General Trading Chat

- Thread starter timepass

- Start date

- Tags idle thoughts trading talk only

This news may affect Telecoms and brokers and the others who depend on e-KYC.

Businesses need to pay up to ₹20 for using Aadhaar services

New Delhi, March 07, 2019 23:50 IST Updated: March 07, 2019 23:50 IST

Business organisations using Aadhaar services will now have to pay ₹20 for each customer verification and 50 paise for authentication of each transaction carried out by the entities, the Unique Identification Authority of India (UIDAI) said on Thursday.

“Aadhaar authentication services shall be charged at the rate of ₹20 (including taxes) for each e-KYC transaction and ₹0.50 (including taxes) for each Yes and No authentication transaction from requesting entities,” a notification by the UIDAI said.

The gazette notification, the Aadhaar (Pricing of Aadhaar Authentication Services) Regulations 2019, however, exempts government entities and the Department of Posts from authentication transaction charges.

“The entities have been incurring a cost of ₹150-200 per KYC sans Aadhaar. They have been demanding to use Aadhaar-based authentication and KYC services on account of these being convenient to them and their customers and also the fact that they will save huge amount which they currently incur in doing KYC through traditional means such as paper, physical verification, etc,” an official source told PTI.

The UIDAI source said with a nominal cost for each eKYC transaction entities would still be saving on Know Your Customer (KYC) cost while serving people with ease.

According to the notification, the entities shall be required to deposit the authentication transaction charges within 15 days of issuance of the concerned invoice based on the usage. The delay in payment beyond 15 days shall attract interest compounded at 1.5% per month and discontinuation of authentication and e-KYC services.

Sources said that if an existing requesting entity (except those exempt), continues to use Aadhaar authentication services beyond the date of publication of these Regulations, it shall be deemed to have agreed to the specified authentication charges.

The source said that now as per the amendments made through the Aadhaar Ordinance, several entities may now become eligible to use Aadhaar authentication subject to their meeting security and other conditions as per the Aadhaar Act and related regulations.

“Therefore, it is just, fair and reasonable that such entities should contribute to meet expenses nominally which are incurred by UIDAI in providing these services,” the source said.

The notification says that the scheduled commercial banks engaged in providing Aadhaar enrolment and update facilities in accordance with its gazette notification issued in July 2017 shall be exempt from authentication transaction charges.

However, such banks, which fall short of the Aadhaar enrolment and update targets, as communicated from time to time, will be charged in proportion to the shortfall in achieving the target.

UIDAI sources said that the above charges shall be in addition to the licence fees and financial disincentives, as applicable. The details of the transaction error codes and its charges shall be issued separately.

The official said that in case a requesting entity does not wish to pay authentication transaction charges, it shall discontinue the use of

Aadhaar authentication services and intimate its decision to the UIDAI immediately and surrender its access to the authentication facilities

“However, the transaction charges as applicable till the date of de-activation of access to authentication services shall have to be paid,” the source said.

https://www.thehindu.com/news/natio...or-using-aadhaar-services/article26460636.ece

Businesses need to pay up to ₹20 for using Aadhaar services

New Delhi, March 07, 2019 23:50 IST Updated: March 07, 2019 23:50 IST

Business organisations using Aadhaar services will now have to pay ₹20 for each customer verification and 50 paise for authentication of each transaction carried out by the entities, the Unique Identification Authority of India (UIDAI) said on Thursday.

“Aadhaar authentication services shall be charged at the rate of ₹20 (including taxes) for each e-KYC transaction and ₹0.50 (including taxes) for each Yes and No authentication transaction from requesting entities,” a notification by the UIDAI said.

The gazette notification, the Aadhaar (Pricing of Aadhaar Authentication Services) Regulations 2019, however, exempts government entities and the Department of Posts from authentication transaction charges.

“The entities have been incurring a cost of ₹150-200 per KYC sans Aadhaar. They have been demanding to use Aadhaar-based authentication and KYC services on account of these being convenient to them and their customers and also the fact that they will save huge amount which they currently incur in doing KYC through traditional means such as paper, physical verification, etc,” an official source told PTI.

The UIDAI source said with a nominal cost for each eKYC transaction entities would still be saving on Know Your Customer (KYC) cost while serving people with ease.

According to the notification, the entities shall be required to deposit the authentication transaction charges within 15 days of issuance of the concerned invoice based on the usage. The delay in payment beyond 15 days shall attract interest compounded at 1.5% per month and discontinuation of authentication and e-KYC services.

Sources said that if an existing requesting entity (except those exempt), continues to use Aadhaar authentication services beyond the date of publication of these Regulations, it shall be deemed to have agreed to the specified authentication charges.

The source said that now as per the amendments made through the Aadhaar Ordinance, several entities may now become eligible to use Aadhaar authentication subject to their meeting security and other conditions as per the Aadhaar Act and related regulations.

“Therefore, it is just, fair and reasonable that such entities should contribute to meet expenses nominally which are incurred by UIDAI in providing these services,” the source said.

The notification says that the scheduled commercial banks engaged in providing Aadhaar enrolment and update facilities in accordance with its gazette notification issued in July 2017 shall be exempt from authentication transaction charges.

However, such banks, which fall short of the Aadhaar enrolment and update targets, as communicated from time to time, will be charged in proportion to the shortfall in achieving the target.

UIDAI sources said that the above charges shall be in addition to the licence fees and financial disincentives, as applicable. The details of the transaction error codes and its charges shall be issued separately.

The official said that in case a requesting entity does not wish to pay authentication transaction charges, it shall discontinue the use of

Aadhaar authentication services and intimate its decision to the UIDAI immediately and surrender its access to the authentication facilities

“However, the transaction charges as applicable till the date of de-activation of access to authentication services shall have to be paid,” the source said.

https://www.thehindu.com/news/natio...or-using-aadhaar-services/article26460636.ece

This news may affect Telecoms and brokers and the others who depend on e-KYC.

Businesses need to pay up to ₹20 for using Aadhaar services

New Delhi, March 07, 2019 23:50 IST Updated: March 07, 2019 23:50 IST

https://www.thehindu.com/news/natio...or-using-aadhaar-services/article26460636.ece

Businesses need to pay up to ₹20 for using Aadhaar services

New Delhi, March 07, 2019 23:50 IST Updated: March 07, 2019 23:50 IST

https://www.thehindu.com/news/natio...or-using-aadhaar-services/article26460636.ece

https://www.bloomberg.com/news/arti...g-25-billion-bad-debt-on-india-court-decision

Banks Risk Adding $25 Billion Bad Debt on India Court Decision

Hanging in the balance is the fate of more than $25 billion of loans to power producers. They are among parties contesting the central bank directive that forced lenders recognize loans as soured if dues are delayed even by a day and to approach bankruptcy courts if a restructuring isn’t agreed to within 180 days.

...

...

The power sector was among the hardest hit with the government identifying as stressed 34 plants with outstanding debt of about 1.8 trillion rupees. If the RBI directive is upheld, many of these would immediately be pushed into insolvency court with lenders forced to dial-up provisions. .

...

Of the 34 plants identified as stressed, only a few units -- including JP Power’s Prayagraj unit -- are anywhere close to resolution, people familiar with the matter said. Banks could face a 75 percent loss ratio on their lending to these stressed companies which are on brink of bankruptcy, according to a Bank of America Merrill Lynch estimate.

Banks Risk Adding $25 Billion Bad Debt on India Court Decision

Hanging in the balance is the fate of more than $25 billion of loans to power producers. They are among parties contesting the central bank directive that forced lenders recognize loans as soured if dues are delayed even by a day and to approach bankruptcy courts if a restructuring isn’t agreed to within 180 days.

...

...

The power sector was among the hardest hit with the government identifying as stressed 34 plants with outstanding debt of about 1.8 trillion rupees. If the RBI directive is upheld, many of these would immediately be pushed into insolvency court with lenders forced to dial-up provisions. .

...

Of the 34 plants identified as stressed, only a few units -- including JP Power’s Prayagraj unit -- are anywhere close to resolution, people familiar with the matter said. Banks could face a 75 percent loss ratio on their lending to these stressed companies which are on brink of bankruptcy, according to a Bank of America Merrill Lynch estimate.

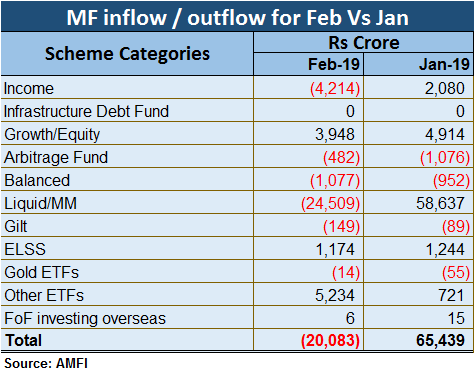

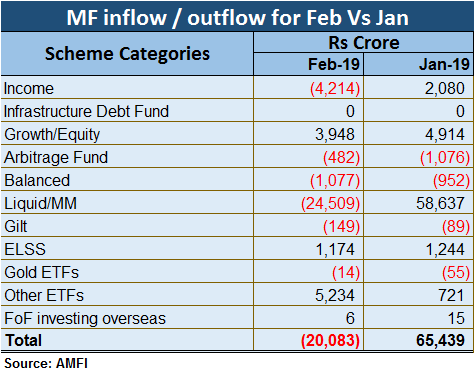

MFs see over Rs 20,000cr in outflows in Feb led by liquid funds; equity inflows dwindle

Cash plans, or liquid schemes, reported the highest outflows across all MF categories

Moneycontrol News@moneycontrolcom

Fund flows into mutual funds reversed in February, with outflows at Rs 20,083 crore, after the 43-player industry witnessed net inflows of Rs 65,439 crore in January, according to data from the Association of Mutual Funds in India (AMFI).

Cash plans, or liquid schemes, reported the highest outflows across all MF categories. This category registered outflows of over Rs 24,509 crore in February as against an inflow of Rs 58,637 crore in January.

Companies normally park their money in liquid schemes to meet their short-term needs instead of keeping their money idle in a non-interest bearing current account. Since liquid plans do not levy any entry or exit fee, they facilitate easy cash management.

Income funds too saw outflows of Rs 4,214 crore in February. Debt fund investors are still shying away from making investments after the recent crisis at IL&FS affected these schemes.

The trouble, which began after multiple defaults by Infrastructure Leasing & Financial Services (IL&FS) came to light a few months back, impacted debt funds that held securities issued by it, worth Rs 2,800 crore.

For the second consecutive month, balanced funds saw net outflows of Rs 1,077 crore in February, after outflows of Rs 952 crore in January

Equity funds continued their downward journey for the fourth straight month, with the quantum of inflows declining 16.9 percent month-on-month to Rs 5,122 crore in February.

Commenting on February monthly data, NS Venkatesh, CEO, AMFI, said: “Amid global uncertainty, tension along the Pakistan border, liquidity tightness and credit events, it is heartening to see retail investor continuing to stay invested. The continued healthy confidence that retail investors are showing, as reflected in the rising number of SIP (Systematic Investment Plans) inflows, is laudable. The patience to stay invested, amid uncertainty, will help from an individual long-term wealth creation perspective. Once political uncertainty and liquidity tightness recedes over the next few months, we expect inflows in both equity and liquid funds to strengthen further."

https://www.moneycontrol.com/news/b...uid-funds-equity-inflows-dwindle-3624191.html

Cash plans, or liquid schemes, reported the highest outflows across all MF categories

Moneycontrol News@moneycontrolcom

Fund flows into mutual funds reversed in February, with outflows at Rs 20,083 crore, after the 43-player industry witnessed net inflows of Rs 65,439 crore in January, according to data from the Association of Mutual Funds in India (AMFI).

Cash plans, or liquid schemes, reported the highest outflows across all MF categories. This category registered outflows of over Rs 24,509 crore in February as against an inflow of Rs 58,637 crore in January.

Companies normally park their money in liquid schemes to meet their short-term needs instead of keeping their money idle in a non-interest bearing current account. Since liquid plans do not levy any entry or exit fee, they facilitate easy cash management.

Income funds too saw outflows of Rs 4,214 crore in February. Debt fund investors are still shying away from making investments after the recent crisis at IL&FS affected these schemes.

The trouble, which began after multiple defaults by Infrastructure Leasing & Financial Services (IL&FS) came to light a few months back, impacted debt funds that held securities issued by it, worth Rs 2,800 crore.

For the second consecutive month, balanced funds saw net outflows of Rs 1,077 crore in February, after outflows of Rs 952 crore in January

Equity funds continued their downward journey for the fourth straight month, with the quantum of inflows declining 16.9 percent month-on-month to Rs 5,122 crore in February.

Commenting on February monthly data, NS Venkatesh, CEO, AMFI, said: “Amid global uncertainty, tension along the Pakistan border, liquidity tightness and credit events, it is heartening to see retail investor continuing to stay invested. The continued healthy confidence that retail investors are showing, as reflected in the rising number of SIP (Systematic Investment Plans) inflows, is laudable. The patience to stay invested, amid uncertainty, will help from an individual long-term wealth creation perspective. Once political uncertainty and liquidity tightness recedes over the next few months, we expect inflows in both equity and liquid funds to strengthen further."

https://www.moneycontrol.com/news/b...uid-funds-equity-inflows-dwindle-3624191.html

Pharma index is already going thru' a lean patch, isn't it ? There is more sorrow in store for some scrips.

Govt reduces prices of 390 cancer drugs up to 87%

March 08, 2019 23:17 IST

This move is expected to benefit 22 lakh cancer patients in the country.

The maximum retail price of 390 non-scheduled cancer medicines have been reduced by up to 87 per cent, which would result in annual savings of around Rs 800 crore for the patients, the government said Friday.

The National Pharmaceutical Pricing Authority on February 27 had brought 42 non-scheduled anti-cancer drugs under price control, capping trade margin at 30 per cent.

Manufacturers and hospitals were directed to convey the revised MRP, to be effective from March 8, based on the trade margin formula.

"The NPPA under Ministry of Chemicals and Fertilisers has put out list of 390 anti-cancer non-scheduled medicines with MRP reduction up to 87 per cent. The revised prices would come into effect from March 8, 2019," an official release said.

A total of 390 brands -- that is 91 per cent of the 426 brands reported by the manufacturers -- showed downward price movement, it added.

This move is expected to benefit 22 lakh cancer patients in the country and would result in annual savings of around Rs 800 crore to the patients, the release said.

"The trade margin rationalisation for 42 anti-cancer drugs was rolled out as Proof of Concept, stressing on the new paradigm of self-regulation by the industry. The manufacturers of these 42 drugs have been directed not to reduce production volumes of brands under regulation," it said.

While the MRP of 38 brands has been reduced by 75 per cent and more, 124 brands have seen reduction between 50 per cent to 75 per cent.

The MRP of 121 brands has been reduced between 25 per cent to 50 per cent, while the maximum retail price of 107 brands have been reduced below 25 per cent, the release said.

https://www.rediff.com/business/report/govt-reduces-prices-of-390-cancer-drugs-up-to-87/20190308.htm

Govt reduces prices of 390 cancer drugs up to 87%

March 08, 2019 23:17 IST

This move is expected to benefit 22 lakh cancer patients in the country.

The maximum retail price of 390 non-scheduled cancer medicines have been reduced by up to 87 per cent, which would result in annual savings of around Rs 800 crore for the patients, the government said Friday.

The National Pharmaceutical Pricing Authority on February 27 had brought 42 non-scheduled anti-cancer drugs under price control, capping trade margin at 30 per cent.

Manufacturers and hospitals were directed to convey the revised MRP, to be effective from March 8, based on the trade margin formula.

"The NPPA under Ministry of Chemicals and Fertilisers has put out list of 390 anti-cancer non-scheduled medicines with MRP reduction up to 87 per cent. The revised prices would come into effect from March 8, 2019," an official release said.

A total of 390 brands -- that is 91 per cent of the 426 brands reported by the manufacturers -- showed downward price movement, it added.

This move is expected to benefit 22 lakh cancer patients in the country and would result in annual savings of around Rs 800 crore to the patients, the release said.

"The trade margin rationalisation for 42 anti-cancer drugs was rolled out as Proof of Concept, stressing on the new paradigm of self-regulation by the industry. The manufacturers of these 42 drugs have been directed not to reduce production volumes of brands under regulation," it said.

While the MRP of 38 brands has been reduced by 75 per cent and more, 124 brands have seen reduction between 50 per cent to 75 per cent.

The MRP of 121 brands has been reduced between 25 per cent to 50 per cent, while the maximum retail price of 107 brands have been reduced below 25 per cent, the release said.

https://www.rediff.com/business/report/govt-reduces-prices-of-390-cancer-drugs-up-to-87/20190308.htm

I do not understand what is the profit margin in medicines.

Some 10 years back, when local medicine shop didnt give any discount, I use to buy medicine from Chandni Chowk (medicine wholesale market), at 19-20% discount whenever I have to go there for some other work, once in 30/45 days.

Slowly, local shops started providing 10%, and now some shops 15%

Currently, a near by shop (though at a distance) provides 20-25% discount (as per medicine) and that too with free home delivery.

Though many online shops are providing 20-25% + this + that, but I never tried.

Some 10 years back, when local medicine shop didnt give any discount, I use to buy medicine from Chandni Chowk (medicine wholesale market), at 19-20% discount whenever I have to go there for some other work, once in 30/45 days.

Slowly, local shops started providing 10%, and now some shops 15%

Currently, a near by shop (though at a distance) provides 20-25% discount (as per medicine) and that too with free home delivery.

Though many online shops are providing 20-25% + this + that, but I never tried.

I do not understand what is the profit margin in medicines.

Some 10 years back, when local medicine shop didnt give any discount, I use to buy medicine from Chandni Chowk (medicine wholesale market), at 19-20% discount whenever I have to go there for some other work, once in 30/45 days.

Slowly, local shops started providing 10%, and now some shops 15%

Currently, a near by shop (though at a distance) provides 20-25% discount (as per medicine) and that too with free home delivery.

Though many online shops are providing 20-25% + this + that, but I never tried.

Some 10 years back, when local medicine shop didnt give any discount, I use to buy medicine from Chandni Chowk (medicine wholesale market), at 19-20% discount whenever I have to go there for some other work, once in 30/45 days.

Slowly, local shops started providing 10%, and now some shops 15%

Currently, a near by shop (though at a distance) provides 20-25% discount (as per medicine) and that too with free home delivery.

Though many online shops are providing 20-25% + this + that, but I never tried.

I don't know the cost of Asthalin inhaler because I got it free from Delhi Govt. Polyclinic, but it costs >Rs. 100 in the market

The margins are huge for the pharma companies. If I buy Deriphyllin from the generic medicine shop, it costs me Rs. 2.5 for 10 tablets, whereas at a regular medicine store it costs about Rs. 7. For a DicloParaSara combo, it costs Rs. 20 at generic medicine shop, and Rs. 80 at medical store !!!.

I don't know the cost of Asthalin inhaler because I got it free from Delhi Govt. Polyclinic, but it costs >Rs. 100 in the market

I don't know the cost of Asthalin inhaler because I got it free from Delhi Govt. Polyclinic, but it costs >Rs. 100 in the market

But what I posted in my previous post was for branded medicines and not for generic medicines.

Generic medicines are available at 10 to 40% (depending on medicine) of price of branded medicine. But sometime, its availability is a problem at JanAushadhi counters.

The cost of production (COP) of most med is 1/10 or less of its market price. For e.g. paracetamol can be produced for as little as Rs.5 per strip. Once the composition is known it does not take much to produce medicines. But then you need to add QC/QR costs, marketing costs. These costs sometimes are more than the actual COP.

For innovator companies too once the composition is known, the COP is not much. But to get to production, sunk costs for cancer meds are hundreds of millions of dollars - R&D, animal trials, 4 phase clinical trials, marketing. You also need to recover costs of failed R&D and clinical trials.

The actual margin for cancers meds are sometimes 100x. But then the market price includes the above costs as well.

For innovator companies too once the composition is known, the COP is not much. But to get to production, sunk costs for cancer meds are hundreds of millions of dollars - R&D, animal trials, 4 phase clinical trials, marketing. You also need to recover costs of failed R&D and clinical trials.

The actual margin for cancers meds are sometimes 100x. But then the market price includes the above costs as well.

Last edited:

Similar threads

-

-

What are some general and basic price-volume action pattern one should know?

- Started by shyttrader

- Replies: 1

-

-

-