@Smart_trade Sir & Seniors, Can you please comment on my below plan, does it looks sensible. Also, if you think i have shortlisted wrong company, please reply. Thanks !

Current Status: i am currently investing 150,000 per month for past 6 months. I am planning to continue doing this for next 10-15 years.

Target: To hold this Portfolio for next 20-30 year (no hurry).

Expectation: Expecting 15% PA return in long run.

Shortlisted Stocks:

Current Status: i am currently investing 150,000 per month for past 6 months. I am planning to continue doing this for next 10-15 years.

Target: To hold this Portfolio for next 20-30 year (no hurry).

Expectation: Expecting 15% PA return in long run.

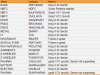

Shortlisted Stocks:

Attachments

-

30.5 KB Views: 342

Last edited: