden rule is not to let nifty go down without me. 3400 and 3367 becomes the range and I have to ride nifty breaking out in either direction.

I welcome any comments or observations or criticism. The very purpose of posting the progress is to attract opinions and that will help me weed out any more flaws.

http://www.traderji.com/options/27603-nifty-straddle-target-whole-premium.html

Now, the strategy has become a bit complex and the old rules no longer apply. There were certain design flaws and the rules have been modified so that I can add to my profit without having to add extra risk. I find this is to be the safest and most profitable way to play nifty positions.

The process might sound a bit complicated, but making money in this market is never simple and easy. there is no short cut.

last month i was able to gain 34 thousand by using this strategy but a good amount of it was luck. I acheved my targeted profit early and i exited.

I have initiated the following positions yesterday, on 21st April09

-- Nifty long on 2 lots at 3402

-- Nifty 3400 PE may 2 lot sold at 215

-- Nifty 3400 CE may 2 lots sold at 230

Total investment about 1,25,000 /-

Profit target : 40,000 plus

How I want to play these positions

shorting straddles (i.e. selling both calls and puts of the same strike price) is a neutral strategy where the expectation is that market will remain range bound and at the end of the series, you get to keep a portion of the premium that u receive.

for example,

I shorted 3400 call May at 222

and shorted 3400 put May at 203

total premium received = 445

my lower break even is 3400 - 445 = 2955

and upper break even is 3400 + 445 = 3845

If nifty closes between 2955 and 3845 when the series closes on 28th May09, I stand to make a profit.

Now my target is to use this 445 points as my hedge, so every time bad luck happens, I end up loosing some of the targeted profit. Itll take a lot of misfortune for me to loose 445 points playing nifty. And if I am lucky, I can add to that 445 points. Let me explain how

Below 3400, I will short nifty and above 3400 I will go long.

Below 3400, the nifty shorts and short 3400 put act like a covered put and the amount of points I gain by shorting nifty will be marginally nullified by the loss on shorting 3400 put. But the other leg, 3400 call will loose value more rapidly and ultimately bring the straddle to a profit.

And likewise, above 3400, it becomes a covered call and the amount of points I gain by going long on nifty will be marginally nullified by the loss on shorting 3400 call.

So eventually, I get to keep the whole premium i.e.445 points. This strategy looked fine on paper but when I put it to trade, gap ups and gap downs were tearing this strategy to shreds. Plus I had to rely a lot on luck and thats not good for any strategys success rate. Plus I noticed that every time nifty comes back to the strike price, I was gaining on the straddle but I was giving up profits from nifty.

What I mean is I shorted nifty at 3397 and it went down to 3360 levels, the 3400 put gained in value, 3400 call lost some value and nifty short was in good profit. But when nifty started going back to 3400 levels, why should I let the profit I made in shorting nifty go away by riding it back. I closed the short at 3365 and put a sell nifty trigger at 3367 and hence I can safely wait it out, for nifty to break 3400 on the upside and 3367 on the down side. And when nifty started falling, I can short it again and ride it down for some more profit. but the main golden rule is not to let nifty go down without me. 3400 and 3367 becomes the range and I have to ride nifty breaking out in either direction.

I welcome any comments or observations or criticism. The very purpose of posting the progress is to attract opinions and that will help me weed out any more flaws.

This is excellant... Thanks for sharing this stretegy.. It is certainly an interesting game plan, but then it gets challenging to execute with so many trades being done on future -- it will require one to be full time in front of screen to profit from this stretegy? is that correct understanding?

Cheers,

Heems

Similar threads

-

-

Step by Step guide to become a Consistent Profitable Trader

- Started by markbagh

- Replies: 1

-

-