hmmm ok let me try to explain this again

Yes S/R would be 15 Min Open candle ( High as Resistance and Low and as support) + we only trade failed breakouts.

So Consider opening Candle data

OHLC: Open 10 High 15 L 5 C 7

So here and High of 15 I will mark a Horizontal Line

Low of 5 would be my another horizontal line

now my resistance is 15

and 5 is support

Lets move on

Price breaks high of 15. We consider this as a breakout. Since price travelled above resistance of 15. Now this resistance becomes support. Also important to note that at this stage . No Trade is trigered. Since this is a breakout ( but we only trade a failed breakout)

Now price zooms higher and after some time it comes back to below 15. So now we are active but not yet triggered.

If the next candle after the break of support closes below or breaks below low of prev candle our trade is triggered with a SL of Candle high. If the candle is a WRB no Trade can be taken. We only want high probability trade.

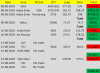

Attached a sample chart.

Longs ...1 st post chart please refer that

Yes S/R would be 15 Min Open candle ( High as Resistance and Low and as support) + we only trade failed breakouts.

So Consider opening Candle data

OHLC: Open 10 High 15 L 5 C 7

So here and High of 15 I will mark a Horizontal Line

Low of 5 would be my another horizontal line

now my resistance is 15

and 5 is support

Lets move on

Price breaks high of 15. We consider this as a breakout. Since price travelled above resistance of 15. Now this resistance becomes support. Also important to note that at this stage . No Trade is trigered. Since this is a breakout ( but we only trade a failed breakout)

Now price zooms higher and after some time it comes back to below 15. So now we are active but not yet triggered.

If the next candle after the break of support closes below or breaks below low of prev candle our trade is triggered with a SL of Candle high. If the candle is a WRB no Trade can be taken. We only want high probability trade.

Attached a sample chart.

Longs ...1 st post chart please refer that